JPY flows: JPY firm after hawkish BoJ

BoJ hikes rates more than expected but JPY gauns have stalled near term after earlier leak

The BoJ not only delivered a rate hike, which was not expected by the majority of forecasters, even though it was around 55% priced into the market at European close on Tuesday, they delivered a 15bp rate hike rather than the 10bp move that had been anticipated by the hawks. On top of this, they announced a halving in the JGB bond buying program to JPY3trn by Q1 2026.

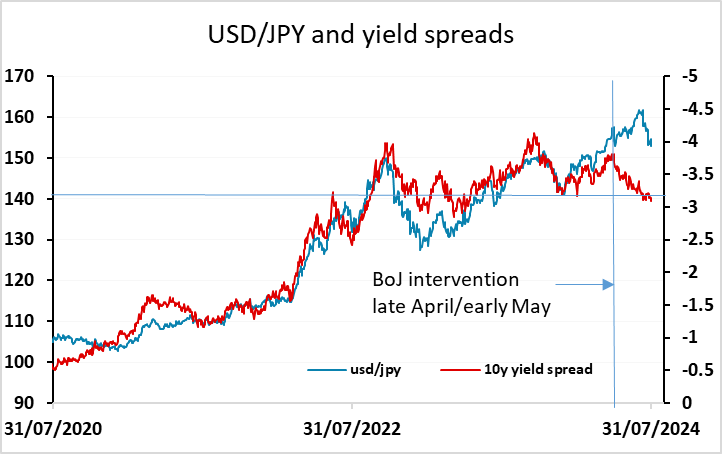

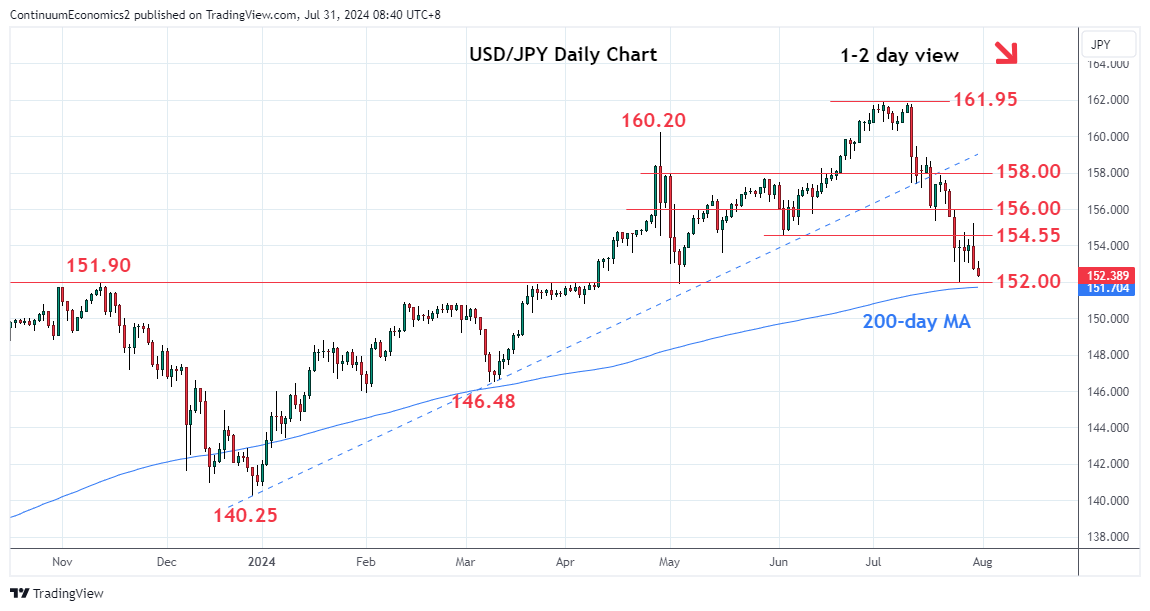

There was some leakage of the decision ahead of time, with Jiji news agency reporting in NY afternoon that the BoJ is considering raising short-term interest rates to around 0.25% from the current 0-0.1% at its two-day policy meeting that ends on Wednesday. Nikkei ran a similar report. USD/JPY was consequently sharply lower in NY hours, and after an initial spike lower USD/JPY rallied sharply in reaction to the decision, and at the moment remains above the pre-decision lows. Nevertheless, the decision is significantly more hawkish than was expected yesterday, and the risks for the JPY should consequently be on the upside, especially since yield spreads already suggest upside scope for the JPY against all the major currencies.

There is still technical support in USD/JPY around the 152 area, and this may hold it up short term, but longer term players are now likely to start turning their positions long JPY. However, the FOMC meeting later may limit the move today.