U.S. October PPI - No surprises but a little too high, Initial Claims lower in early November

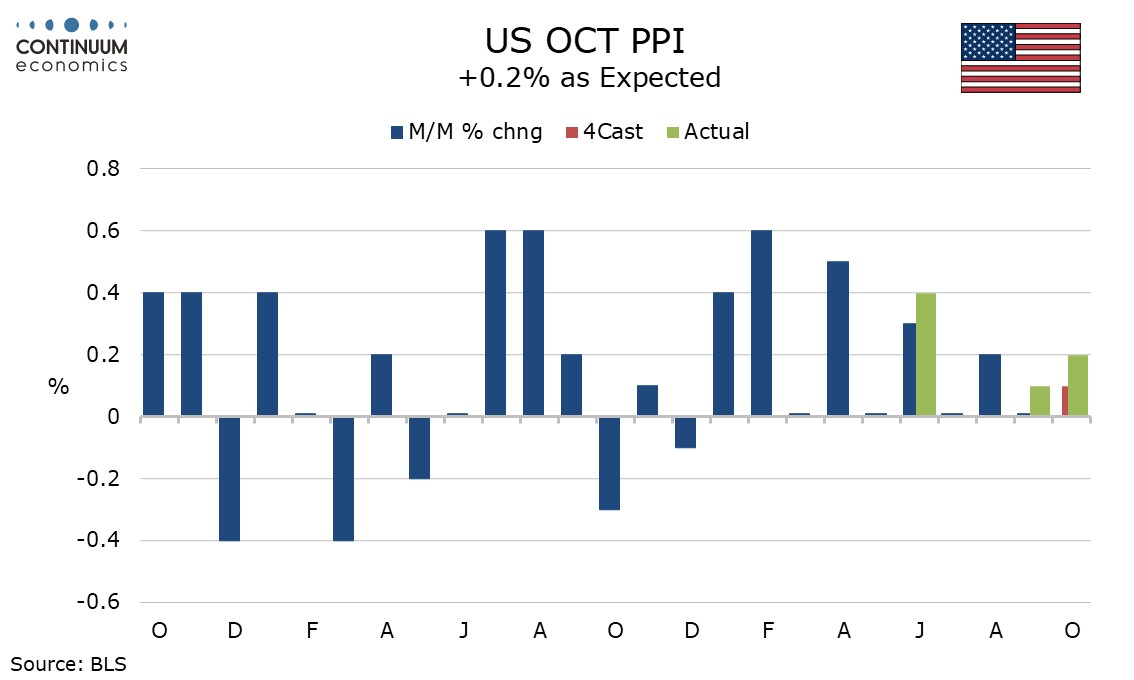

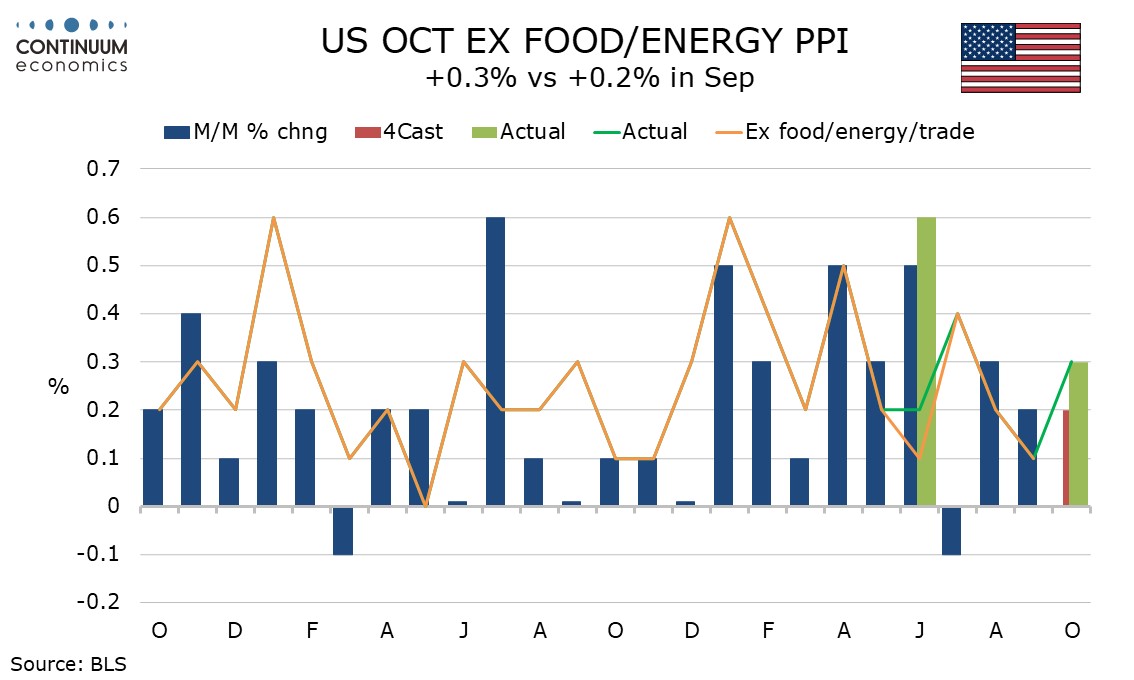

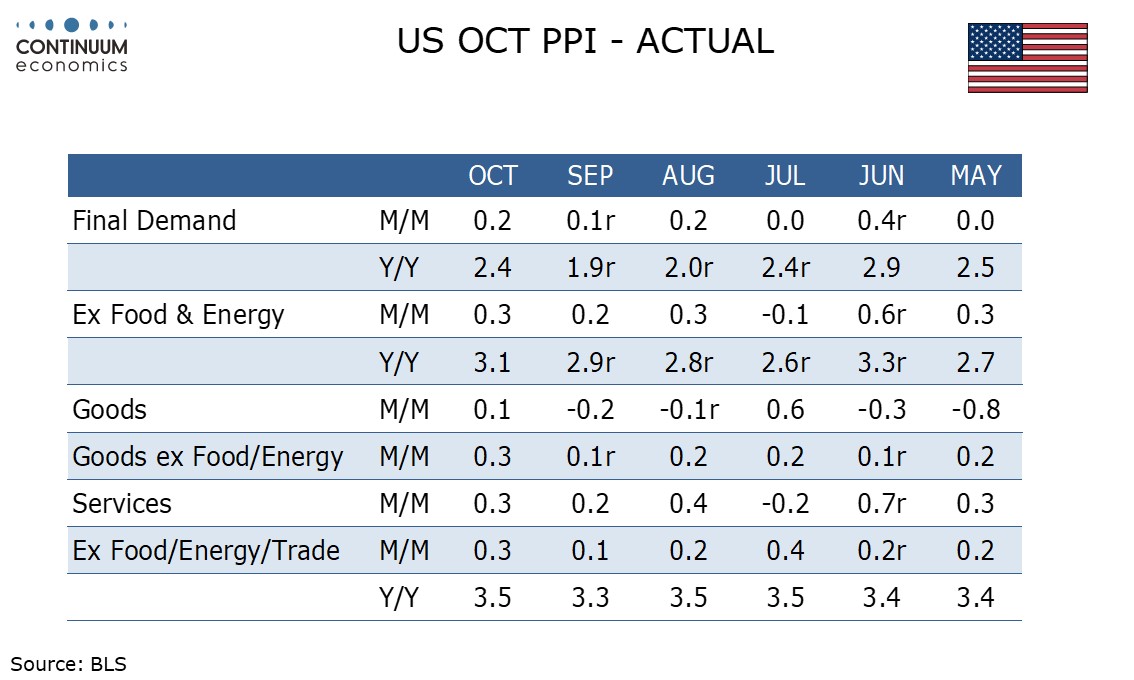

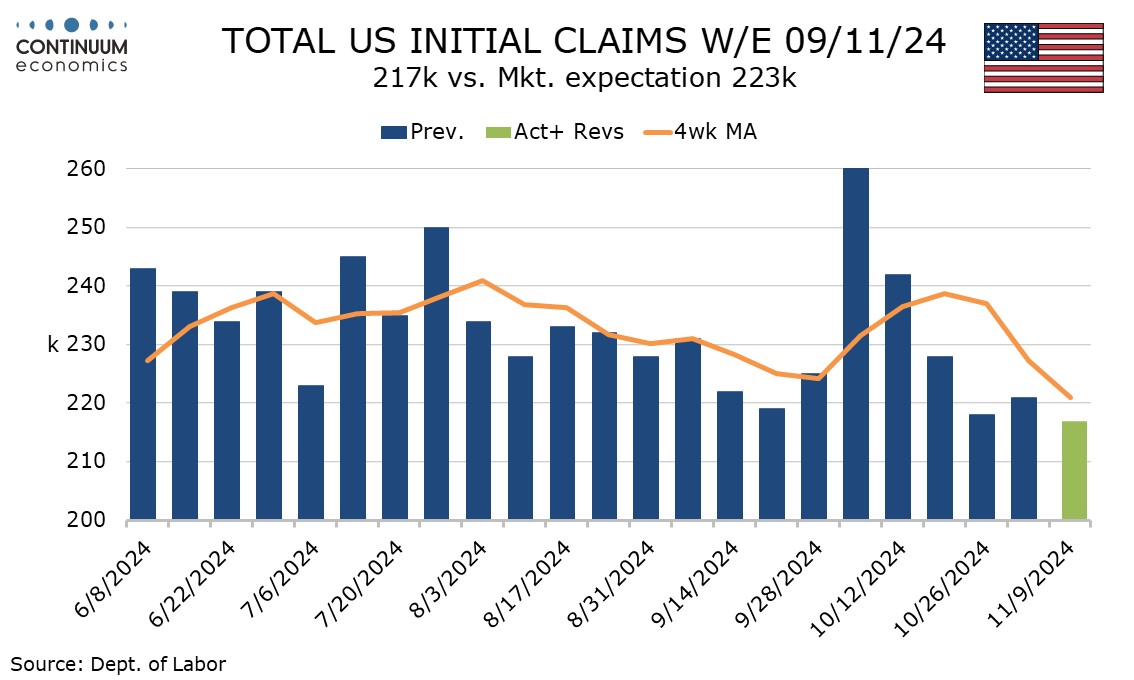

October PPI with a 0.2% increase overall, and 0.3% gains in the core rates ex food and energy and ex food., energy and trade, is in line with expectations but not soft enough to be consistent with inflation at the Fed’s 2.0% target. The labor market appears to be regaining momentum in early November, with initial claims falling to 217k from 221k.

PPI saw marginal declines in both food and energy, the former correcting a sharp September rise and the latter showing a smaller decline than in October.

Both goods ex food and energy and services increased by 0.3%, the former a six month high. Services saw a 0.1% gain in trade, a 0.5% gain in transport and warehousing, and a 0.3% rise elsewhere.

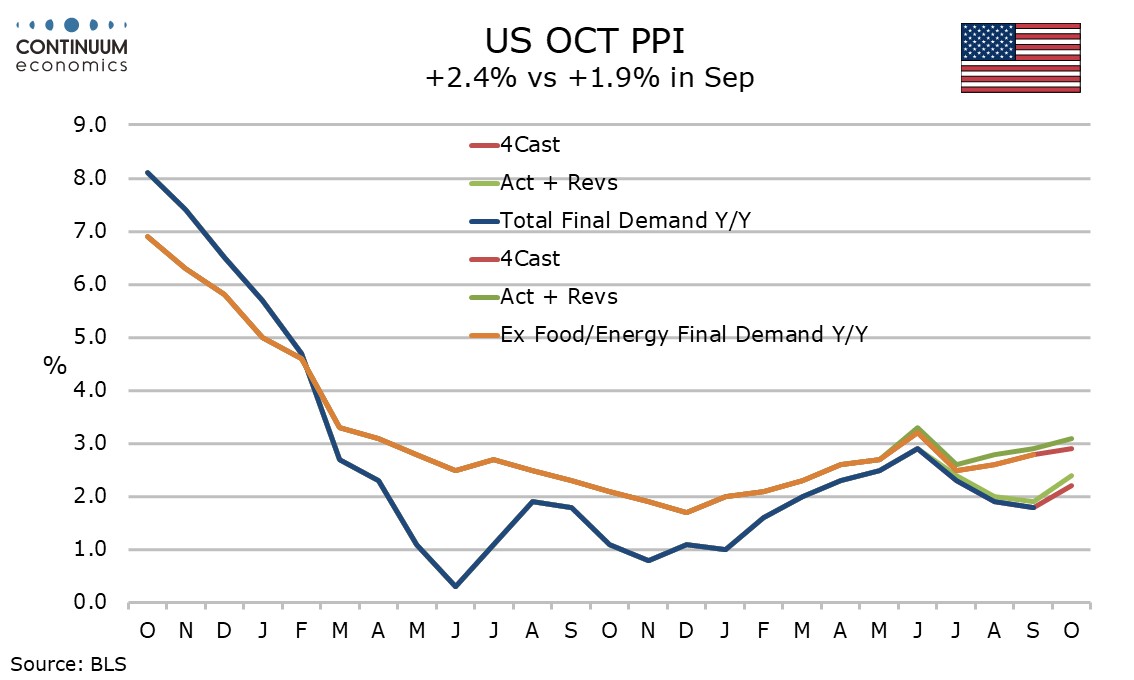

Yr/yr growth is stronger, overall at 2.4% from 1,9% and a 3-month high, ex food and energy at 3.1% from 2.9% and a 4-month high, while ex food, energy and trade at 3.5% from 3.3% returned to its pace seen in July and August.

Intermediate data was firm for goods, processed goods up 0.5% and 0.4% ex food and energy, while unprocessed goods rose by 4.1% and 2.1% ex food and energy, Intermediate services however rose by only 0.1%, a third straight subdued month.

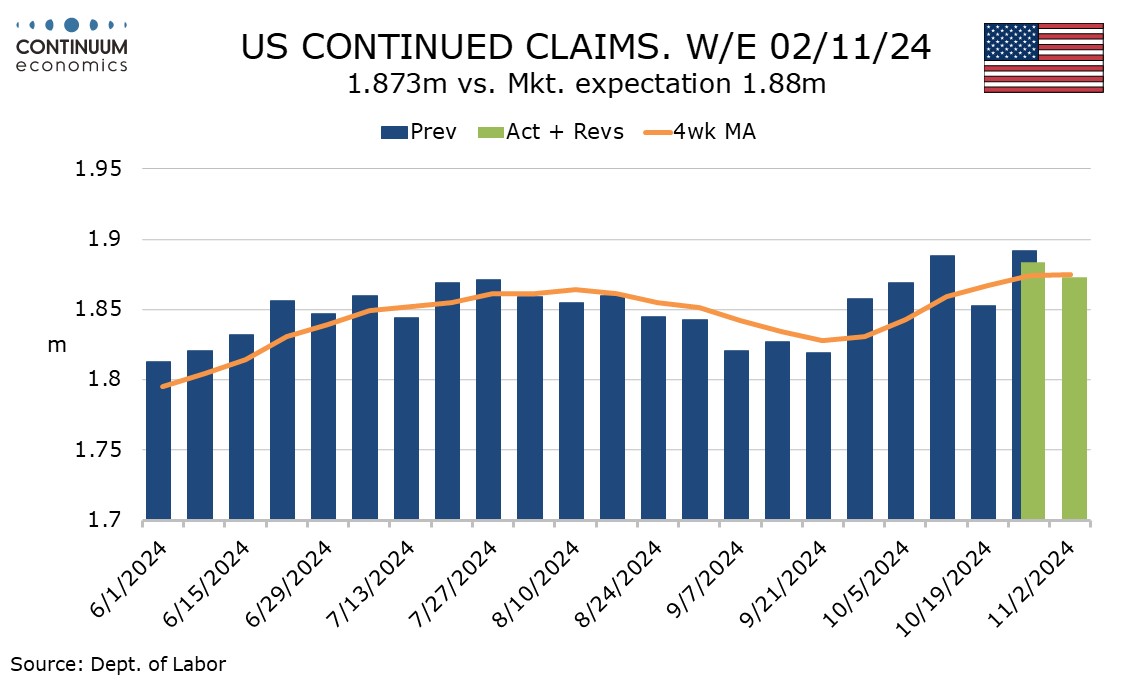

Initial claims at 217k are the lowest since May 18 and suggest the labor market is gaining momentum after being hit in early October by hurricanes. November’s non-farm payroll will be surveyed next week.

Continued claims, which cover the week before initial claims, slipped by 11k to 1.873m after last week’s 35k increase. Here the 4-week average is still rising, suggesting those who lost their jobs in the hurricanes have not all found fresh work.