Published: 2025-05-05T12:00:47.000Z

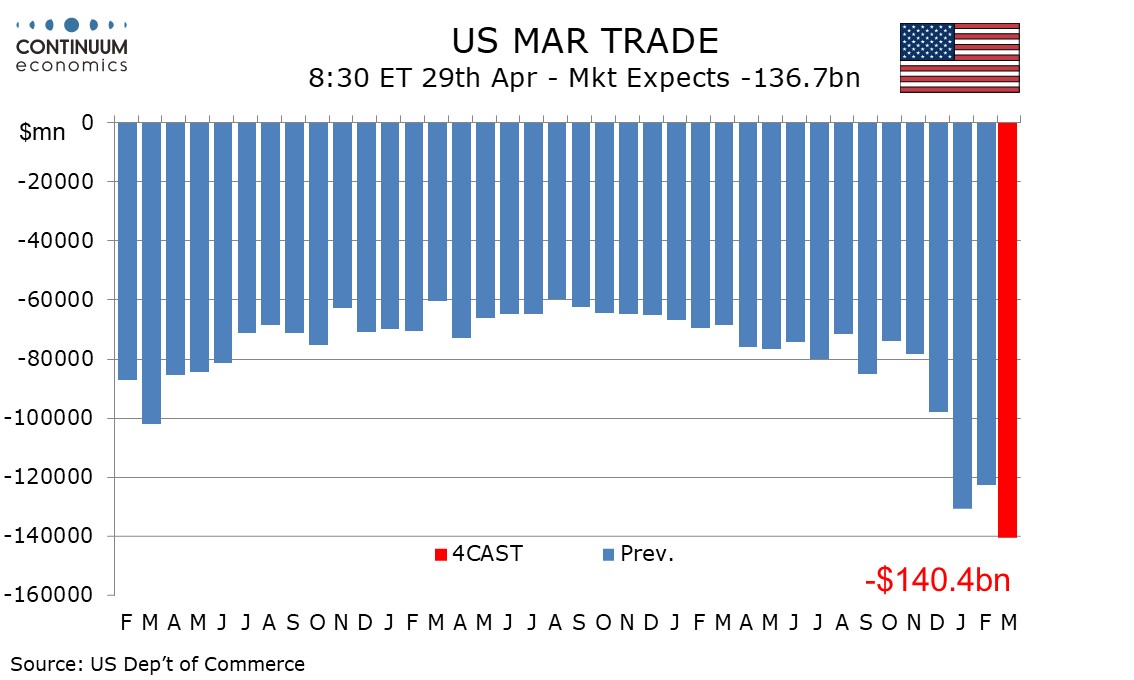

Preview: Due May 6 - U.S. March Trade Balance - Record deficit on pre-tariff import surge

1

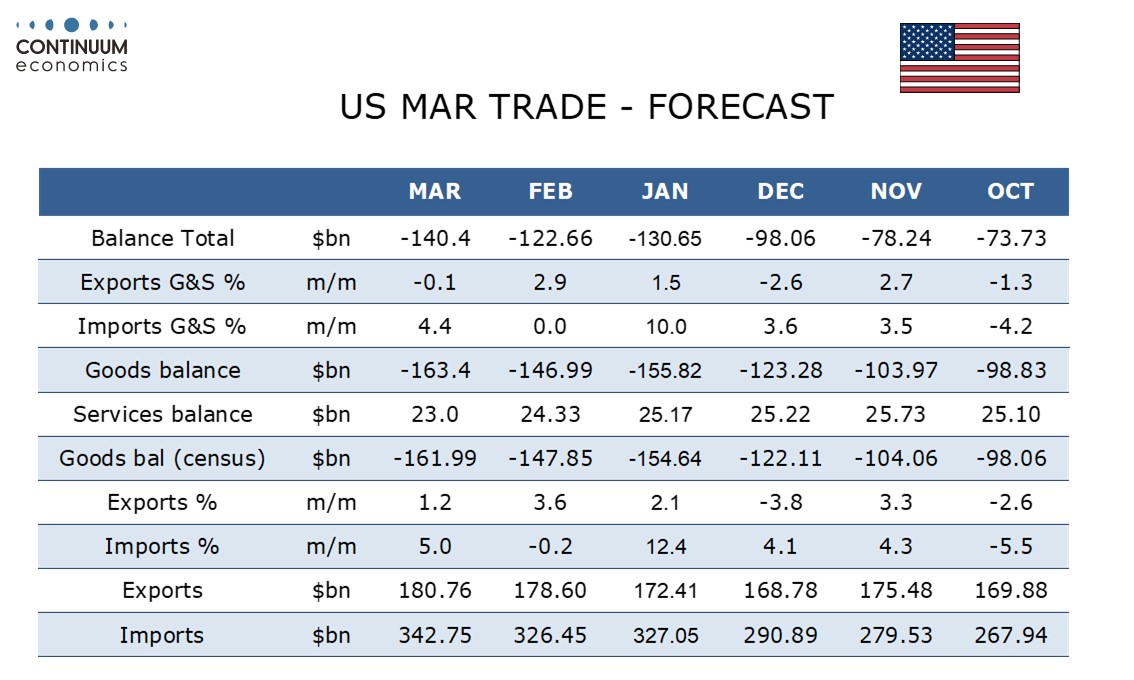

We expect a record March deficit of $140.4bn, up from $122.7bn in February and the previous record of $130.7bn set in January. We expect a marginal 0.1% decline in exports but a surge of 4.4% in imports ahead of the April 2 tariff announcement.

Advance goods data (measured on a census basis) showed exports up by 1.2% and imports up by 5.0%. We expect goods exports in this report (measured on a balance of payments basis) to rise by only 0.4%, while imports increase by 5.2%. This would be consistent with the assumptions in the Q1 GDP report.

We expect slippage in the services surplus to a 2-year low of $23.0bn from $24.3bn. We expect service exports to fall by 1.0% as tourists, particularly Canadians, avoid the US, while service imports rise by 0.6%. This would also be consistent with the assumptions of the Q1 GDP report.