This week's five highlights

U.S. August Non-Farm Payrolls Less weak than July

U.S. ADP Employment Losing momentum

And U.S. ISM Data

Dovish Tone from the Bank of Canada

USD/JPY Begins its Trip to the South

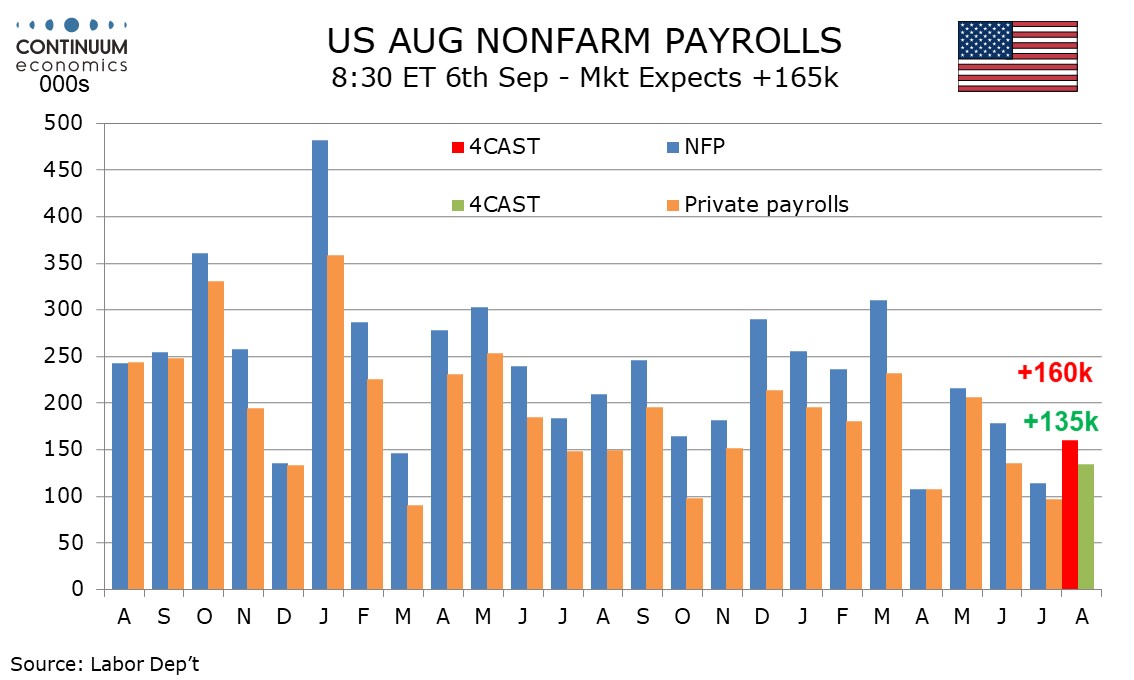

We expect August’s non-farm payroll to rise by 160k, 135k in the private sector, both slightly stronger than respective July gains of 114k and 97k that were probably restrained by weather but below 3-month averages of 170k and 146k, and thus implying a continued modest slowing in trend. We expect unemployment to correct lower to by 0.1% to 4.2% after rising by 0.2% to 4.3% in July, and a 0.3% rise in average hours earnings to follow a below trend 0.2% in July. A less weak payroll in August should help the FOMC decide to ease by 25bps on September 18 rather than by 50bps. While July’s press release saw no discernable impact from Hurricane Beryl in the data, we suspect there was a modest negative impact. State data showed a 14.5k decline in Texas, the state most impacted by the hurricane. It is also possible that unusually hot weather in the Midwest had a negative impact in July.

Initial claims data to the August survey week shows the 4-week average almost unchanged from July’s survey week, suggesting the labor market has not weakened further in August. Recent JOLTS job openings for July and ADP private sector employment data for August were weaker than expected, but neither in our view represented a sharp deviation from a gradually slowing trend.

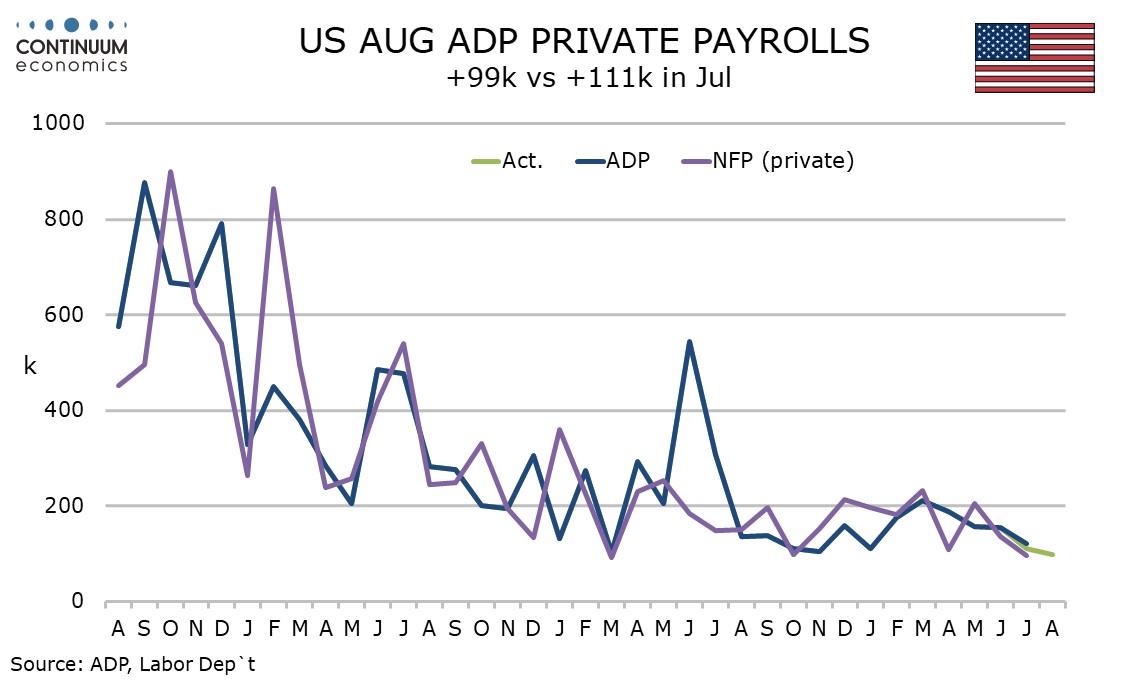

ADP’s August estimate for private sector employment growth of 99k is below expectations and consistent with a continued slowing of the labor market, with the gain being the slowest since January 2021. While the data suggests some downside risk to non-farm payrolls, our private sector payrolls call of 135k would to be a dramatic outperformance of the ADP data. We expect overall payrolls to rise by 160k. Initial claims at 227k from 232k still suggest quite a strong labor market. August’s ADP data shows education and health up by only 29k. This sector has been leading recent non-farm payroll gains and while some slowing is possible it is still likely to outperform the ADP data. The ADP data also showed leisure and hospitality, a sector which until quite recently was leading ADP gains, with a second straight subdued month, up by 11k.

One sector to look quite strong in the ADP report is construction, up by 27k. Declines were seen in manufacturing by 8k and business and professional by 16k. ADP data signaled some stabilization in wage growth with yr/yr gains of 4.8% for job stayers and 7.3% for job changers both unchanged from July, a pause in what had been a steady slowing in trend.

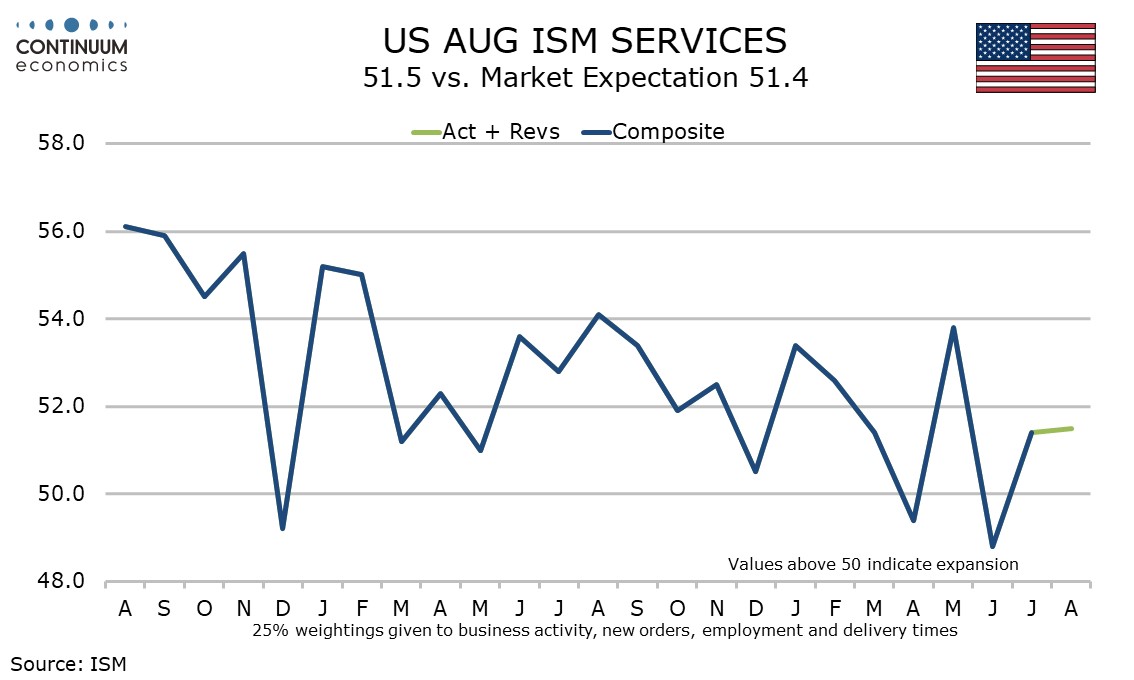

August’s ISM services index at 51.5 is almost unchanged from July’s 51.4 and implies an economy continuing to expand at a modest pace. Employment at 50.2 is down from July’s 51.1, but in being above the neutral 50 remains stronger than the readings seen from February through June. The composite is less positive than the S and P services index of 55.7, with the correlation between the two series poor and the S and P data seemingly more sensitive to interest rate expectations.

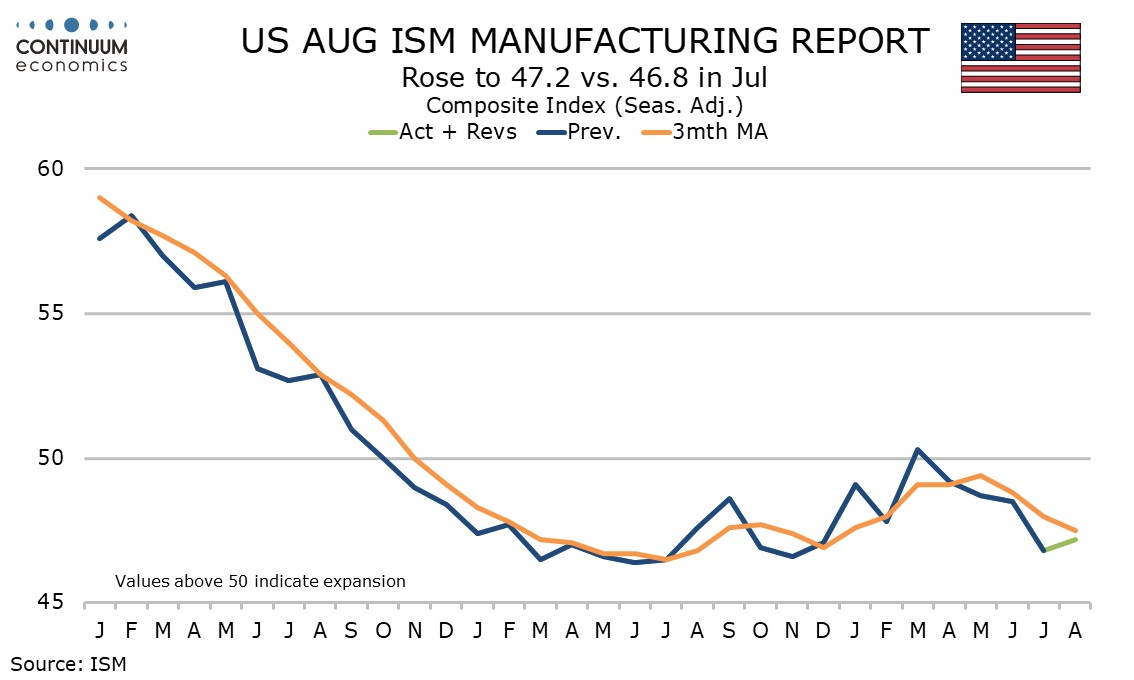

August’s ISM manufacturing index at 47.2 is up from July’s 46.8 but still quite weak, with the first two months of Q3 weaker than each of the six months in the first half of the year. New orders at 44.6 from 47.4 are the weakest since May 2023. Production also weakened to 44.8 from 45.9, this the lowest since May 2020 at the height of the pandemic. The gain in the composite was led by inventories, which saw a sharp rise to 50.3 from 44.5.

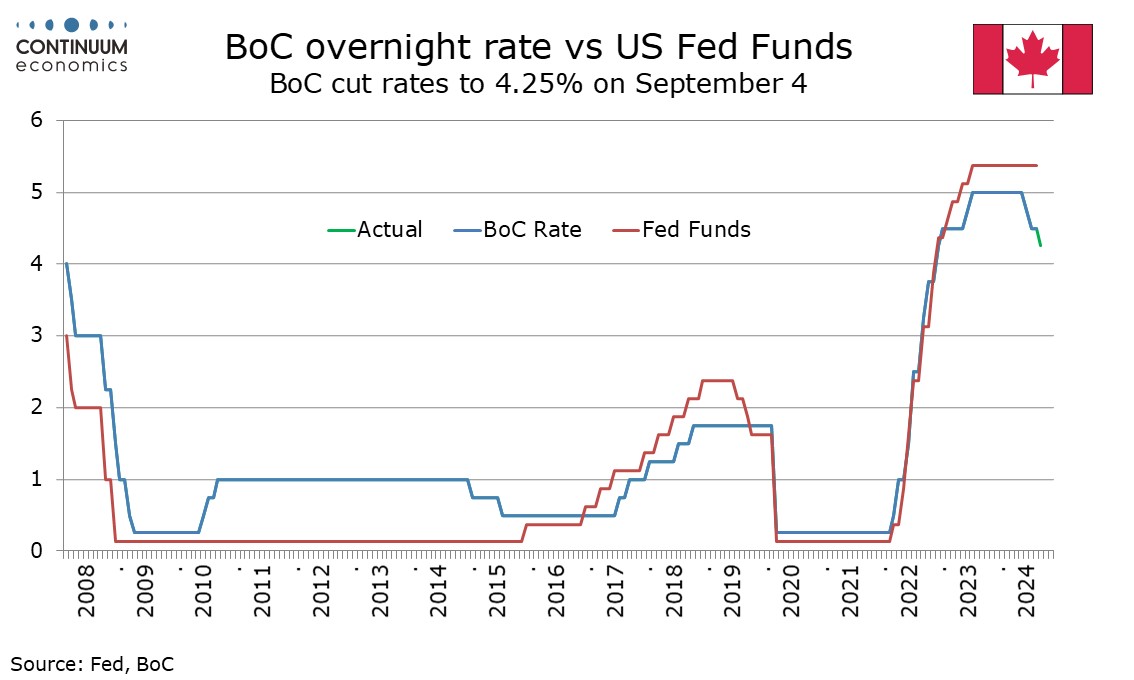

The Bank of Canada eased rates by 25bps for a third straight meeting as expected, taking the rate to 4.25%. The tone of the statement and press conference was dovish, expressing concern that growth may fall short of their expectations while seeing some progress in still resilient shelter inflation. This suggests that the pace of easing could be accelerated by early 2025. The statement saw global growth as in line with projections in July’s Monetary Policy report, and 2.1% annualized Canadian GDP growth in Q2 was above forecast. However the statement also noted soft activity in June and July and continued slowing in the labor market. Inflation slowing to 2.5% in July was seen as expected. While the statement stated the BoC continues to weigh the opposing forces of excess supply reducing inflation and price increases in shelter and other services holding inflation up, the tone of Governor Tiff Macklem’s opening press statement was dovish. He saw the sources of upside pressure from shelter and some other services as having eased slightly but the downward pressure from excess supply remaining. He also noted that July’s economic projection had growth strengthening further in the second half of the year but recent indicators suggested some downside risk to this. He stated the share of CPI components growing above 3% was now around the historical norm but shelter inflation was still too high, despite early signs of easing.

In responding to questions Macklem stated there was a strong consensus for a 25bps cut and that a slower and faster pace of easing were both considered. He added that the BoC was prepared to take a bigger step if needed. If GDP growth does not improve as expected, leaving the upward trend in unemployment, now at 6.4% after starting 2023 at 5.0%, intact, and inflation gets close to target, the BoC may consider accelerating the pace of easing. The neutral range is currently estimated as 2.25-3.25% and the BoC may want to move more rapidly to neutral, or even a little below. We continue to expect 25bps moves in the remaining two meetings this year, on October 23 and December 11. Risk is however for more, increasingly so for December, if, as we expect, GDP does not gain momentum.

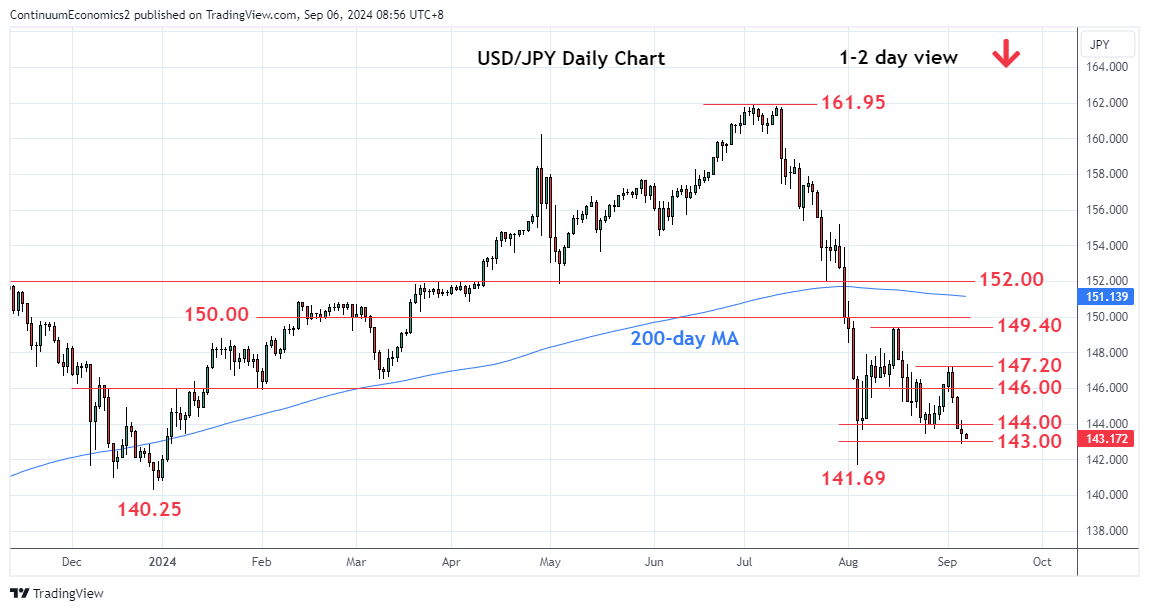

USD/JPY is beginning is breakout of consolidation, currently waiting for the U.S. NFP release to trigger another move. U.S. Treasury Yields continue to slide while JGB yields are relatively steady. The market is waiting for the Fed to cut and is anticipating the BoJ to hike at least once this year, which will further narrow the yield differential and decrease the attractiveness of carry trade. That may deteriorate when market participants feel like the downside potential out-scale the potential yield. The major correction have begun and we may see another wave of it in the coming weeks.

On the chart, USD/JPY is consolidating at the 143.00 level as prices unwind the oversold intraday studies but pressure remains firmly on the downside. Break will will see room to extend losses to retest the 142.00 level and the 141.69, August low. Would expect reaction here but corrective bounce see resistance now at the 145.00/145.20 congestion area which is expected to cap and sustain losses from the 147.20, lower high. Below the 141.69 low will extend losses from the July YTD high at 161.95 and see room to the 140.80/140.25, January YTD and December lows.