This week's five highlights

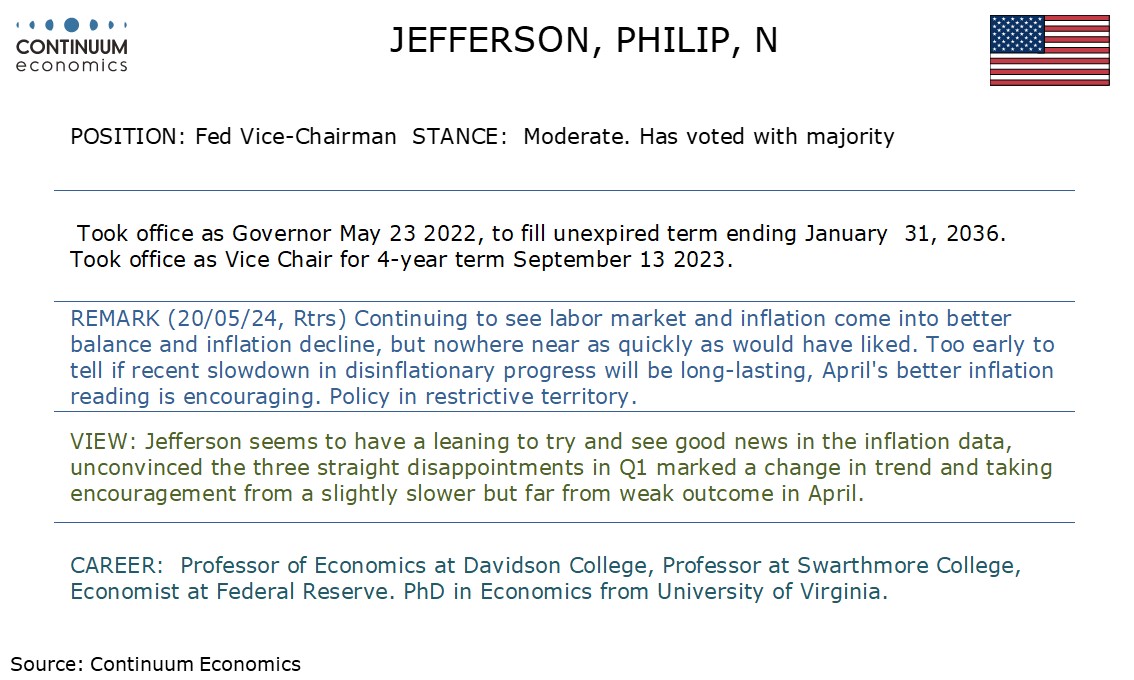

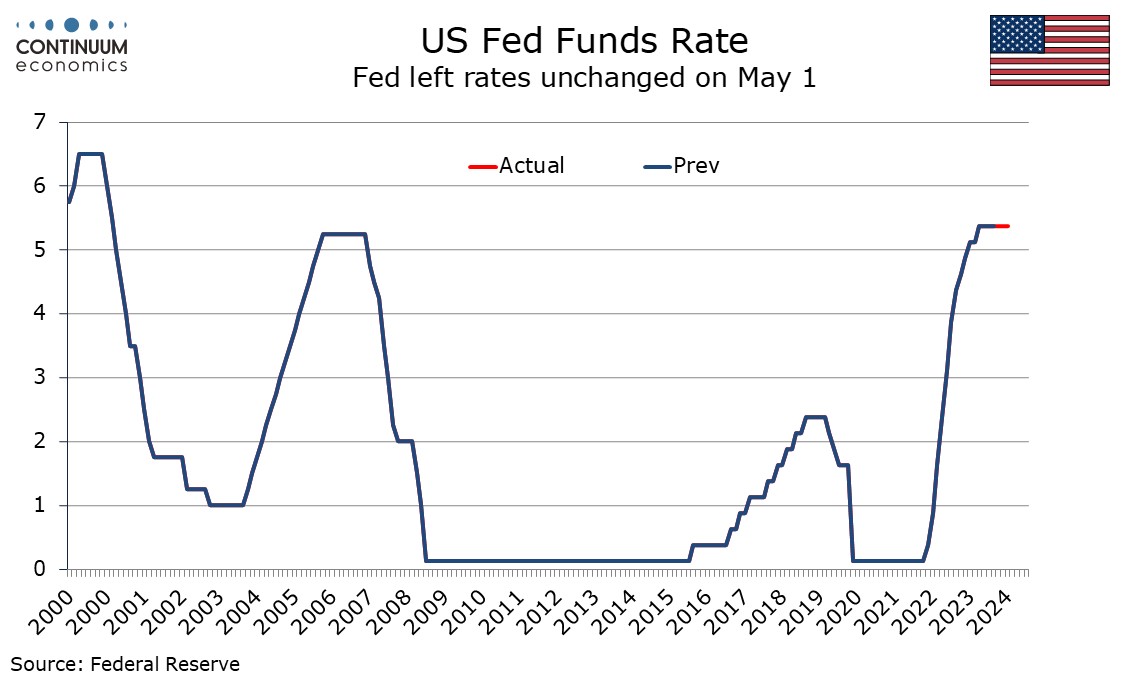

This week's Fed Speaker and May FOMC Minute Review

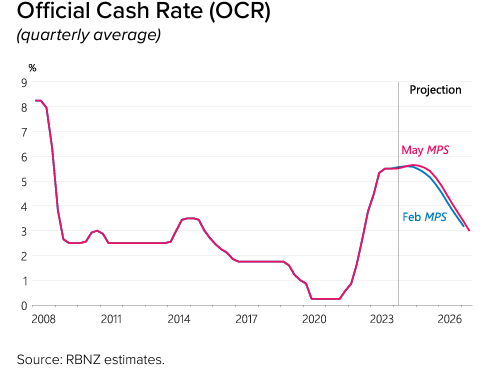

RBNZ Keeping Restrictive Rates Longer

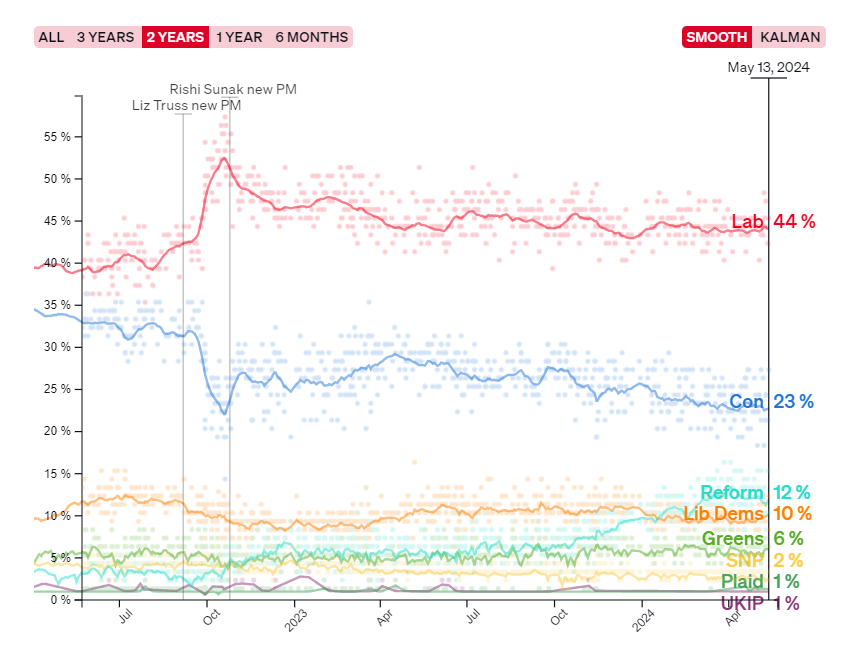

UK Called for July Election

UK Inflation Falls Further Amid More Signs of Price Persistence

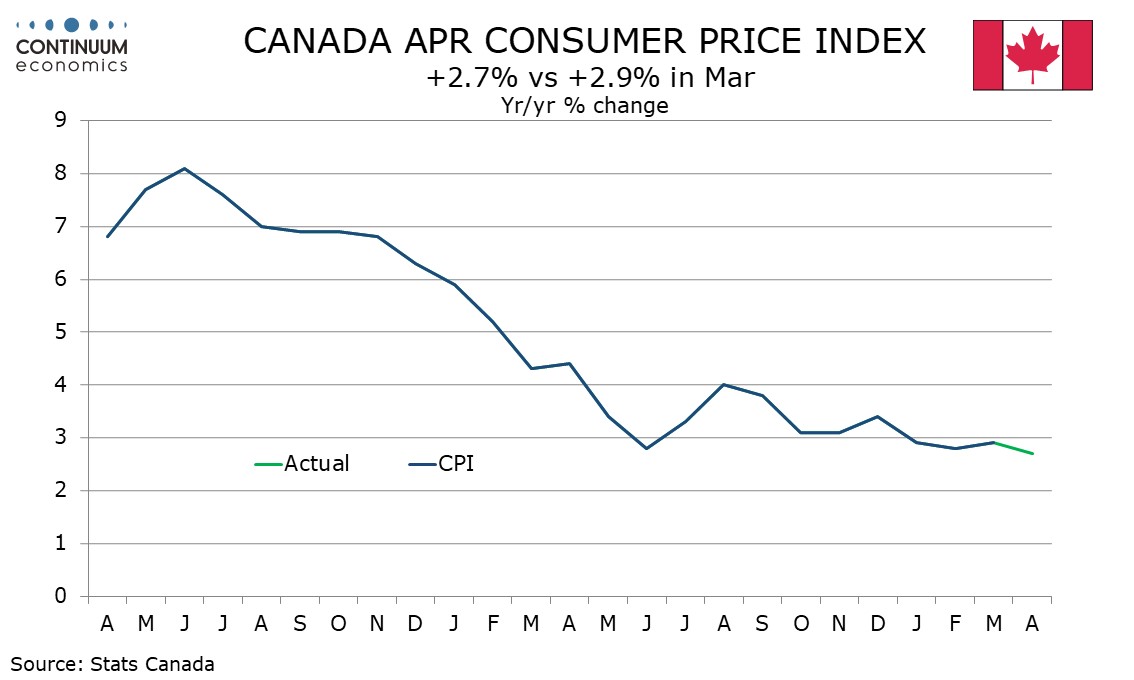

Canada April CPI Shows Continued Progress in the BoC core rates

FOMC minutes from May 1 do not show a very hawkish view of the economy, with inflation and the economy still expected to slow, though with the former seen at a slower pace and with less confidence. Policy is seen as data-dependent, and the potential for a more hawkish turn if data disappoints can be seen. April data released since the meeting may have reduced the hawkish risks somewhat. That various participants mentioned a willingness to tighten policy further suggests there may be a few more hawkish voices than the balance of recent speakers have implied. Many participants also commented on their uncertainty over the degree of restrictiveness of current policy. However the main considerations appear to be reflected in participants discussing maintaining the current stance for longer if inflation does not show signs of moving sustainably to 2% or reducing policy restraint in the event of an unexpected weakening of labor market conditions. It is clear that employment data as well as that for inflation will matter for policy.

Participants continue to expect inflation to fall to 2% over the medium term but recent data had not increased their confidence and suggested the disinflation process would take longer than previously thought. A few considered the possibility of seasonal issues in January’s inflation strength and several noted the role of volatile components in recent data, though some emphasized the broad based nature of recent inflationary disappointment. Participants assessed that supply and demand in the labor market were continuing to come into better balance but at a slower rate. Slowing in Q1 GDP was downplayed given strength in private sector demand, but a slowing in GDP from 2023’s strong pace was still expected, consumer spending in particular. Many felt that the public had a good understanding of their data-dependent approach.

RBNZ kept rates unchanged at 5.5%. The OCR path has been revised higher in the May meeting, mostly in 2025 and thus not suggesting an imminent hike but rather higher for longer.

Some key takeaways:

- Restrictive Policy is Working: "Restrictive monetary policy has reduced capacity pressures in the New Zealand economy and lowered consumer price inflation." .The RBNZ continue to expect CPI to return to the one to three percent target range by end 2024.

- Service Inflation's Stubbornness Delays Easing: "...services inflation is receding slowly, and expected policy interest rate cuts continue to be delayed.". While goods inflation cools, RBNZ highlights that service inflation is moderating slower than expected and will be delaying the planned rate cuts.

- OCR Revised Higher: The OCR has been revised higher but mostly in 2025. By September 2025, the OCR forecast has been revised almost 25bps higher and around 3% by mid 2027. The revision seems to suggest the RBNZ is not looking for an imminent hike, rather OCR will be staying higher for longer.

The key to the May meeting from the RBNZ is the upward revision of OCR due to service inflation remain stubborn. However, the RBNZ is also aware capacity pressure and labor market is softer and will be contributing to a cooler domestic inflation. The difference in sensitivity to interest rate is the reason why the RBNZ would rather keep rates higher for longer than further tightening. The inflation forecast is close to unchanged with previous meeting.

Figure: Labour Far Ahead in the Opinion Polls

In a somewhat surprise announcement, PM Sunak has called a general election for July 4, somewhat earlier than the autumn timetable that had been previously hinted at. He is doing so with his Conservative Party lagging severely in the polls. However, especially after recent local election results, the circa 15 to 20-point lead that the opposition Labour Party currently enjoy (Figure 1) is not enough definitively to secure a parliamentary majority; although we think that the party will do so. The decision to call an election now may (we think) reflects Conservative implicit acceptance that recent better economic news may not persist!

Possibly somewhat cynically, Sunak is realizing that in spite of somewhat better economic news seen of late, his party is gaining nothing in terms of opinion polls standings. Indeed, support for the right of centre thinking - usually based around the Conservatives - has haemorrhaged somewhat to the new Reform Party. As likely, Sunak may also realise that the somewhat better news may not persist, not least economically given nascent signs that the labor market is loosening; that BoE Rate cuts may be deferred; while on the broader political front news, immigration flows may take a turn for the worse.

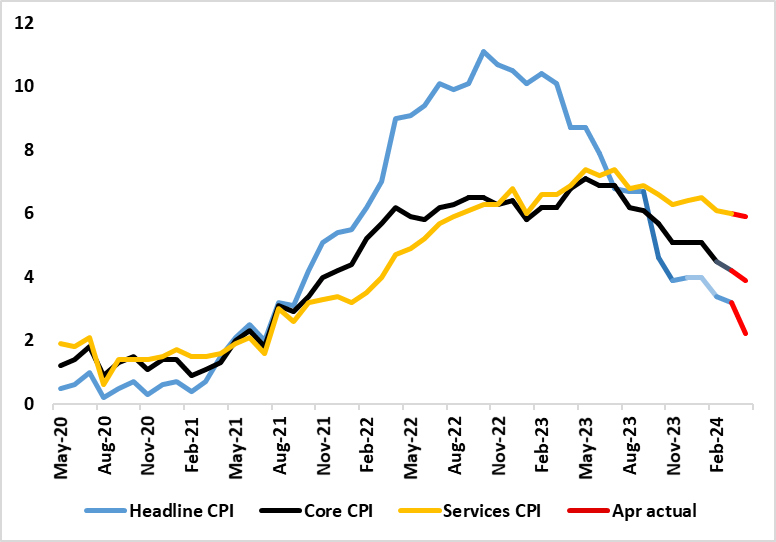

Figure: Headline and Core Inflation Drop to Continue But Services Still Resilient?

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. But perhaps the CPI data is the most crucial with more signs of resilient services (and particularly in regard to eating out) very much questioning whether a rate cut from the MPC will come as soon as the verdict due on June 20. What the bar of acceptability is for the MPC in terms of the CPI picture is unclear; do they just have to hit the forecasts laid out in the recent Monetary Policy Report, or undershoot, this assessment made all the more awkward as another set of CPI data are due the day before that next MPC decision. As for the April numbers, helped by favourable base effects and the drop in the energy cap, led to a decisive but lower-than expected fall in the April headline of 0.9 ppt to 2.3% (the lowest since July 2021) but just 0.1 ppt for services (Figure), the latter likely to accentuate the MPC hawks’ emphasis on persistent price pressures. Indeed, in this regard, the core was down 0.3 ppt, this outcome consistent with an m/m adjusted reading even more above a rate consistent with target .

The April outcomes exceed BoE thinking which saw the headline at 2.1% and services down to 5.5%. The April data was dominated by a drop in energy costs due a fall in the OFGEM energy cap, but this was partly offset by a rise in petrol costs and eating out. But despite base effects, and a drop in over half the 12 CPI main components, services inflation hardly buckled, a development highlighted by the fresh rise in restaurant inflation – often considered to be a leading indicator of persistent inflation swings.

April’s Canadian CPI at 2.7% yr/yr from 2.9% is in line with market expectations and shows subdued data on the month and continued progress in reducing the Bank of Canada’s core rates. The headline yr/yr pace is the lowest since March 2021. The data should sustain hopes for a June BoC easing. On the month CPI rose by 0.5% overall and 0.3% ex food and energy. Seasonally adjusted however the overall rise was only 0.2% with a 0.1% ex food and energy pace, with March ex food and energy revised down to 0.2% from 0.3%. With January and February having seen gains of only 0.1% seasonally adjusted ex food and energy this presents a subdued underlying picture in the year to date.

The seasonally adjusted data continues to show strength in shelter which rose by 0.5% while transport rose by 0.6% with support from energy. Elsewhere the data was subdued. Clothing, which fell in January and February but rebounded in March was unchanged, meaning that unlike January and February, the weak seasonally adjusted ex food and energy pace was not restrained by clothing. The ex food and energy rate is not one of the BoC’s three core rates, which all continued to slip, CPI-common and CPI-median to 2.6% from 2.9% and CPI-trim to 2.9% from 3.2%, all measured yr/yr. These are all still above the 2.0% target but moving in the right direction with the average at 2.7% matching the overall pace.