This week's five highlights

U.S. Trade Complication Persists

Prospect of a U.S.-China Trade Deal

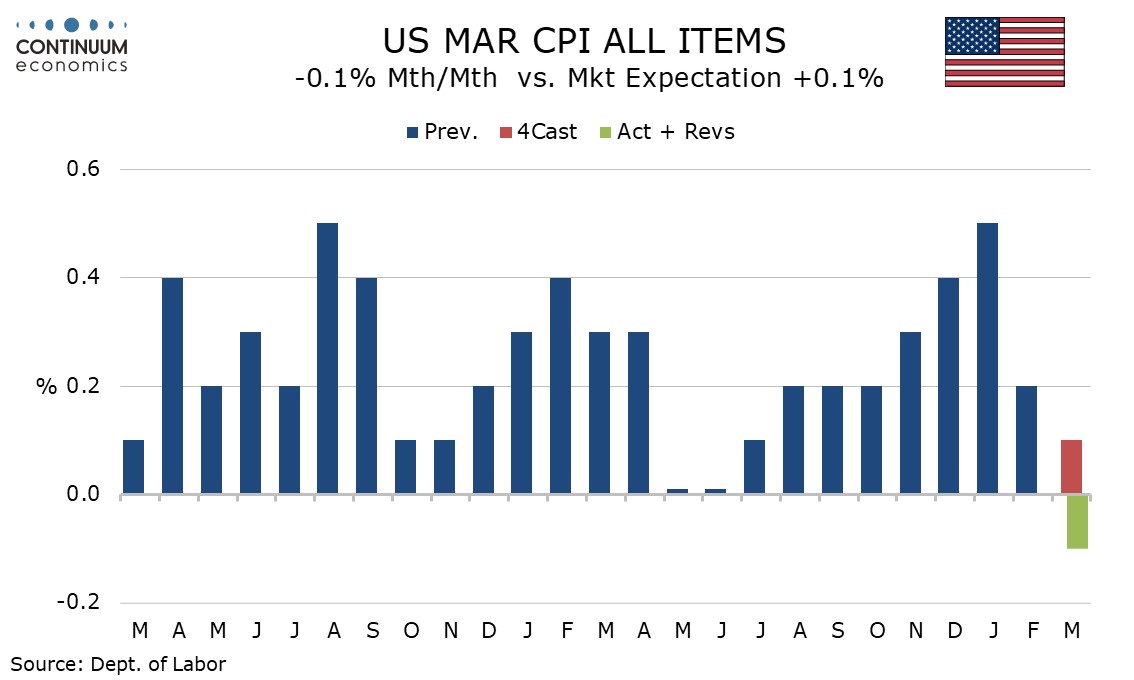

U.S. March CPI Shows Pre-tariff momentum appears lower than was realised

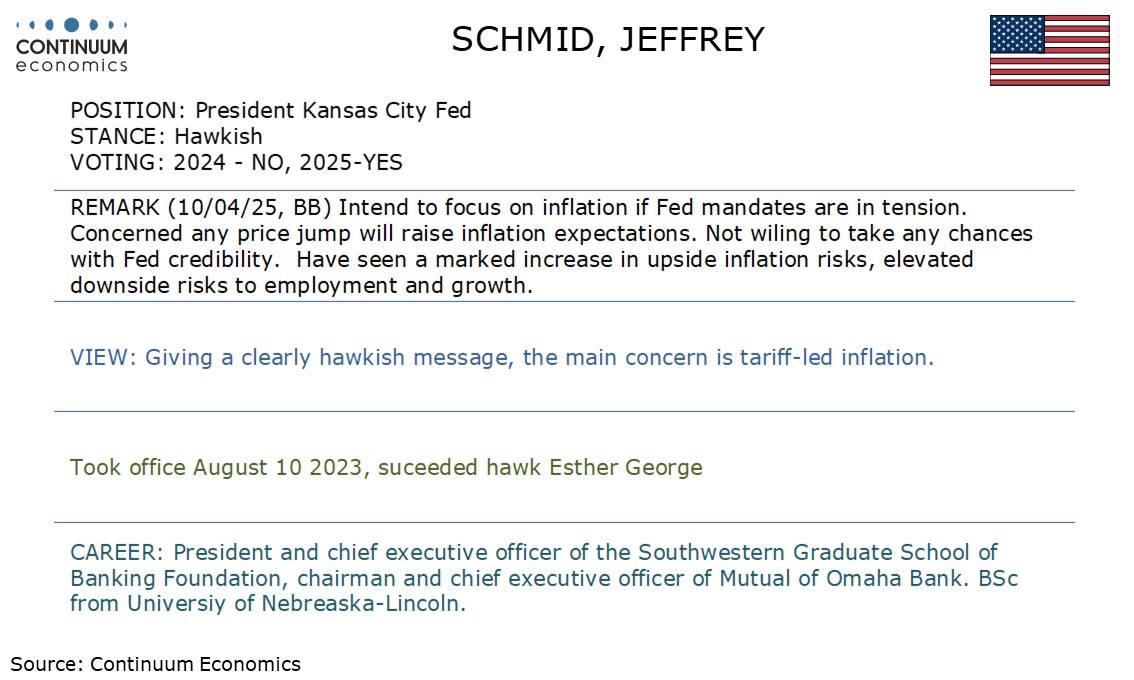

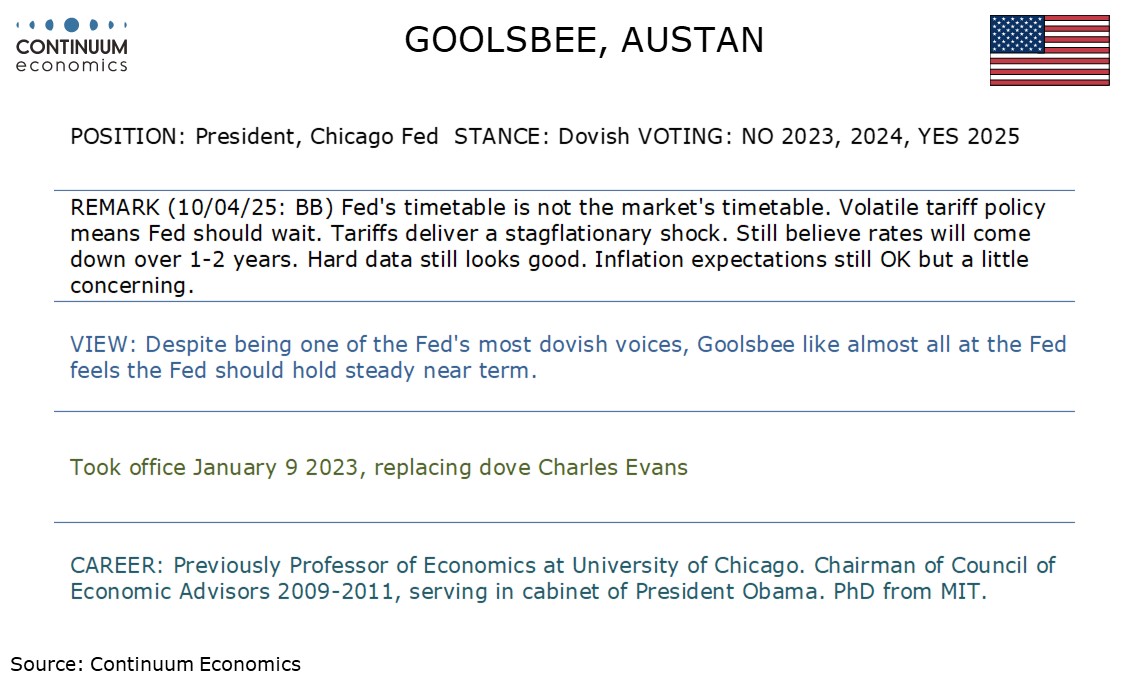

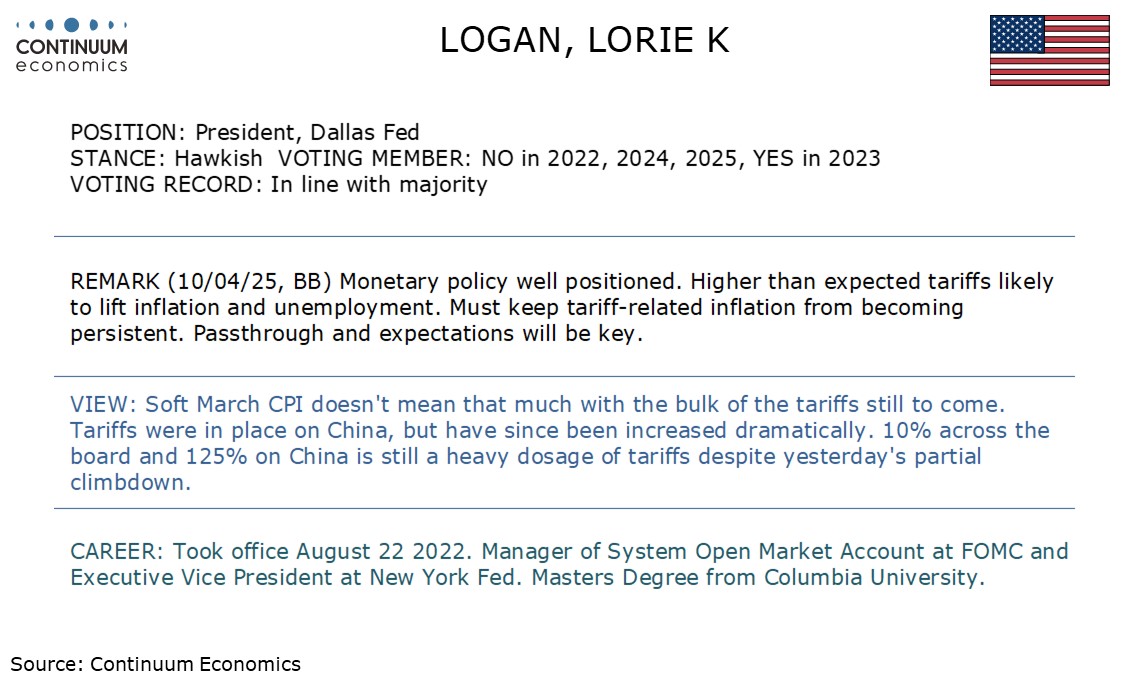

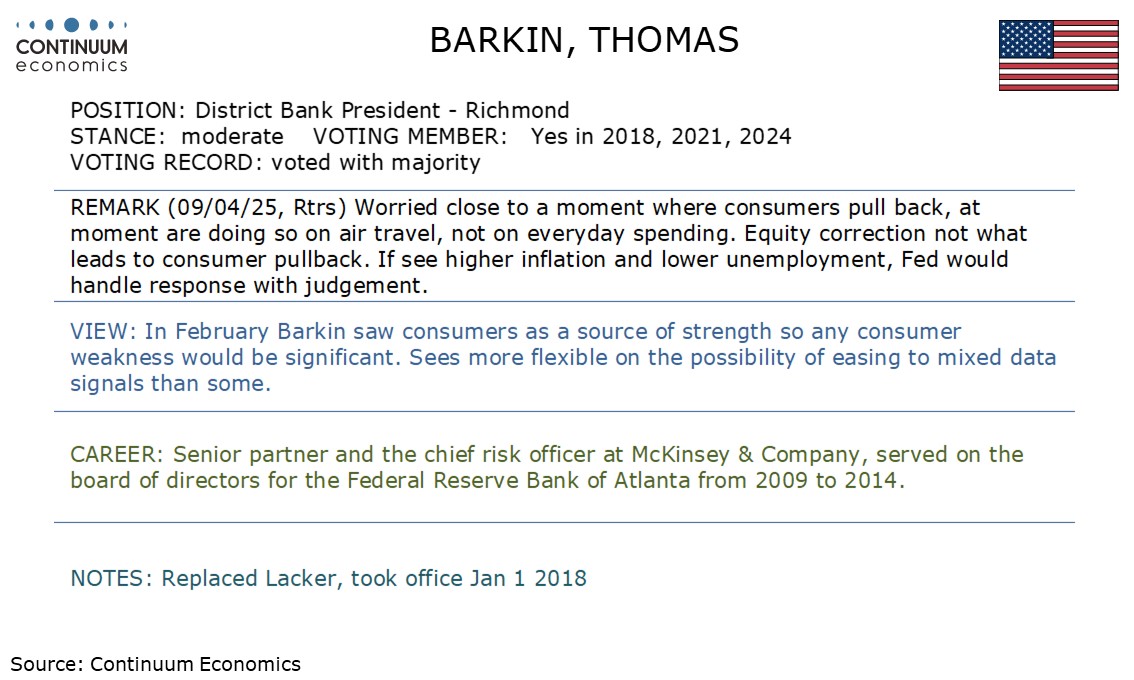

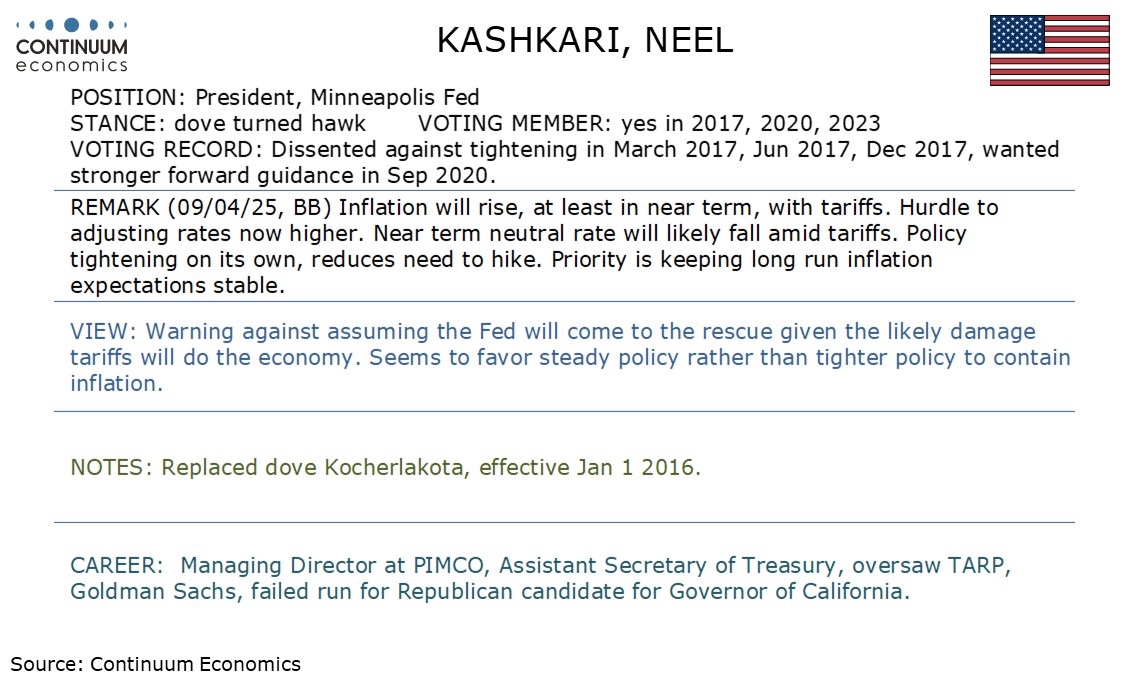

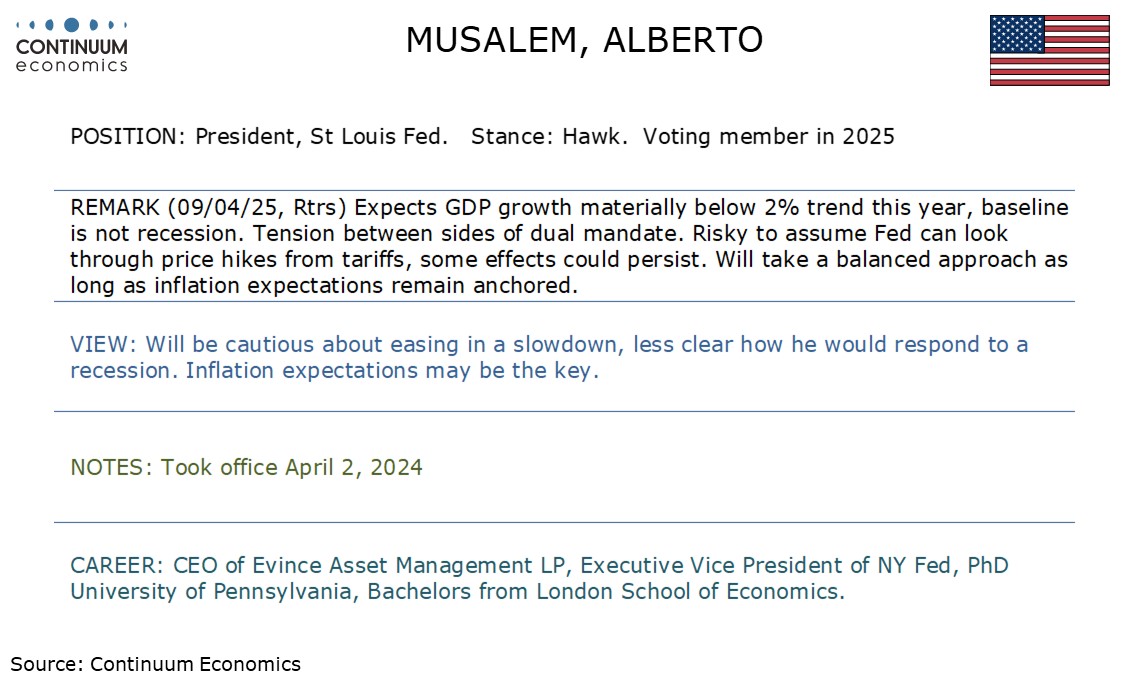

And a barrage of Fed Speakers

USD/JPY Searching for Lower Grounds

The U.S. has paused extra reciprocal tariffs beyond the 10% baseline for 90 days except for China and 75 countries have approached the U.S. about trade deals. With a 90 day period until July 9, trade negotiations will start with up to 75 countries excluding China. Trump press conference on Wednesday suggested that the spread of financial instability to the U.S. Treasury market was a key reason for the partial U turn on reciprocal tariffs.

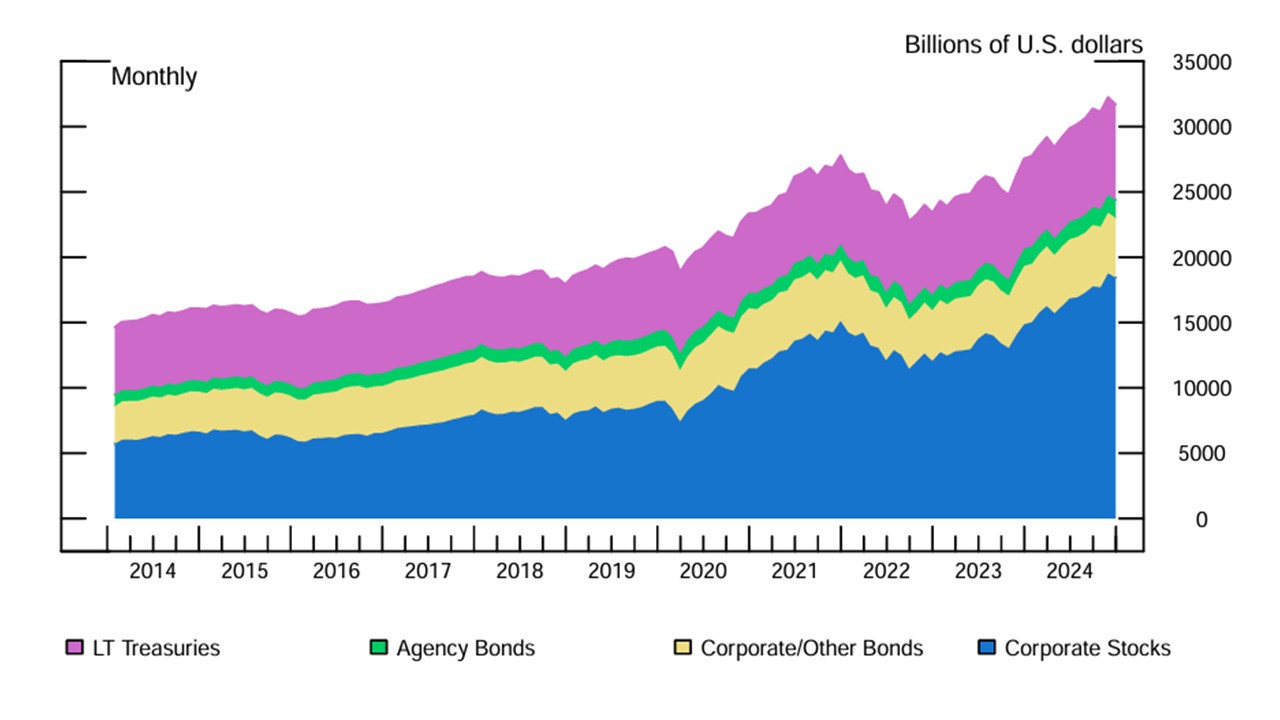

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Trump administration desires for tariff tax revenue to fund extra tax cuts and a desire to shift production back to the U.S. Aggressive U.S. demands for no bilateral trade deficit and major non-tariff barrier concessions will also have to be softened to agree trade deals. Overall, we feel that the reciprocal tariffs will likely be lowered for certain countries to the 10% minimum or below and that new product tariffs could be delayed, which is likely to mean that an average 25% tariff gets watered down to around 12-15%. However, this is still a major hit to the U.S. economy.

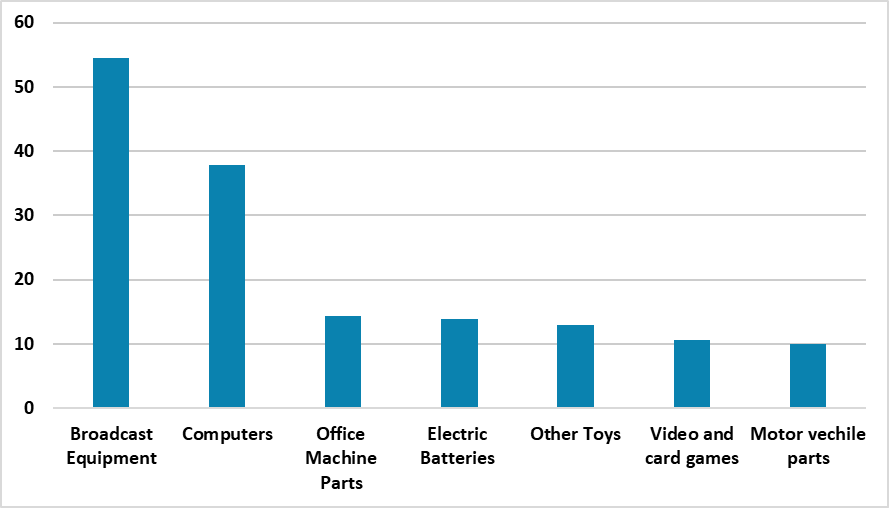

Figure: 2023 U.S. Imports from China By Key Products (USD Blns)

The prospect of a trade deal between the U.S. and China are less and likely delayed into 2026, due to the hardline stance of Trump 2.0 due to the extra focus on tariff tax revenue and shifting production back to the U.S. It is still our baseline that a deal will be agreed though we would now see a deal that only partially reverse new tariffs and likely coming in 2026. The risk of an early watering down of reciprocal tariffs on China is likely less than other countries. A 35-40% probability exists that no deal will be reached and a hard break between China and the U.S. economically will kick in.

This all means that extra uncertainty exists around our baseline that negotiations would start in the summer and a trade deal would be reached in Q4 2025/H1 2026. An alternative moderate probability scenario (33-40%) is that negotiations occur but the two sides fail to agree a trade deal, due to large differences on key areas. This would leave an economic hard break between the U.S. and China, which would initially be damaging to both sides. In some ways this would be an economic cold war. This would hurt the U.S. and China, as well as global trade. Perversely this could make Trump less aggressive with Canada and Mexico. On balance, our baseline still remains a trade deal (60-65%) being reached, given Trump deal instincts; China desire for a deal and the economic disadvantage of an economic cold war to the U.S. when it is trying to reset trade with all countries. However, such a deal would not reverse all new 2025 tariffs, but likely just water down the 34% across the board reciprocal tariffs. Additionally, negotiations could drag on through H2 2025 and mean that a deal is not reached until 2026.

March CPI comes as a pleasant surprise, a 0.1% decline overall led by an expected dip in gasoline, but the 0.1% rise ex food and energy is well below consensus and recent trend and suggests the inflationary pressures entering the trade war are lower than was previously thought. Initial claims, up 4k to 223k are as expected and suggest the labor market remains healthy. Continued claims fell by 43k to 1.85m. Gasoline prices fell by only 0.9% before seasonal adjustment but were down 6.3% seasonally adjusted, leading a 2.4% decline in energy. Food remains quite firm with a second straight rise of 0.4%, eggs still firm, up by 5.6%, after rising by over 10% in both January and February.

The ex food and energy rate was up only 0.057% before rounding, which is the lowest since January 2021. Commodities less food and energy fell by 0.1%, with a 0.7% fall in used autos, which is unlikely to persist with tariffs set to lift auto prices, and a 1.1% decline in medical care commodities looking erratic. Services less energy rose by only 0.1%. The main negative was air fares, down by 5.3%, something that will not be repeated every month but softer oil prices and weaker demand as tourists boycott the US will restrain air fares going forward. Air fares are not a full explanation for the weakness. They fell a similar 4.0% in February but services less energy still rose by 0.3% in that month. Owners’ equivalent rent rose by a slightly above trend 0.4% but lodging away from home was weak, down by 3.5%, another sign of weakness in tourism. Transportation service weakness went beyond air fares, with auto services, often a source of strength in recent months, seeing slippage, with auto insurance down by 0.8%.

USD/JPY continues to search for lower grounds as risk asset took a nose dive. USD is trading broadly lower but JPY received some haven bids on the fall of equities. JPY has been gaining on prospect of BoJ hike, yet the latest auto U.S. tariffs seems to be derailed the possibility of an imminent hike as it hits the Japanese auto industry and the economy as a whole for export account a big chunk of Japanese GDP. While fundamental would be in play in a medium to long run, another strong risk aversion event would trigger a strong bid in JPY.

On the chart, consolidation within the 146.00/148.00 area has given way to renewed selling pressure to reach fresh low below the 144.00 level. Prices has since steadied at the 142.87 low to consolidate at the lower channel from the January high. However, the downside still vulnerable and lower will see room to the 142.00 congestion. Oversold intraday and daily studies suggest consolidation here likely before further extension to the 140.00 figure and 139.58, September 2024 year low. Meanwhile, support is lowered to 144.55 low of last week and extending to the 146.00 congestion area.