Canada Q4 GDP suggests BoC rate cuts are providing support

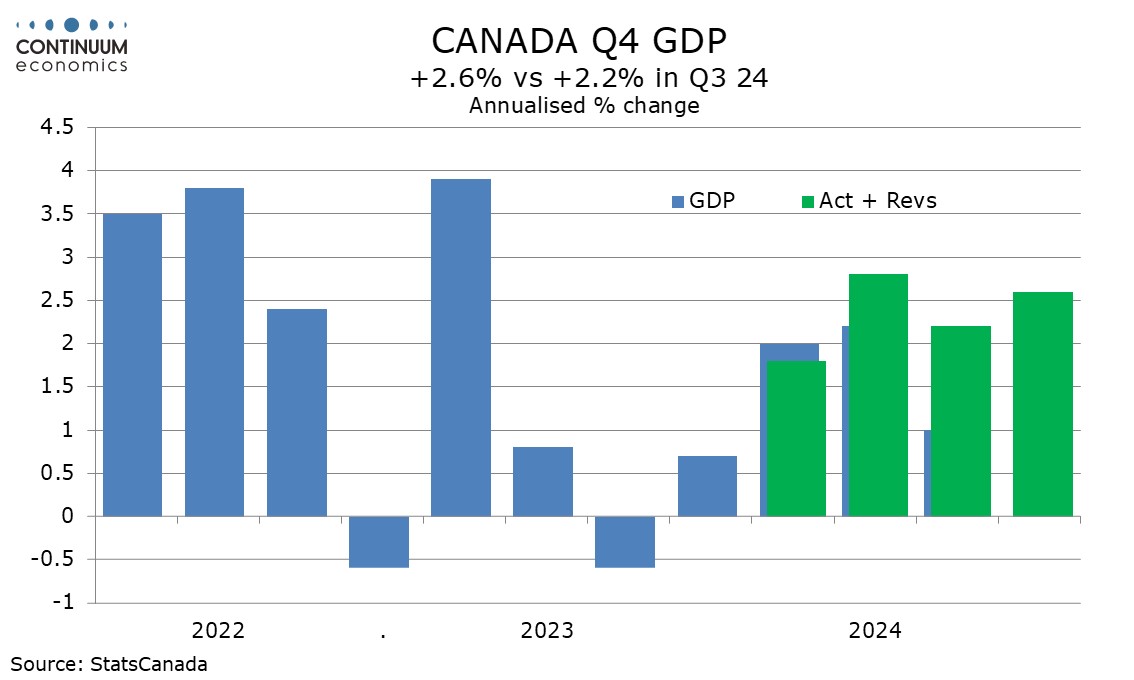

The message from Canada’s surprisingly strong Q4 GDP data, up 2.6% annualized with positive revisions to Q2 and Q3, with December up 0.2% and the advance estimate for January up 0.3%, is that Bank of Canada easing is giving more support to the economy that was fully appreciated. Tariffs are of course a massive threat for 2025, but Canada faces the threat with some momentum in place.

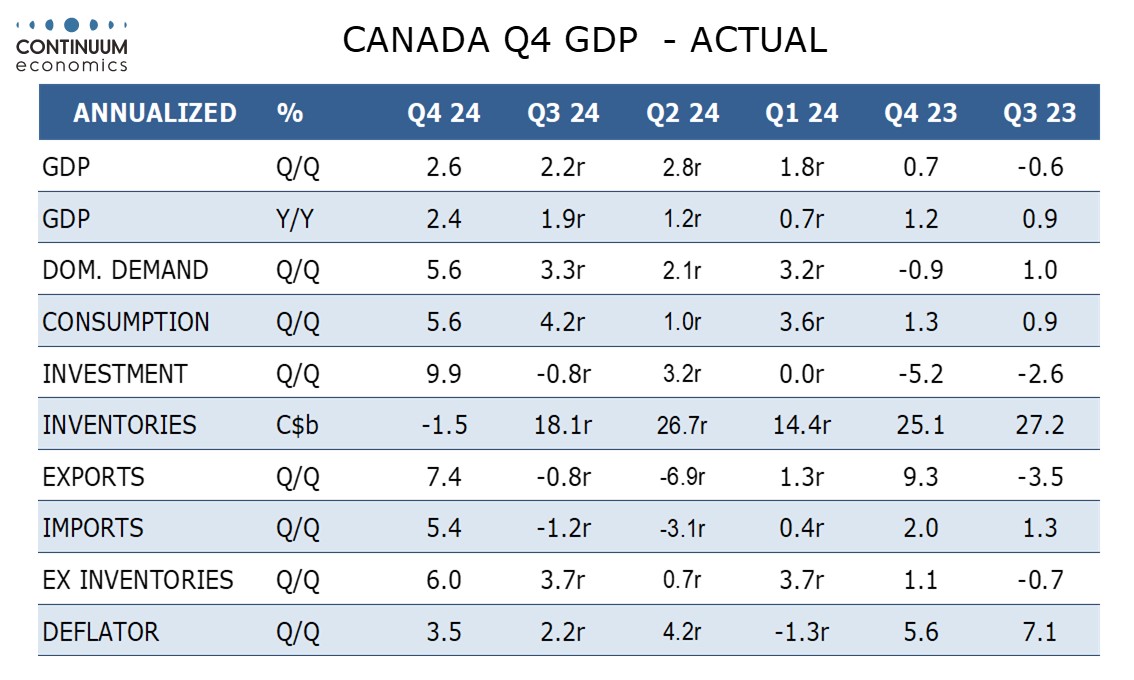

Canada’s Q4 GDP increase of 2.6% annualized is a seven-quarter high with Q3 revised up sharply to 2.2% from 1.0% and Q2 revised to 2.8% from 2.2%. The economy now seems to be growing above potential, and while an output gap may persist it is probably narrowing.

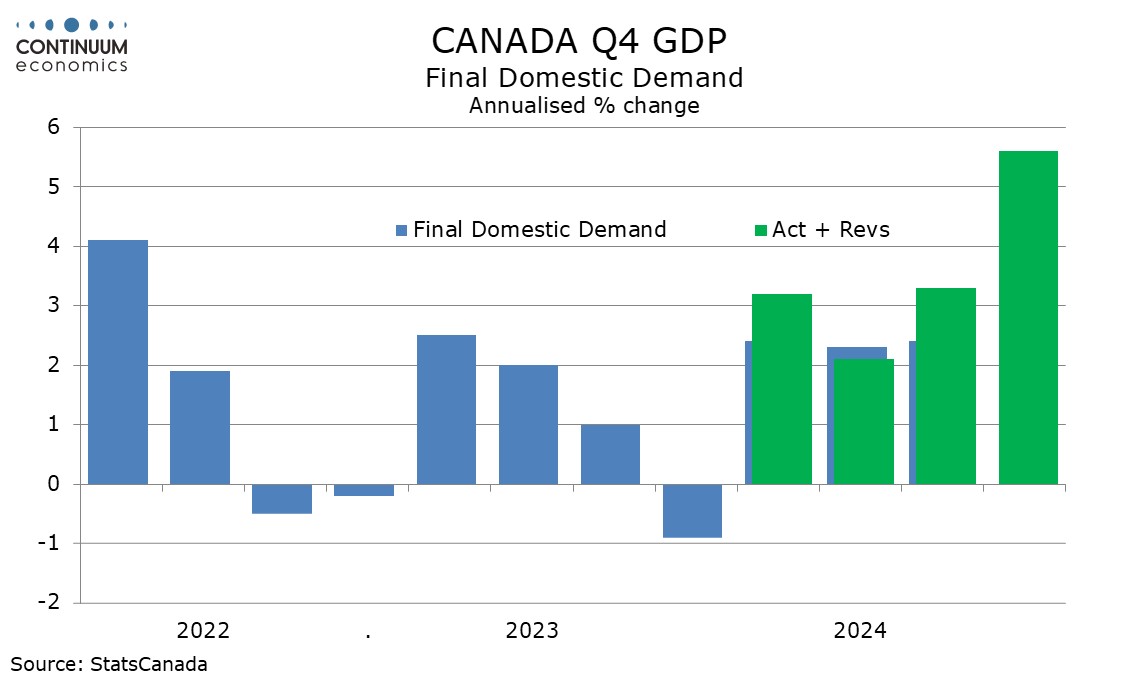

The details are constructive, with domestic demand up by 5.6% annualized on the quarter, with consumer spending, business investment and government all contributing. Exports saw a healthy 7.4% increase exceeding a 5.4% rise in imports. The only negative in the detail was an inventory contraction, with GDP less inventories up 6.0%. Inventory rebuilding seems to be needed.

The price deflator was quite strong, up 0.9% on the quarter (3.5% annualized) though yr/yr growth is moderate at 2.2%. Still recent signs of improving growth and some signs of resilience in inflation data may caution the BoC against further easing, though tariffs could complicate the picture.

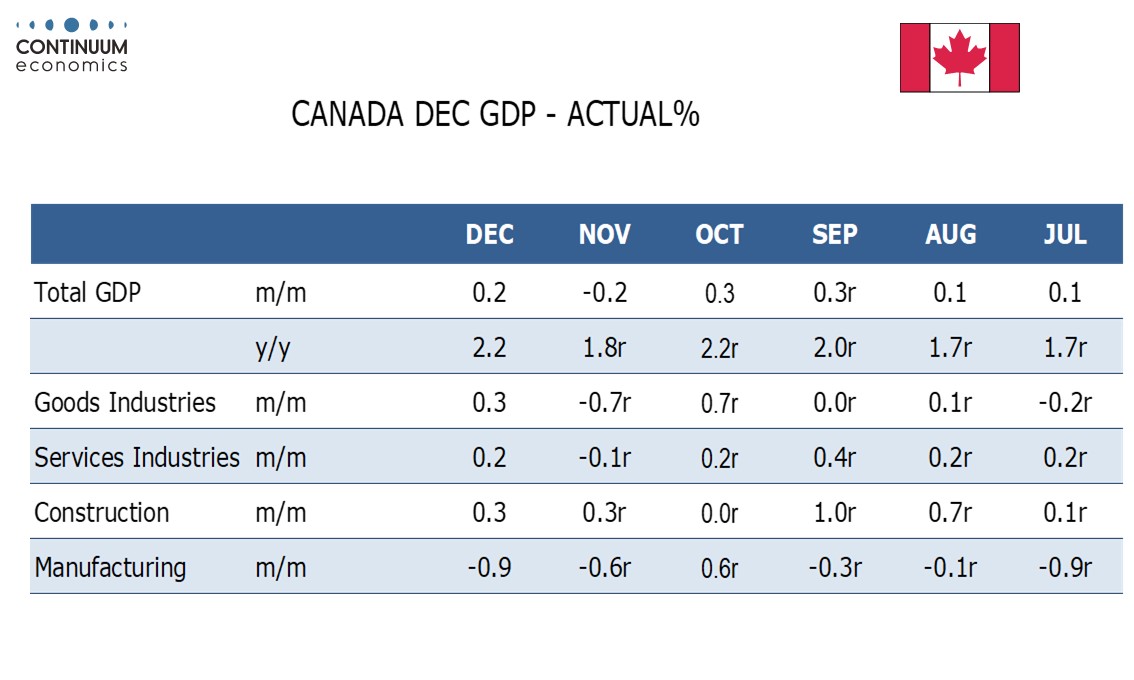

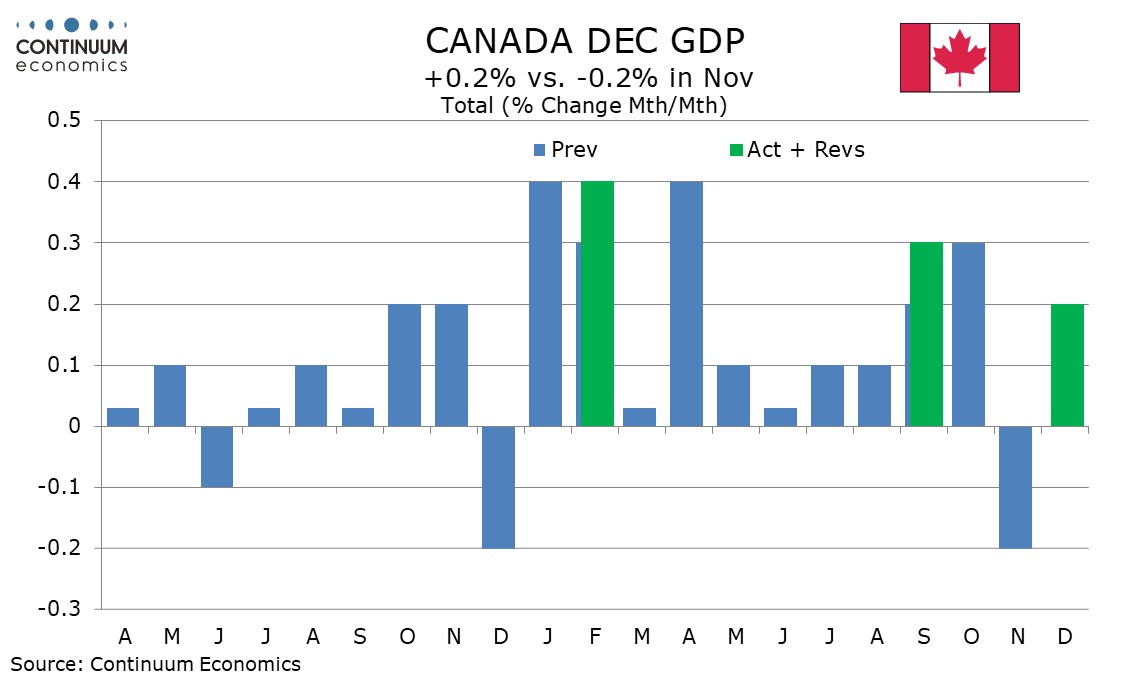

The 0.2% monthly GDP increase in December was as suggested with November’s report and simply reversed a 0.2% November decline, which was not revised. While October was revised up to 0.3% from 0.2% the monthly data has seen less impressive revisions than the quarterly data.

A 2.6% rise in retail led December’s gain and was supported by a sales tax holiday that will extended into mid-February. January GDP will be supported by the end of a postal workers strike.