USD, JPY flows: USD reverses initial dip on payroll revision

US benchmark payroll revised down m ore than expected, but little implication for current trend

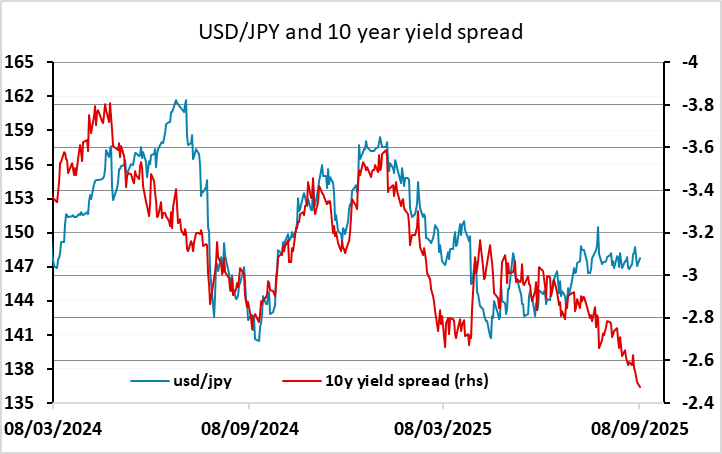

Although the payroll revision of -911k is larger than expected (-682k was the consensus), the USD has quickly reversed the initial dip on the announcement. This is to some extent fair enough, as the downward revision says nothing about the trajectory of employment between March 2024 and March 2025. There is no breakdown as to whether the downward revisions were in early 2024 or more recent, so it isn’t clear what the momentum was coming into this year. In any case, the data doesn’t affect the most recent numbers or their trend, which is getting close to being flat or marginally higher, broadly n line with the trend in labour supply. The reversal of the initial downmove reflects the fact that this doesn’t add much to our current information on the labour market. US yields are also not much changed. However, we still see scope for USD/JPY to decline after the overnight reports that the BoJ are gearing up for a rate hike in October or December. This underlines the fact that narrowing yield spreads suggest scope for substantial JPY gains.