EUR, AUD flows: EUR upside limited but scope for AUD recovery

USD slips at the open. EUR upside limited given French concerns, but AUD looks undervalued

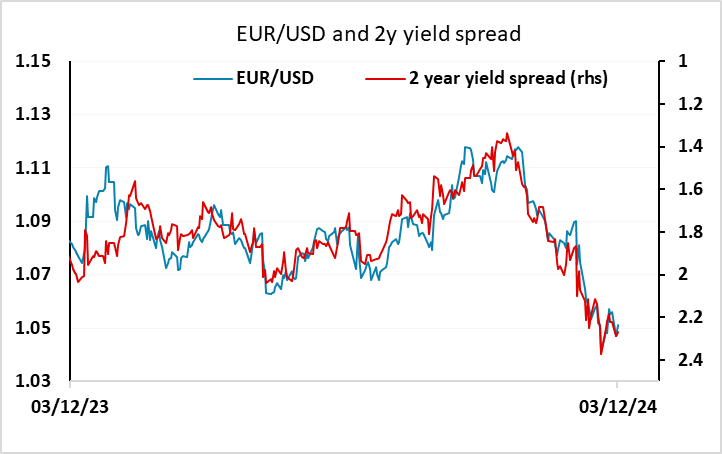

A fairly quiet overnight session has seen little change in the major currencies. The riskier currencies are showing some early strength in Europe, with EUR/USD popping back above 1.05 and AUD/USD above 0.6480. USD/JPY is also edging back below 150. There is no obvious trigger for a weaker USD, but a slightly better equity market tone may be encouraging the higher yielders. The EUR is still at risk from French developments, with PM Barnier set to make a speech at 19:00 GMT and the government likely to face a confidence vote on Wednesday. There’s no data of any note due today, and with the France/Germany spread still at the post-2012 highs, and US/Germany yield spreads still consistent with EUR/USD at 1.05 or below, its hard to conjure any real enthusiasm for the EUR.

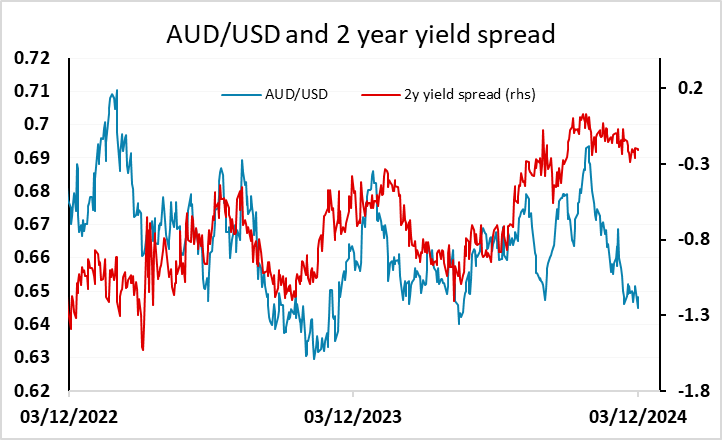

However, there is more of a case for a stronger AUD. While the AUD may be perceived as a potential victim of Trump tariffs and their impact on world trade, both the yield spread relationship and the correlation with Chinese equities suggests the AUD is undervalued at current levels. The Australian economy and the AUD may be at risk from a global slowdown, but in the current more neutral environment the AUD looks attractive, with the 0.6350-0.6450 area also representing good technical support.