Published: 2024-10-16T17:58:53.000Z

Preview: Due October 29 - U.S. September Advance Goods Trade Balance - Deficit to rebound from August dip

2

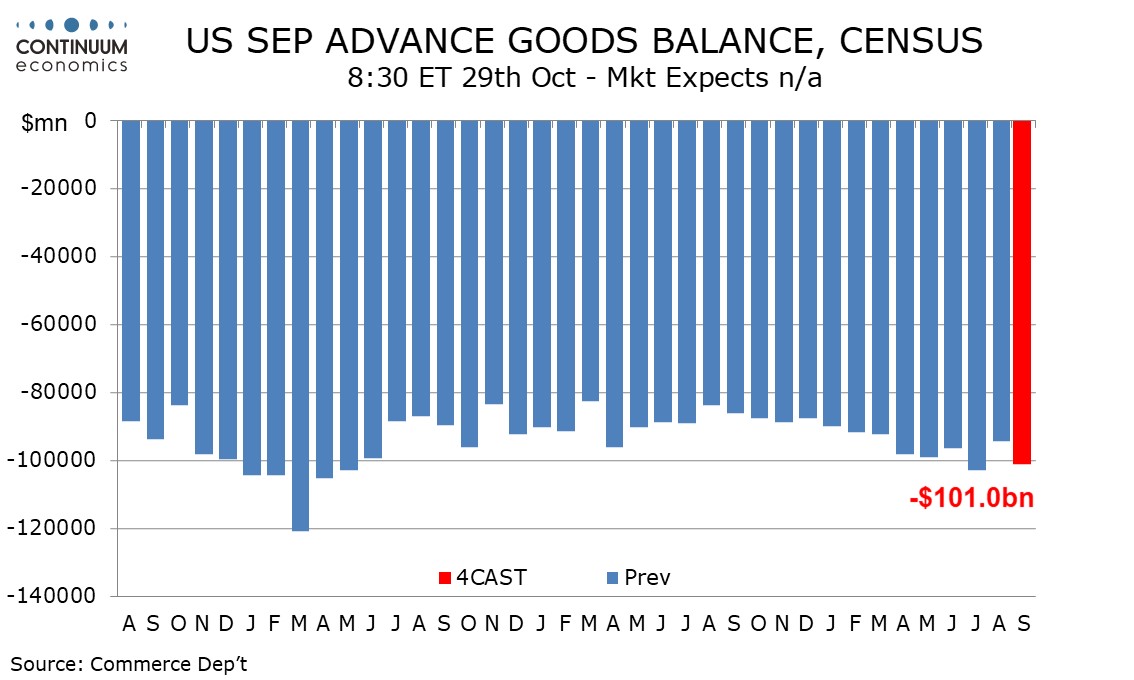

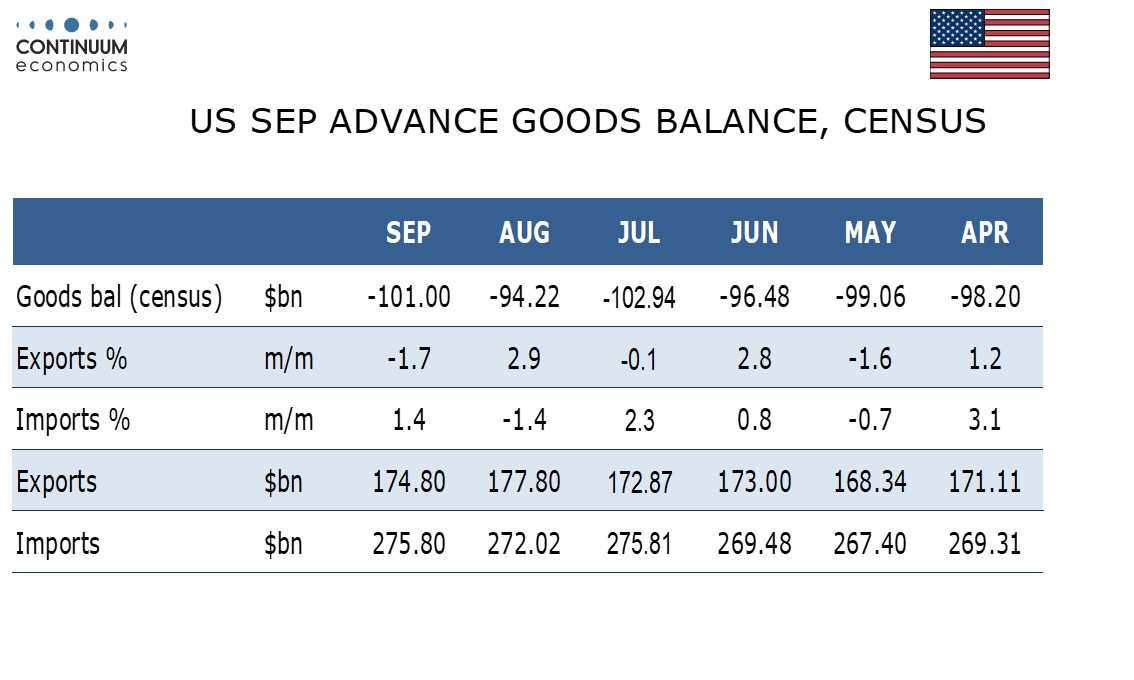

We expect an advance September goods trade deficit of $101.0bn, in a rebound from August’s sharply narrower $94.2bn which corrected a $102.2bn deficit in July, which was the widest since April 2022. This would leave Q3’s deficit wider than Q2’s but only marginally in real terms, implying a limited impact on Q3 GDP.

We expect exports to fall by 1.7% after a 2.9% August increase while imports rise by 1.4% after a 1.4% August decline. Prices fell for both exports and imports in September, but more so for exports.

Boeing exports slipped from an above trend August in September with a strike starting in mid-month, but were not exceptionally weak. Both exports and imports may get some support from preparations for a strike at East coast ports, which ultimately turned out to be brief, lasting form October 1 to October 3.

Advance retail and wholesale inventory data for September will be released with the advance goods trade data, adding to insight on Q3 GDP.