This week's five highlights

All Eyes Remain on Trump

First Sign of De-escalation between U.S. and China?

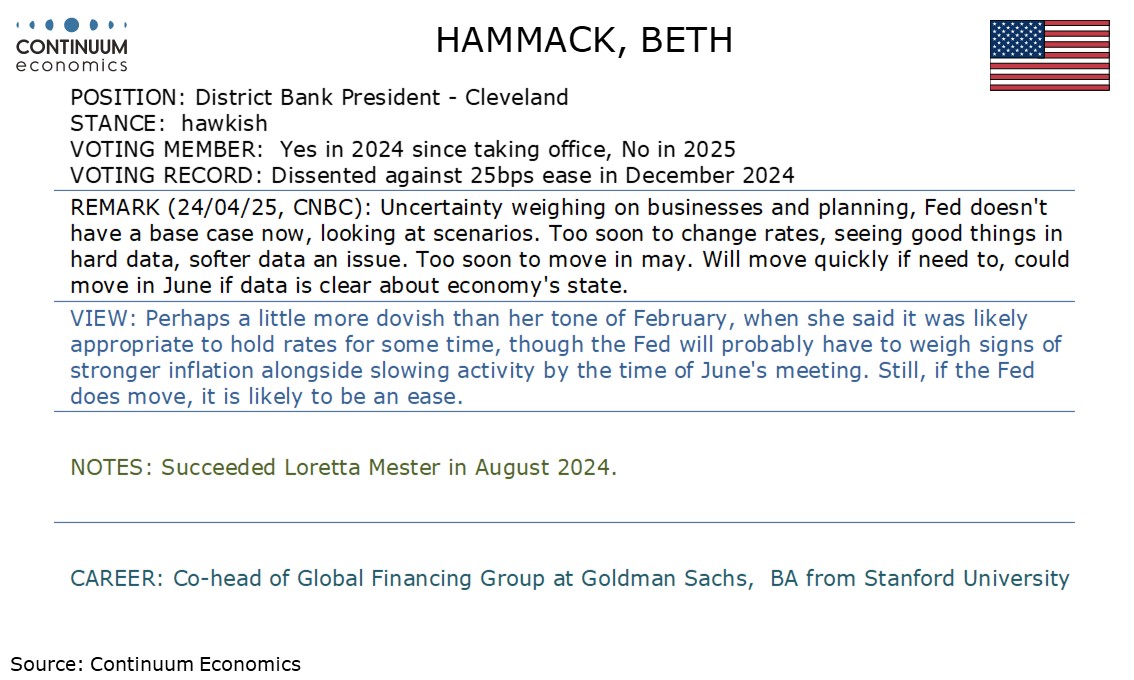

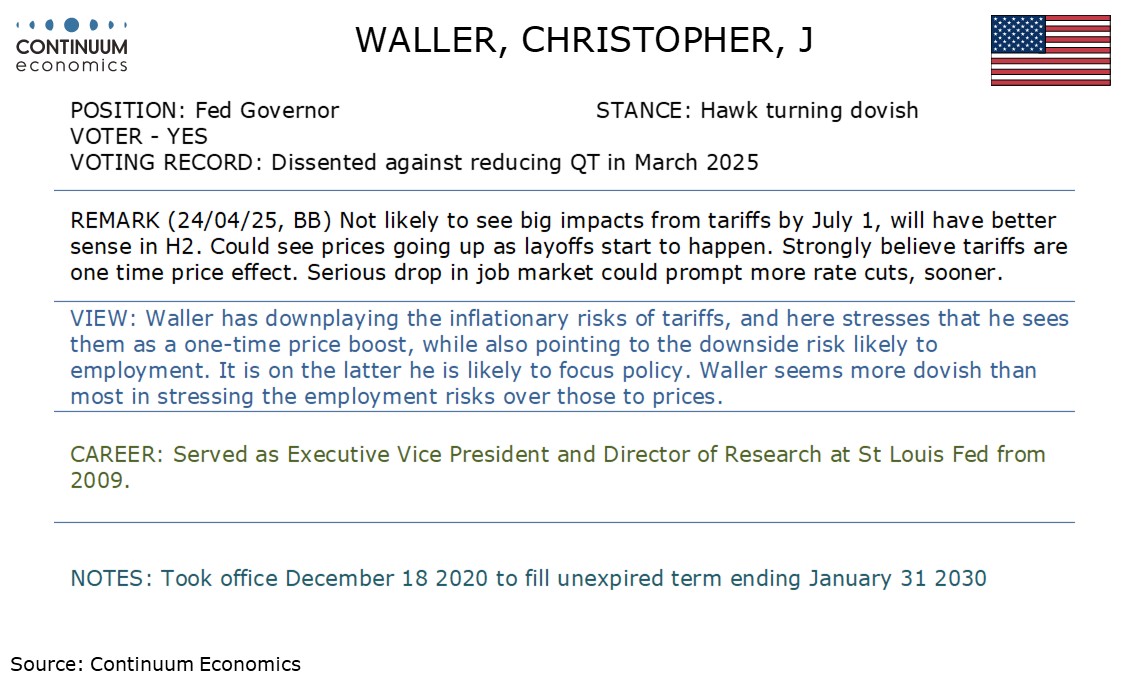

Fed Speakers latest View

Minor Rebound for the USD

USD/JPY Continue to Chop

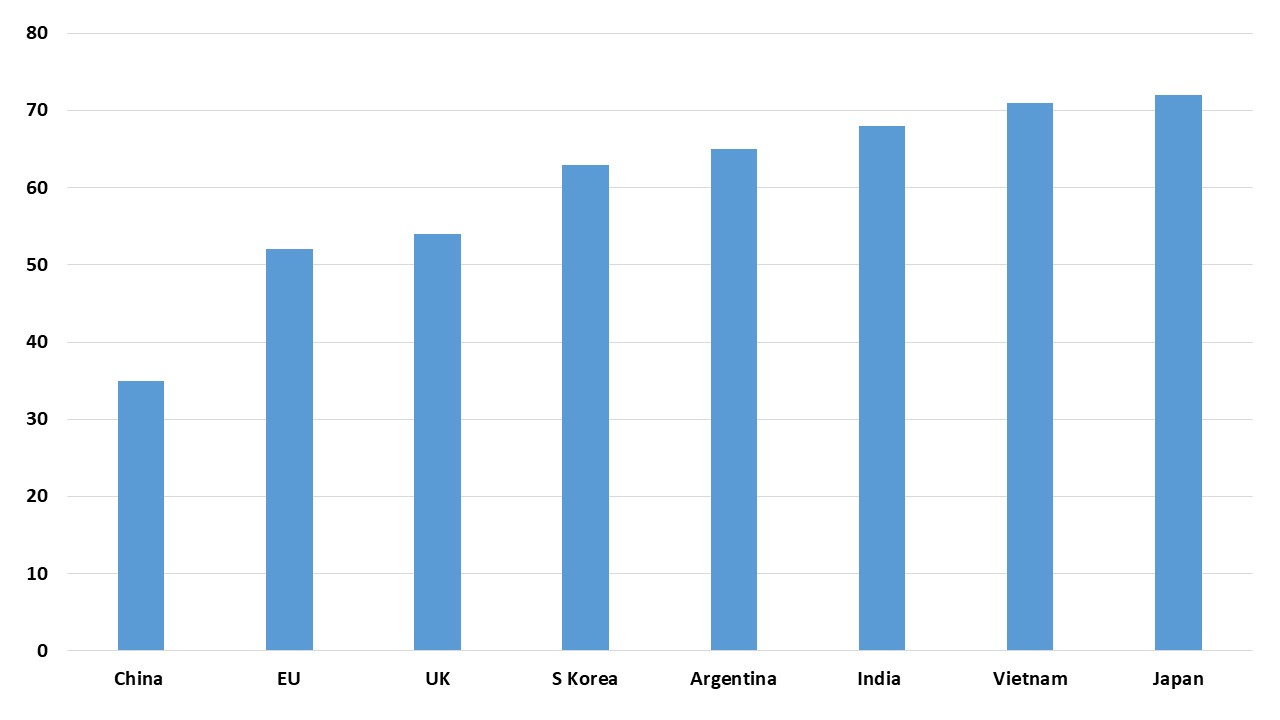

Figure: Betting Odds For A Trade Deal by End June (%)

Source: Polymarket

U.S. PR spin over potential trade deals is a lot more optimistic than briefing from other countries, with Japan suggesting the next set of key discussions are in May; India hoping for a deal by September and the EU saying that negotiations are currently going nowhere. The Trump administration optimism reflects a fear that the tariff tsunami will not only slow the economy but could cause a recession, due to the direct tariff effects and the impact on business confidence and hiring/investment. Trump blame and threats towards the Fed are typical deflection tactics.

Trade deals will still likely be agreed or agreed in principle for a number of countries by the summer, as the Trump administration remains under three fold pressure from the economic numbers; financial markets and U.S. voters approval ratings. Growth will likely slow and inflation pick-up with the April and May releases and in turn hit Trump’s approval ratings. However, quick progress to a trade deal faces a number of obstacles (here). Firstly, for now Trump still believes that the U.S. economy can benefit long-term from a shift of production back to the U.S. and increased tariff (tax) revenue for tax cuts. Last week he was still insisting on the 10% minimum, though the 25% pharma and semiconductors tariff risk has been pushed back by deciding to go to consultation first. Secondly, China is playing poker with Trump (here) by not caving into U.S. pressures. The new U.S. tactic is to sign trade deals with Japan, India, Vietnam and S Korea first, which will include restrictions on China reexports through these countries. This will likely slowdown deals. Finally, U.S. negotiators are asking for non-tariff concessions and sectoral commitments, which makes negotiations more complex. This could mean that outline deals are only agreed with a number of countries by end June, rather than full deals. The Trump administration could be pressured to delay extra reciprocal tariffs until October. We also remain of the view that the next couple of weeks will likely see China and the U.S. agreeing a truce (here); a 90 day delay in U.S./China extra reciprocal tariffs (but not the 20% already implemented) and trade negotiations.

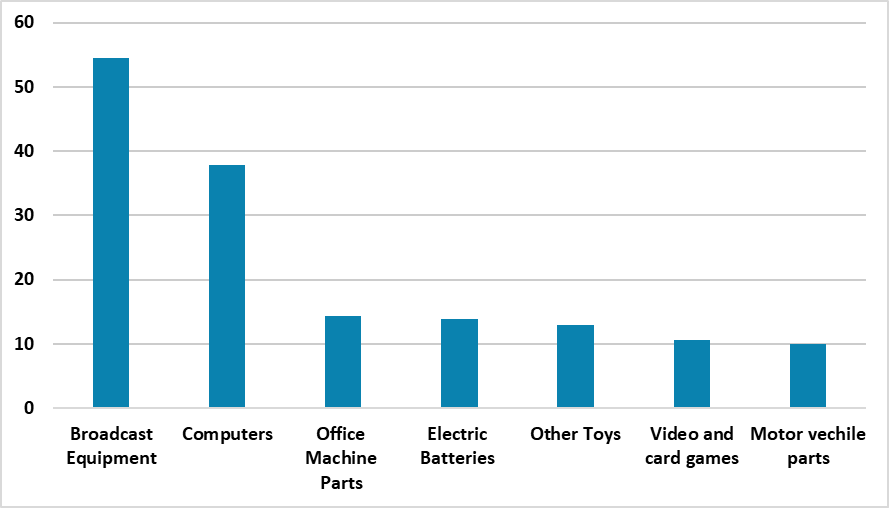

Figure: 2023 U.S. Imports from China By Key Products (USD Blns)

Source: BEA/Continuum Economics

On Friday, headline crossed the wire that China mentioned certain items could be exempted from tariffs, signaling the first sign of de-escalation between U.S. and China since Trump's exorbitant tariff. On balance, our baseline still remains a U.S./China trade deal (55-60%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries. Timeline is Q4 2025 or H1 2026. An alternative moderate probability scenario (30-35%) is that negotiations occur but the two sides fail to agree a trade deal, due to large differences on key areas or that a trade truce is not agreed.

President Donald Trump has hinted at lower tariffs if a deal is struck between the U.S. and China this week, which reflects the growing economic fallout from super high tariffs with China. Once inventories are rundown, production in the U.S. will be impacted in certain sectors given the dependence on parts and intermediate goods from China. This production hit in the U.S. can then hurt employment and income growth as a 2 round effect. The lower tariff for smartphones and electronics already reflects the U.S. inability to diversify away from China in the short-term. As the economy effects on the U.S. worsens and Trump approval ratings softens further, the pressure will intensify for a trade truce with China.

China has responded to Trump offer by saying that all unilateral China tariffs should be removed. This could mean a 10% baseline universal tariff and 25% on cars/steel and aluminum like other countries would be acceptable to China. This is likely too low for Trump currently having marched tariffs up to 145%, with reports suggesting that some in the U.S. administration are thinking about 50-60% for China. However, China is hurting as well and considering exempting U.S. imports of hospital goods and ethane from the 125% tariffs. China has also not launched aggressive fiscal stimulus suggesting it still expects the trade hit to be temporary and modest. We feel all of this is posturing by both sides and that an agreed truce will likely be agreed in the next 2-3 weeks with China. This could be a baseline tariff of 20% and/or by exempting more goods from the super high tariffs.

The greenback has rebounded from the slump in the previous week's risk turmoil. The fate of USD seems to be tracking the moves in short end U.S. Treasury Yields, more than the longer end. The move is triggered by Trump's stance towards tariffs and Fed's chair Powell, calming market sentiment. And we continue to expect such to persist as the volatility in U.S. Treasury Yields will remain choppy on tariff expectation, thus Fed interest rate decision and subsequent the USD.

On the chart, the anticipated minor test lower has bounced from 142.30, as intraday studies turn higher, with prices currently balanced in cautious trade beneath congestion resistance at 144.00. Daily readings continue to rise and oversold weekly stochastics are flattening, suggesting room for further strength in the coming sessions. A break above 144.00 will open up congestion around 145.00. But the negative weekly Tension Indicator and bearish longer-term charts could limit any initial tests in consolidation/selling interest. Meanwhile, support remains at congestion around 142.00 and should continue to underpin any immediate tests lower.

The traditional risk barometer USD/JPY continues to play its role. U.S. equities have rebounded almost at the same time of USD/JPY reversal as the haven seeking JPY is offered on upbeat risk asset. However, there seems to be less impact on the JPY from the potential damage of U.S. tariffs. The BoJ will likely be delaying their pace of tightening in sight of slower economic growth and potential delay offs in the auto industry. Yet, market expectation for the next BoJ hike has always been in late 2025 due to the lack of commitment from the BoJ, which may have avoided any JPY strength being priced in.

On the chart, anticipated gains have met selling interest just beneath congestion resistance at 100.00, as overbought intraday studies unwind, with prices settling back and currently trading around 99.45. A test of support at 99.00 cannot be ruled out. But rising daily readings are expected to limit any break in renewed buying interest above congestion support at 98.00. Meanwhile, resistance remains at 100.00 and extends to the 100.16 year low of 27 September 2024. A close above here will open up the 101.00 break level. But negative weekly charts are expected to limit any initial tests in renewed consolidation.