JPY flows: JPY supported by strong wage data

JPY upside potential remains, downside risks decline as wages rise

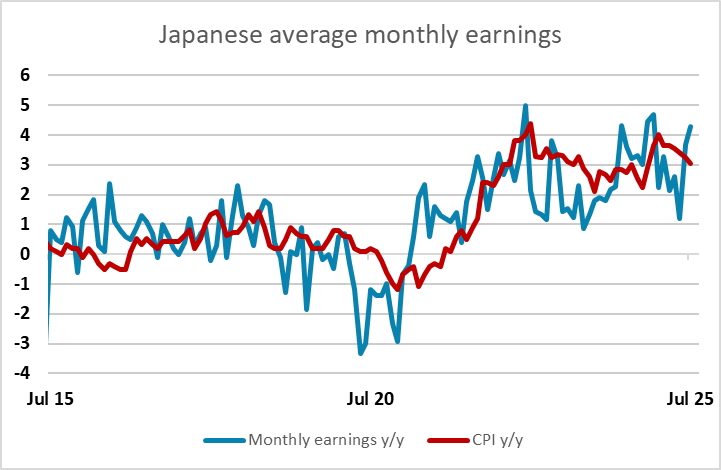

Japanese wage data overnight was stronger than expected, taking real wage growth positive for the first time since January. One of the main reasons the BoJ have been holding off tightening has been the lack of real wage growth over the first half, so these numbers, along with the more hawkish comments recently from deputy governor Himino, suggests there is a strong chance of a 25bps hike this year, perhaps even earlier than the December meeting. As it stands, there are only 13bps priced in for December, and 7bps for the October meeting. This looks too little if we see similar strong wage data in the next couple of months and the global economic picture remains stable.

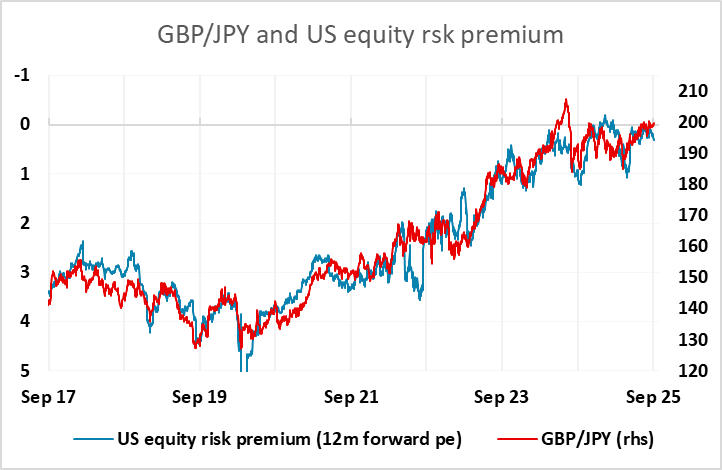

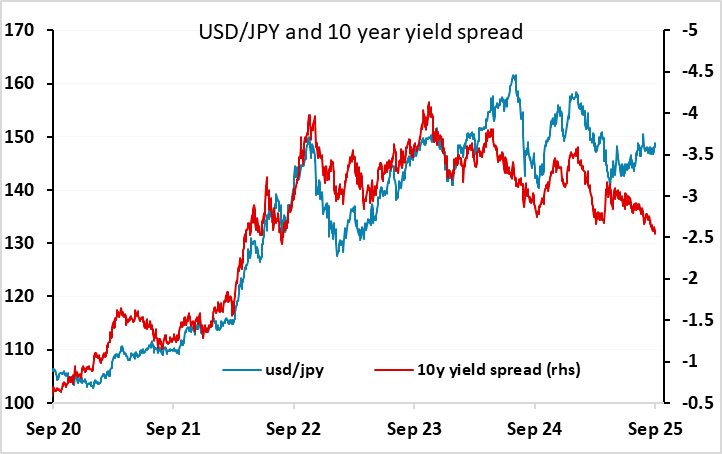

This could therefore be positive for the JPY, but as we often note, the outlook for the JPY in the short to medium term is rarely a function of events in Japan, but rather tends to depend on US yields and global risk sentiment. Strong global risk sentiment and a solid US economy will usually tend to mean a stronger USD/JPY, but in the current circumstances, such conditions look likely to mean a BoJ rate hike which could eb expected to prevent any significant JPY weakness. The alternative of a weakening in risk sentiment will tend to be significantly JPY positive, particularly on the risky crosses. With yield spreads already suggesting USD/JPY is stretched on the upside, the USD/JPY outlook continues to look biased lower.