This week's five highlights

U.S. CPI Shows Strength in Services

While Retail Sales Dipped

USD/JPY Broke 150

Japan Q4 GDP Stays in Contraction

UK GDP Review Confirmed Recession

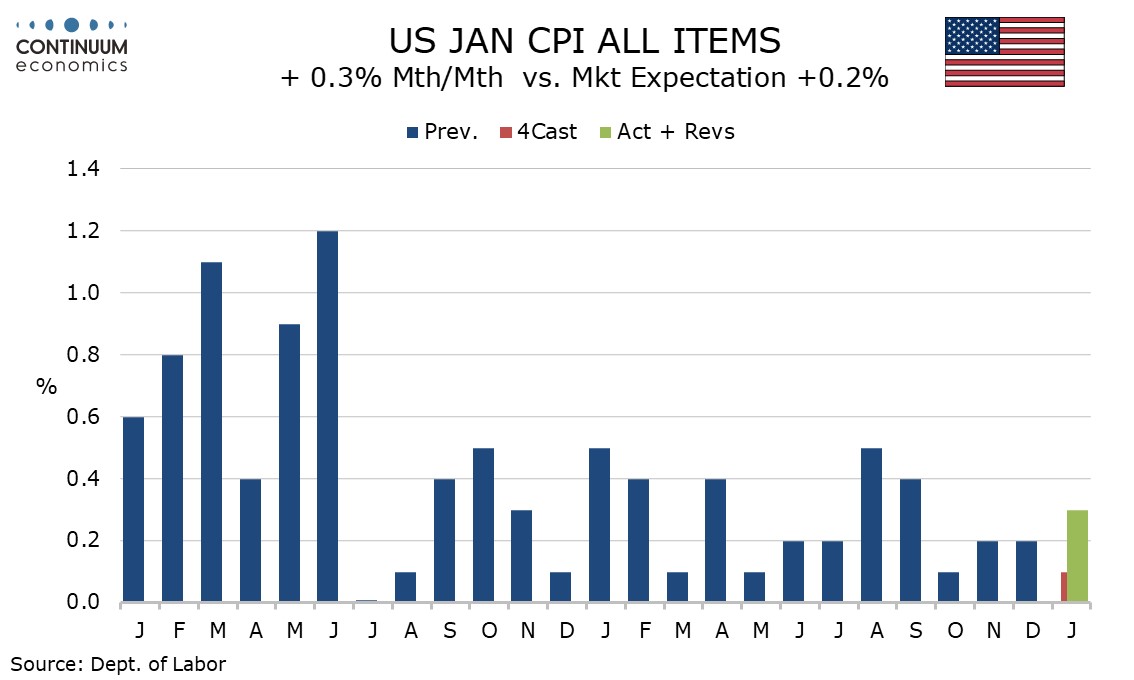

January CPI has come in higher than expected, rising by 0.3% overall and 0.4% ex food and energy, suggesting inflationary pressures still persist at the start of 2024, though whether the recent tendency of core PCE prices to underperform core CPI will persist is unclear. Core CPI rose by 0.392% before rounding.

Food was quite firm with a 0.4% increase but outweighed by a 0.9% decline in energy led by 3.2% fall in gasoline. Energy services were firm with a 1.4% increase. Commodities less food and energy saw a negative trend deepen with a 0.3% decline meaning that services explain the upside surprise, with services less energy up a strong 0.7%. Used autos at -3.4% and apparel at -0.7% were notably weak in the commodities detail. Shelter was strong at 0.6% with owners’ equivalent rent rising by the same amount, its strongest increase since April while lodging away from home rose by 1.8%. Medical care services rose by 0.7% with medical care overall up by 0.5%, and have seen a significant acceleration in the last three months, partly on methodology changes. Transportation services rose by 1.0% with auto services and air fares both stronger. Service strength was however broad based with recreation and education/communication services both up by 0.4% and other personal services up by 1.2%, led by a 2.4% rise in financial.

The broad based strength in services will be of concern to the Fed as it implies that demand and wage pressures persist in generating services inflation despite the decline in goods inflation generated by improving supply. The negative picture in goods is not going to persist for ever so sustaining a fall in inflation will require a decline in services inflation.

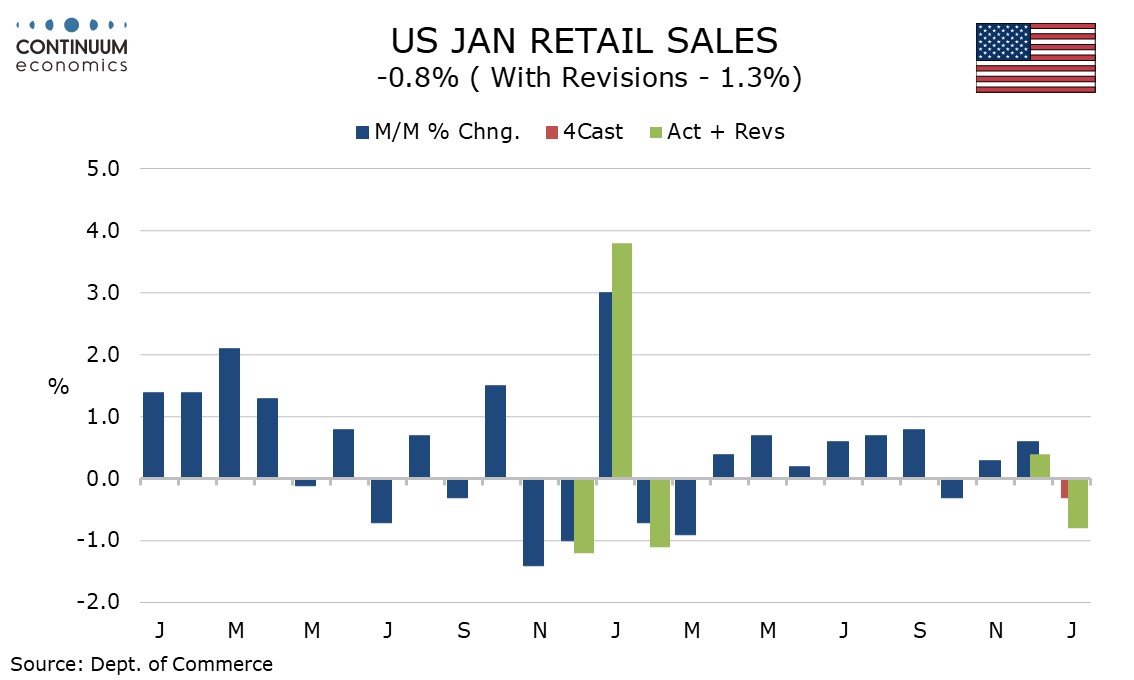

US retail sales have made a weaker than expected start to Q1, falling by 0.8% overall, 0.6% ex autos and 0.5% ex autos and gasoline. One weak month after a strong Q4 (though Q4 did see downward revisions with this report) does not make a trend however, and January’s weakness may be in part weather-induced. December retail sales were revised down to a 0.4% increase from 0.6% and November was revised to unchanged from +0.3%, so the data is significantly weaker than expected net of revisions.

3m/3m data has weakened significantly to increases of 0.1% overall and 0.2% ex autos (not annualized) but the ex-auto and gasoline pace is still solid, if a little slower, at 0.8% 3m/3m. The data will restrain what had been mostly still strong preliminary estimates for Q1 GDP. However January data should be treated cautiously. January 2023 was unusually strong when weather was unusually mild and February and March subsequently corrected lower. January’s weakness is also in part price induced. Despite January CPI having been strong on services commodity prices fell by 0.3%. A 1.7% fall in gasoline sales is price-related but a similar fall in autos is as signaled by industry data that is quoted in volumes. Building materials at -4.1% were the most prominent source of weakness while heath and personal care at -1.1% was unusually weak.

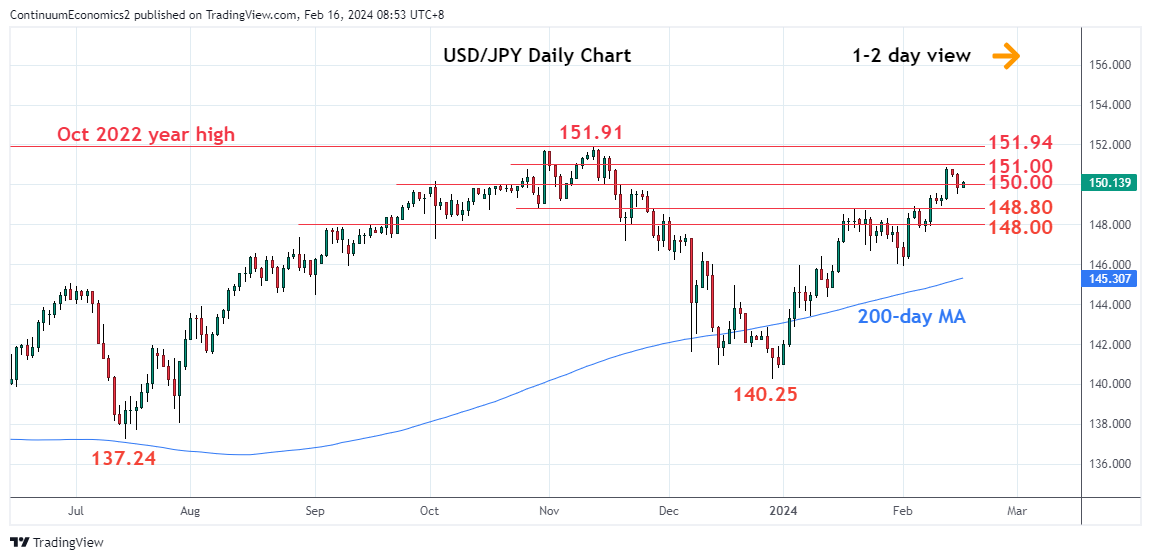

The stronger than expected CPI has sparked market participants' speculation on later rate cut for 2024 and bid the greenback broadly higher. As the Japan side of equation is patiently waiting for the march wage negotiation, the stronger dollar has driven the USD/JPY past 150. Verbal intervention from the Finance Ministry sounds weak and will do little towards the pace of rally. The softer than expected retail sales did tone it down but it looks like in the short run the strength in the greenback will carry the pair further, Unless, there is a spike we are not forecasting any imminent intervention from the BoJ.

On the chart, the pair settled back in consolidation from the 150.88 high as prices unwind the stretched intraday and daily studies to reach 149.57 support. Break here will open up deeper pullback to the strong support at the 148.80, January high. Lower still, if seen, will see scope to the 148.00/147.61 support area. Correction expected to give way to fresh buying interest later and where break of the 150.88/151.00 resistance will further extend gains from the December low. Clearance will shift focus to 151.91/151.94, the 2023 and 2022 year highs to retest.

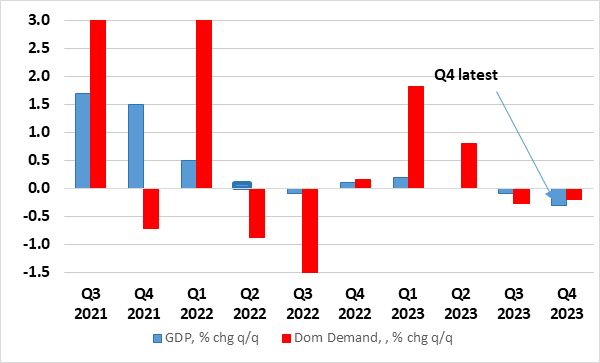

The Q4 Japanese GDP has shown a disappointing -0.4% y/y contraction while it was expected to sprung back to growth of 1.4% y/y. It is contracting slower than the -2.9% in Q3 but still shows a soft private consumption, so as business investment. However, we do not see the poor Q4 GDP to affect BoJ's policy decision and we forecast Q1 2025 GDP to rebound.

Private consumption has been the primary driver for Japanese growth in the past years and with it being significantly affected by negative real wage and inflationary pressure, one can only expect a soft Japan economy. However, with wage growth picking up and inflation moderates further, private consumption should gather some strength in the coming quarter and bring Japan GDP back to positive territory, though it will be modest.

Figure: A Second Successive Fall in Both GDP and Consumer Spending

Coming in lower than expected after taking account of downward revisions, and probably hit by industrial action, GDP shrank by 0.1% m/m in December data, a result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer sending (Figure). Admittedly some upside risks were posed by some survey data, but where the likes of PMI numbers have been very poor guides to GDP swings. As for those swings, the December result and revisions meant a 0.3% q/q Q4 drop, both below the BoE’s flat projection and meaning that, after the Q3 decline, the economy was in formal recession. The underlying trend is one of stagnation given that GDP rose a bare 0.1% on average in 2023, albeit where per capita GDP fell for the sixth quarter in seven. We see stagnation continuing this year, with even a risks of a modest GDP drop on average for 2024.

In terms of recent momentum, monthly GDP is estimated to have fallen by 0.1% in December 2023, following growth of 0.2% in November 2023 (revised down from a 0.3% growth) and a fall of 0.5% in October 2023 (revised down from a fall of 0.3%). GDP was flat in y/y terms and was down almost 1% from the aberrant July figure, all indicative of a flat underlying trend at best. As for the most recent numbers, the main driver to the 0.1% m/m fall in services in December 2023 was wholesale and retail trade; repair of motor vehicles and motorcycles, which saw a 1.9% fall on the month. Human health and social work activities fell by 0.9% in December 2023 following growth of 0.2% in November 2023, this a result of three days of industrial action by junior doctors and hospital dental trainees.

As for the larger than expected Q4 GDP drop, there was a fall in the volume of net trade, household spending and government consumption in Quarter 4 (Oct to Dec) 2023, partially offset by an increase in gross capital formation. It is unclear to what degree that the latter was inventory driven.