This week's five highlights

FOMC leaves rates unchanged

U.S. Q4 GDP Led by Strong Consumer Spending

ECB Policy Still Restrictive

Bank of Canada eases by 25bps as expected

Riksbank Shifts to Easing Bias

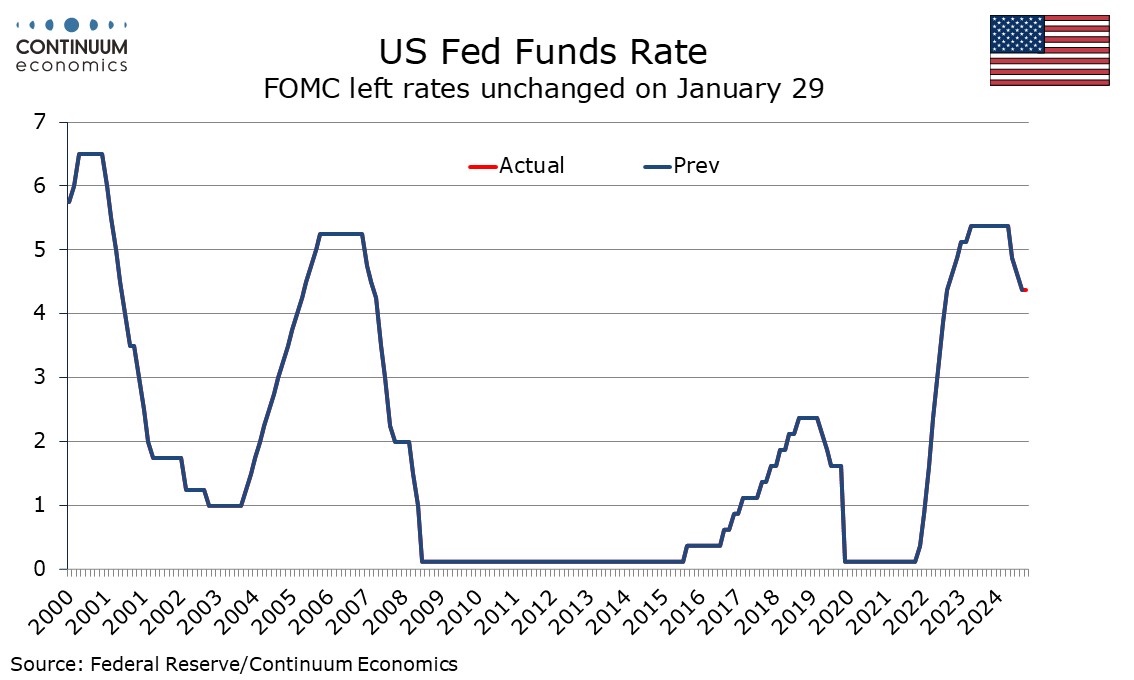

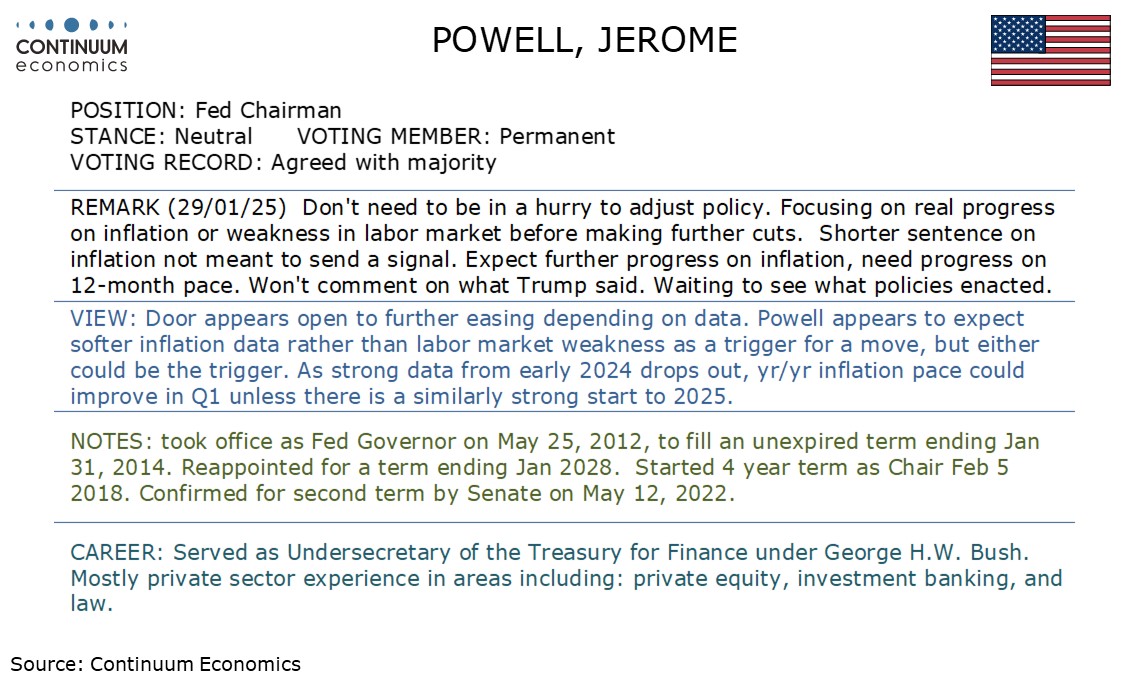

The FOMC has left rates unchanged at 4.25-4.5% as expected. The statement has seen hawkish adjustments in its assessments of labor market conditions and inflation. The latest statement states the unemployment rate has stabilized at a low level in recent months and labor market conditions remain solid. In December the FOMC stated that since earlier in the year labor market conditions have generally eased and the unemployment rate has moved up but remains low. Thus, the FOMC is describing a stable labor market rather than a modestly easing one.

A more hawkish interpretation of the data in the statement appears to be more a justification for the FOMC’s decision to leave rates on hold at this meeting rather than a signal for a protracted period of steady policy. There is still scope for renewed Fed easing if either inflation or labor market data weakens, and we will see two months of employment and CPI data before the FOMC next meets on March 19. The most significant adjustment to the FOMC statement was a removal of a reference to inflation making progress toward the 2% objective, though Chairman Jerome Powell stated at the press conference that this was not intended to send a signal. He added that he expects further progress on inflation, with focus on yr/yr growth. As strong data from early 2024 drops out, yr/yr rates look likely to slip in early 2025.

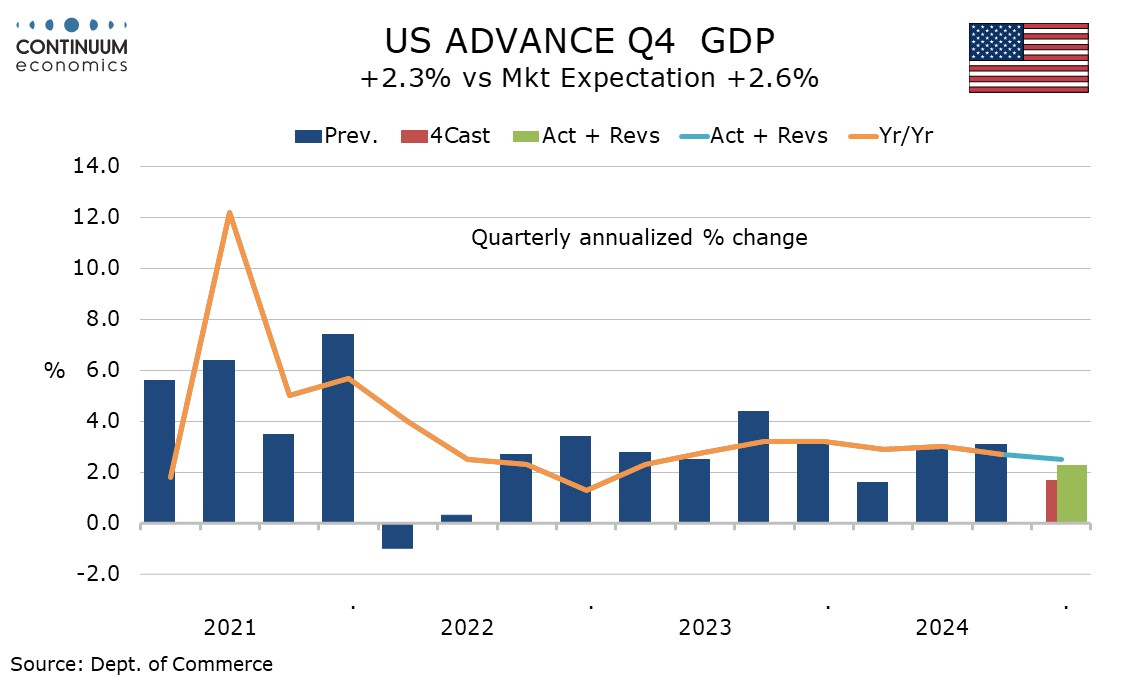

The 2.3% increase in Q4 GDP is little weaker than consensus expectations surveyed before yesterday’s weak trade and inventories data but the data was supported by a significantly stronger than expected 4.2% rise in consumer spending, keeping the pace of growth solid. Core PCE prices at 2.5% are on consensus, showing inflationary pressures moderately above target. Final sales rose by 3.2%, meaning a negative of 0.9% from inventories, and weak inventory growth in Q4 provides potential for a bounce in Q1. Final sales to domestic buyers rise by 3.1%, meaning net exports actually contributed marginally positively to GDP by 0.1% with exports and imports both falling by 0.8%. Both series were restrained in October by a strike at northeast ports.

Residential investment picked up by 5.3% after two straight declines, suggesting Fed easing is having a positive impact, but business investment with a 2.2% decline showed the steepest decline since the pandemic, equipment at -7.8% correcting two straight gains of near 10%. Transportation equipment saw a particularly steep drop and may have been impacted by a strike at Boeing. Government was solid with a rise of 2.5% though slower than the preceding two quarters. Final sales to private sector domestic buyers rose by a healthy 3.2%. Still, the details are quite subdued outside a 4.2% increase in consumer spending, which was led by durables at 12.1% but nondurables at 3.8% and services at 3.1% were both solid. Consumer spending significantly outperformed a 2.8% rise in real disposable income, though the latter is far from weak.

Figure: Improving Household Loan Demand Reflecting Better Interest Outlook?

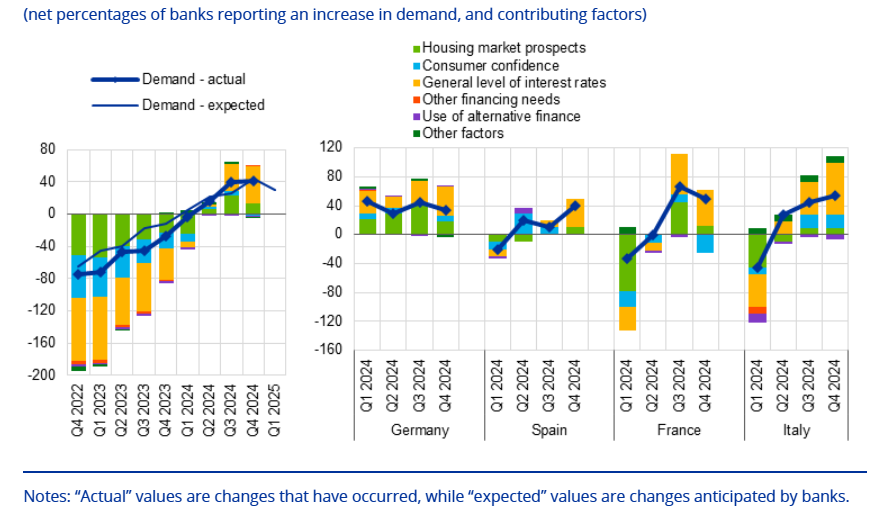

It was always likely that the ECB verdict at this month’s Council meeting would be less resounding than that seen in December. A fifth 25 bp discount rate cut did occur, to 2.75%, but may not have seen any demand to at least consider a larger move as was the case last month. But the door is left open for further cuts as the disinflation process remains on track so that inflation will settle at around the target on a sustained basis. Moreover, the ECB stressed monetary policy remains restrictive – the latter may not be something the hawks would agree with! Little was made of the weaker real economy, with it not being acknowledged that an inflation backdrop that was in line with expectations had actually come about amid a much weaker growth backdrop in the last few months. Given that weakness and the economic headwinds the ECB sees existing implies around three more 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate resulting.

As the account of the December 11-12 Council meeting noted, a minority of the Council wanted a 50 bp move. Such demands were seemingly not repeated this time around. Regardless, given the highlighting of policy still being restrictive, a further move at the next meeting March looks even more on the cards. At that juncture, and extrapolating from recent less-soft survey data and assuming further improved credit demand signs suggesting policy easing is filtering through (Figure 1), the ECB may possibly then consider changing its rhetoric. It may then suggest additional rate cuts will arrive either slower and/or have to be more data driven. The potential presentational problem with any such shift in guidance is that the ECB may have to pare back its growth projections once again in March and maybe markedly and durably so. This would reflect the risks of tariffs and an ensuing trade spat as well as economic divergences with the EZ accentuated by political uncertainty that could yet lead to financial market tensions, all meaning economic risks remain to the downside.

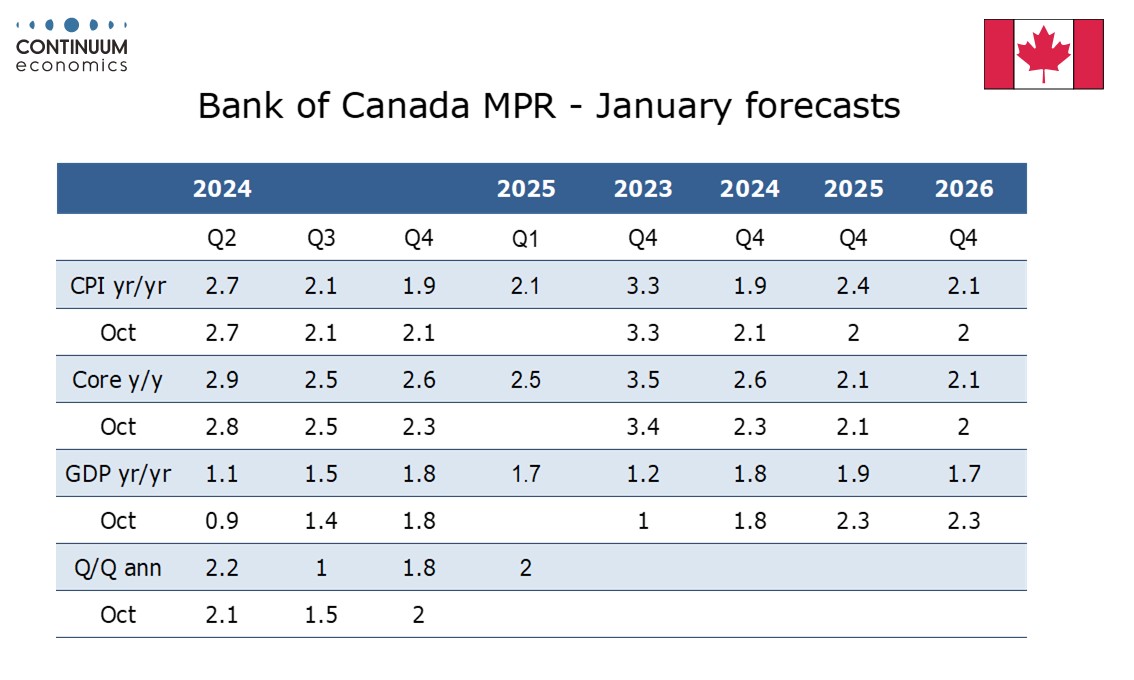

The Bank of Canada eased by 25bps to 3.0% as expected, and confirmed the ending of Quantitative Tightening, as had been outlined by Deputy Governor Toni Gravelle on January 16. The BoC has delivered some fairly optimistic forecasts, but these are made assuming an absence of tariffs, given that the BoC sees the scope and duration of a possible trade conflict as impossible to predict. Compared to October, the Bank of Canada’s CPI forecasts have been revised marginally higher. The picture is still seen remaining close to the 2.0% target, though the core rate is seen at 2.1% in Q4 of both 2025 and 2026. Current slippage in headline CPI is exaggerated by a temporary sales tax holiday which will lift yr/yr comparisons in 12 months’ time. GDP growth for 2025 and 2026 has been revised lower, but this is based on lower expected population growth given reduced immigration. This has seen potential growth revised lower too, and excess supply is seen being gradually absorbed during the projection horizon.

Risks are seen as reasonably balanced setting aside threatened US tariffs, though a protracted trade conflict is seen as likely to lead to weaker GDP and higher prices, which Governor Tiff Macklem stated cannot both be leant against simultaneously. Macklem noted signs of past rate cuts starting to boost activity but in this he noted consumer spending and housing, while noting weakness in business investment, though that is forecast to increase gradually. Despite the threat of tariffs, new capacity for oil and gas is supportive for exports.

Figure: Upbeat GDP Outlook Too Rosy?

Having delivered the widely-expected sixth successive rate cut this month, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (now at 2.25%) having dropped 1.75% in eight months. But the Board remains open to further easing; while the December outlook which envisaged just one more cut is essentially unchanged, the Riksbank did note that it is prepared to act if the outlook for inflation and economic activity changes. We think this will be the case and that a further 25 bp cut will occur later in H1. Indeed, some degree of concern that policy may need to be eased again can be seen from both the lack of dissent to this decision and the fact that the cut was exercised so soon in the six-month window that the Board had pointed to. In addition, while the Riksbank is right to note the emergence of better economic signs, the Riksbank is still over-estimating the real economy backdrop and outlook.

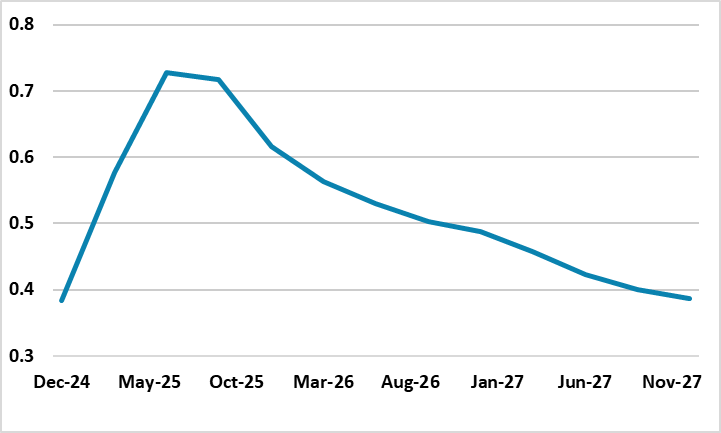

In this regard, while the Riksbank did revise down its slightly above-consensus GDP outlook out to 2027, whilst still suggesting inflation will settle around target, its projections still imply a very upbeat real activity picture through this year. Indeed, in the five quarters to end-2005, cumulative GDP growth is expected to be around 3% (Figure 1). Admittedly, early insights into last quarter suggest some revival in growth, but even if the 0.2% q/q flash GDP estimate released earlier today proves accurate, it would be half of what the Riksbank has pencilled in.

In addition, and largely accepted by the Riksbank, risks emanating from the global economy (eg regrading trade) remain, if not having intensified, while the impact of the rapid Riksbank easing in H2 last year has already been partly unwound by the rise in market rates. Indeed, that latter rise may have been part of the rationale for a move this month merely to show markets its policy intentions have not been diluted, also leaving the March meeting to update the policy outlook when fresh projections will be offered. Admittedly, there are risks seemingly on the opposite side emanating from the krona, but we think such concerns are both overdone and unlikely to emerge.

Those updated projections may show an even friendlier inflation backdrop and outlook, something already evident in adjusted core CPIF inflation readings which are now down to rates last seen prior to the pandemic when Sweden saw persistent undershooting of its inflation target. This all makes still clear Board worries about price pressures seen in some business surveys and from a weaker currency overdone