Published: 2025-06-13T18:16:40.000Z

Preview: Due June 25 - U.S. May New Home Sales - April strength unlikely to be sustained

3

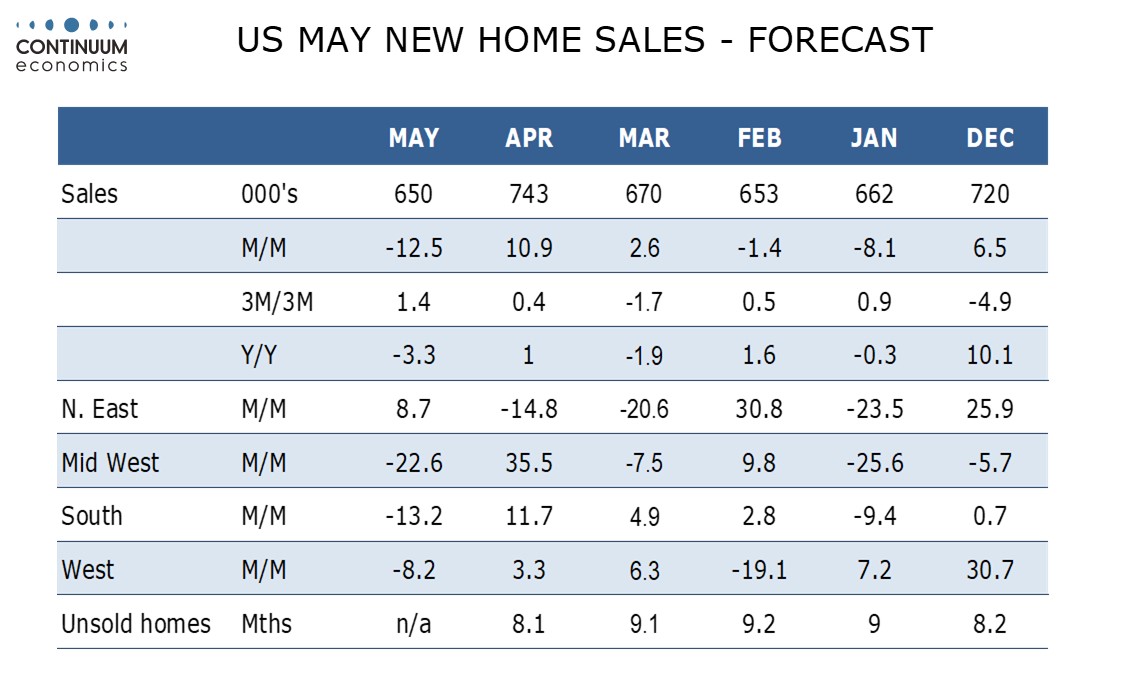

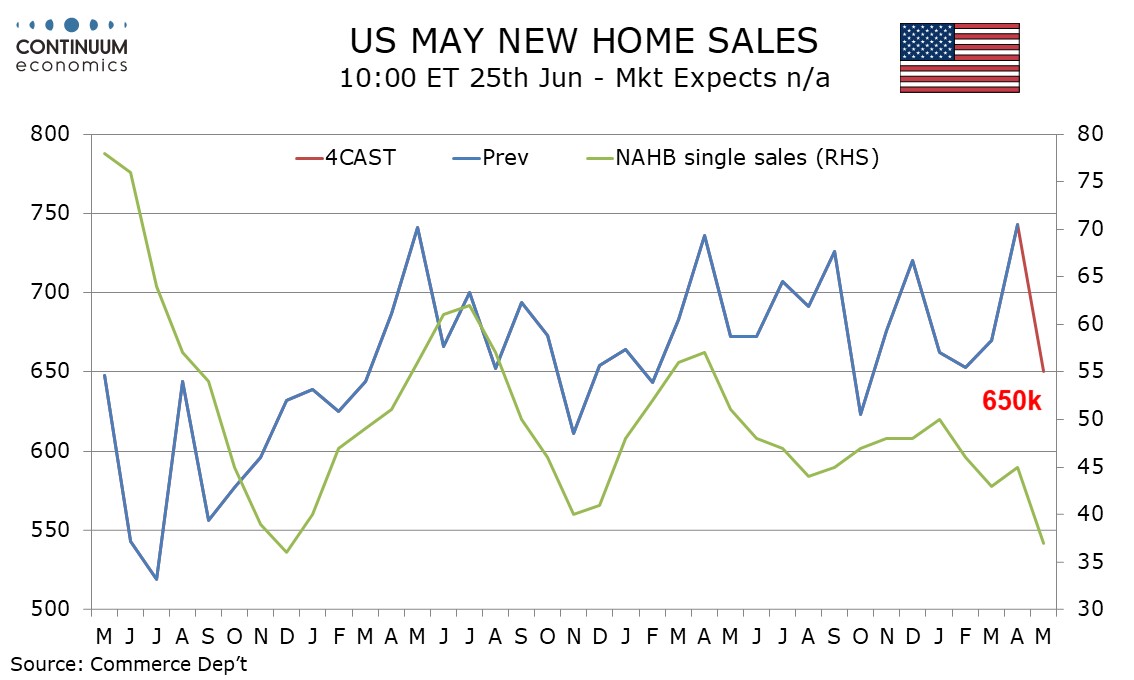

We expect a May new home sales level of 650k, which would be a 12.5% decline if April’s surprisingly strong 10.9% increase to 743k is unrevised. April’s level was the highest since February 2021, but only marginally above the highs of 2023 and 2024, and a downward revision is possible.

The strength of April existing home sales contrasted slippage in April existing and pending home sales. The NAHB homebuilders’ index slipped significantly in May, with rising bond yields putting upward pressure on mortgage rates. Our forecast for April is only marginally below the levels seen in each month of Q1.

We expect the median price to fall by 1.5% on the month after a 0.9% April increase and the average price to fall by 2.5% on the month after a 3.7% April increase. This would leave yr/yr data slipping to a more negative -3.2% from -2.0% for the median, and to a less positive 1.2% versus 2.4% for the average.