U.S. February Job Openings, March ISM Manufacturing - Worrying detail, though not yet a clear trend

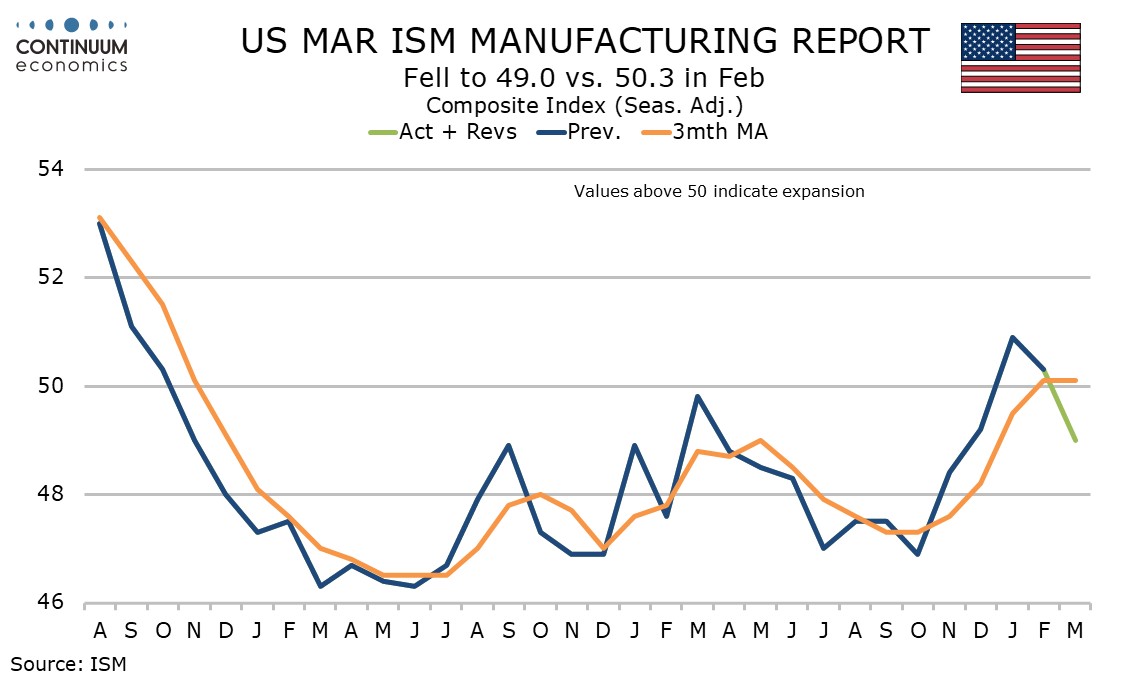

February’s JOLTS report on labor turnover does not make positive reading, with falls in openings and quits but a rise in layoffs, though the volatility of the series calls for caution. March ISM manufacturing data is weaker, at 49.0 from 50.3, but prices but with prices paid up sharply to 69.4 from 62.4.

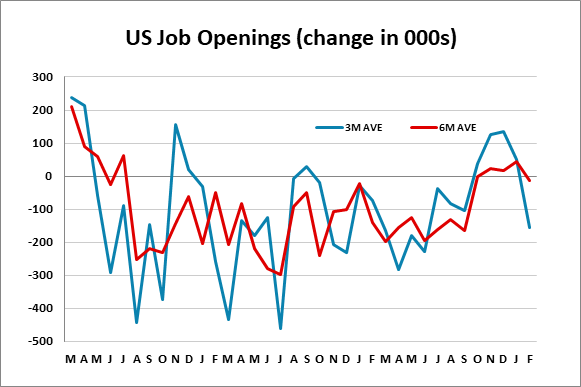

The job openings total fell by 194k, not fully erasing a 254k increase in January. The 3-month average has turned significantly negative after recently turning positive, but the 6-month average is still near neutral. This is not a conclusive change in trend.

Hirings however rose by only 25k and have changed little for four straight months. Separations fell by 11k, but with quits down by 61k (though after a 161k January rise), this means a rise in layoffs.

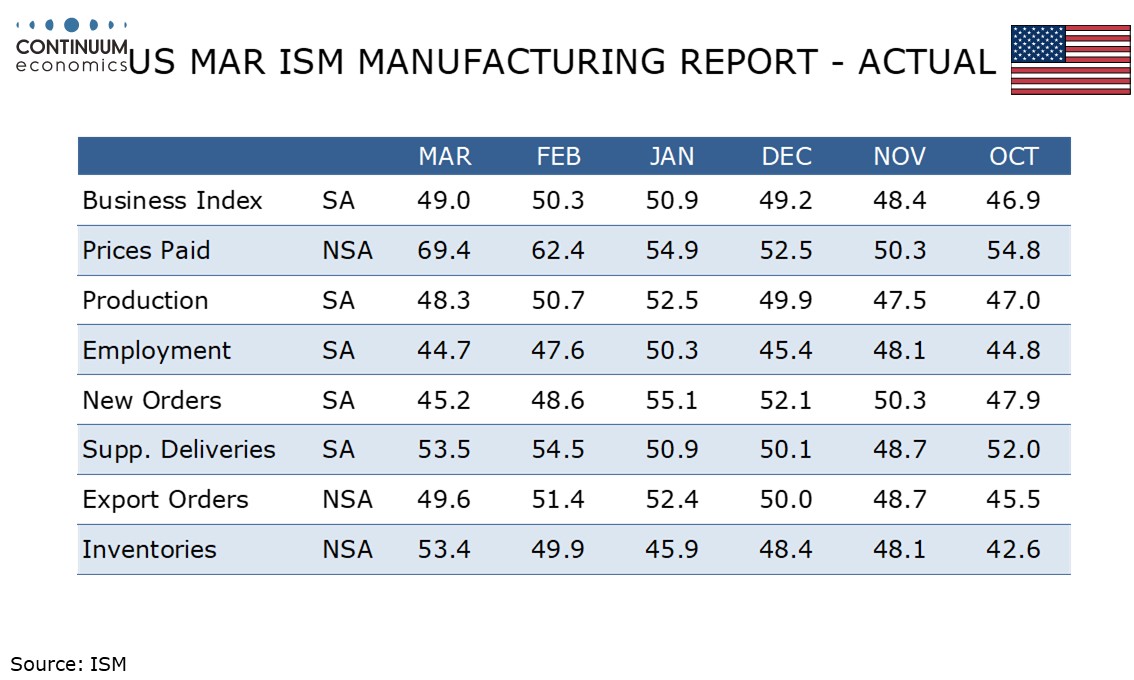

The ISM manufacturing index has fallen back below neutral after two positive months, suggesting that the threat of tariffs is seen as a net negative for the manufacturing sector. The weaker data is consistent with the message of most regional surveys.

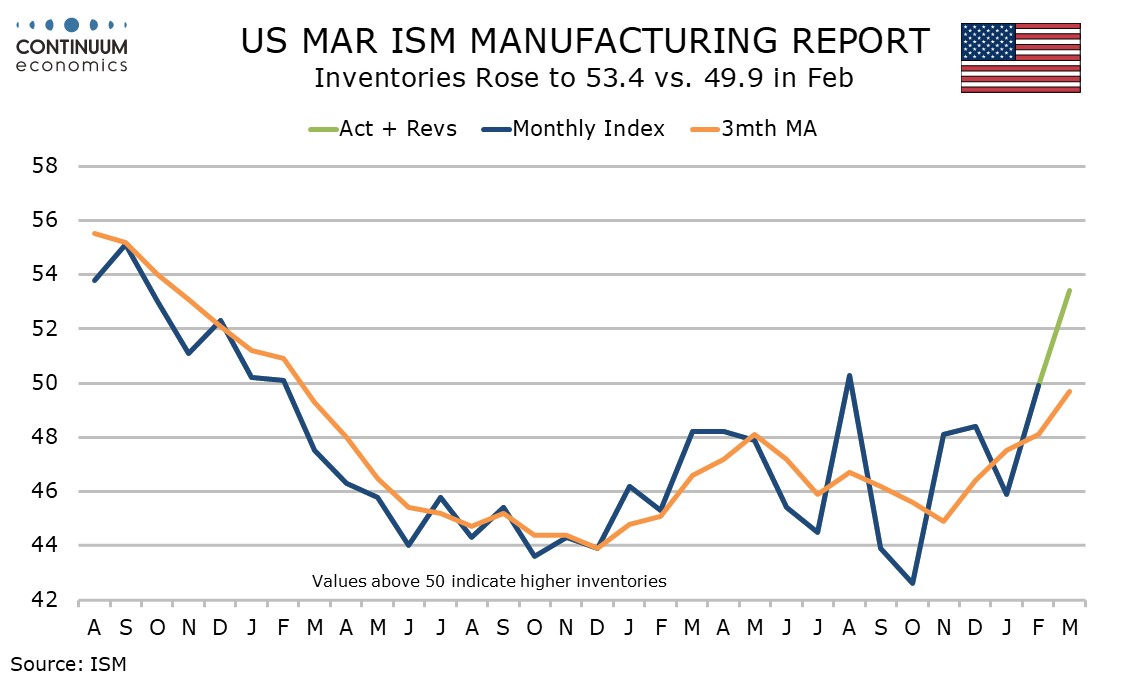

Of the five components that make up the composite, only inventories was stronger, at 53.4 from 49.9, suggesting stockpiling ahead of tariffs, though imports at 50.1 from 42.6 (not a contributor to the composite) are down. Exports, also not a contributor to the composite, are weaker still, at 49.6 from 51.4.

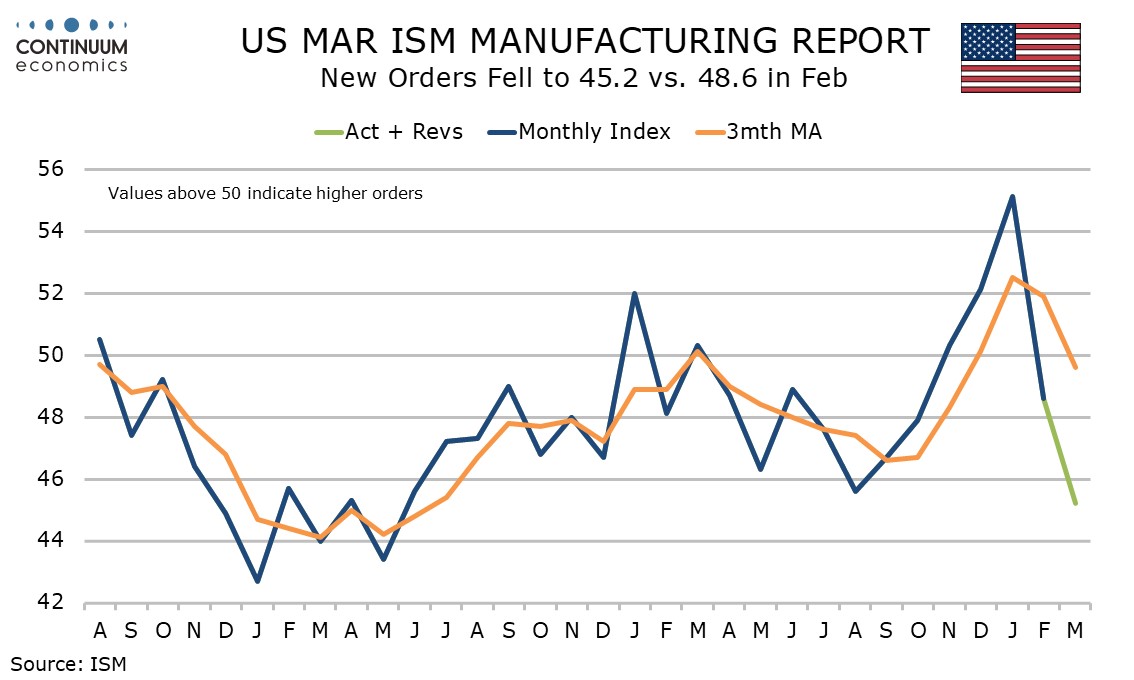

New orders at 45.2 from 48.6 are the weakest since May 2023 while employment at 44.7 from 47.6 and production at 48.3 from 50.7 also weakened. The final contributor to the composite, deliveries, are slightly less strong at 53.5 from 54.5.

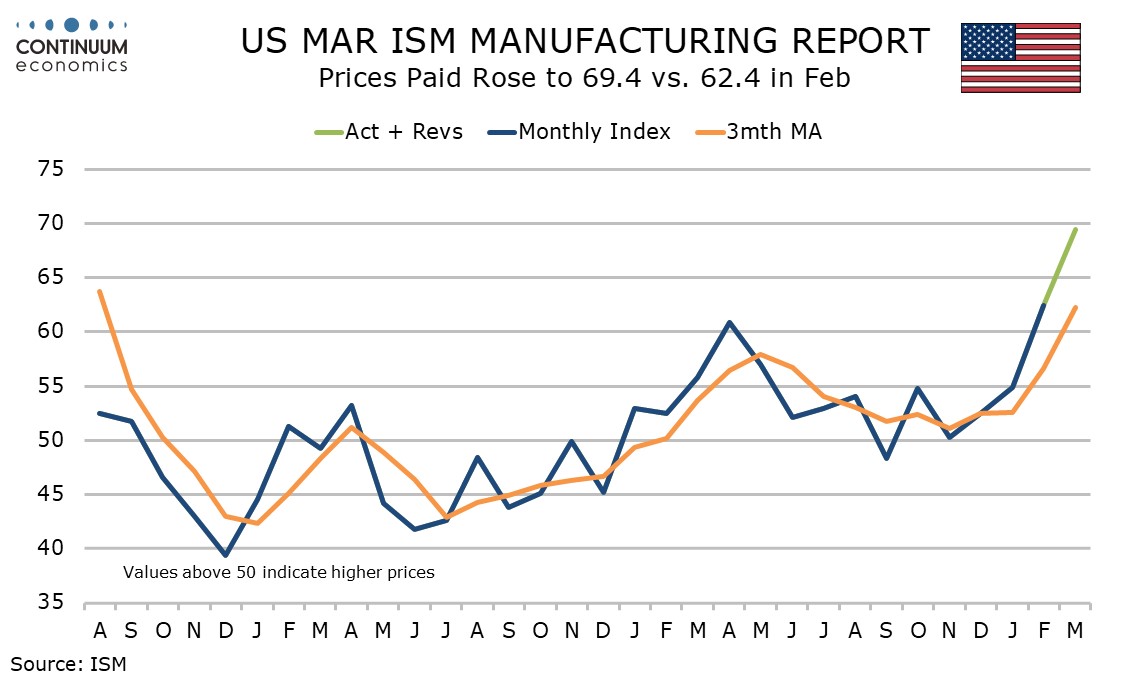

Still positive delivery times despite weakness in activity suggest higher underlying inflationary pressures. So does the highest prices paid index since June 2022 of 69.4 from 62.4. Prices paid do not contribute to the composite but are important to watch.

February construction spending rose by 0.7% after a 0.5% January decline, the bounce probably reflecting improved weather. Trend is subdued, but still positive.