Published: 2024-12-16T14:05:32.000Z

Preview: Due December 17 - Canada November CPI - Renewed slippage after correction higher in October

2

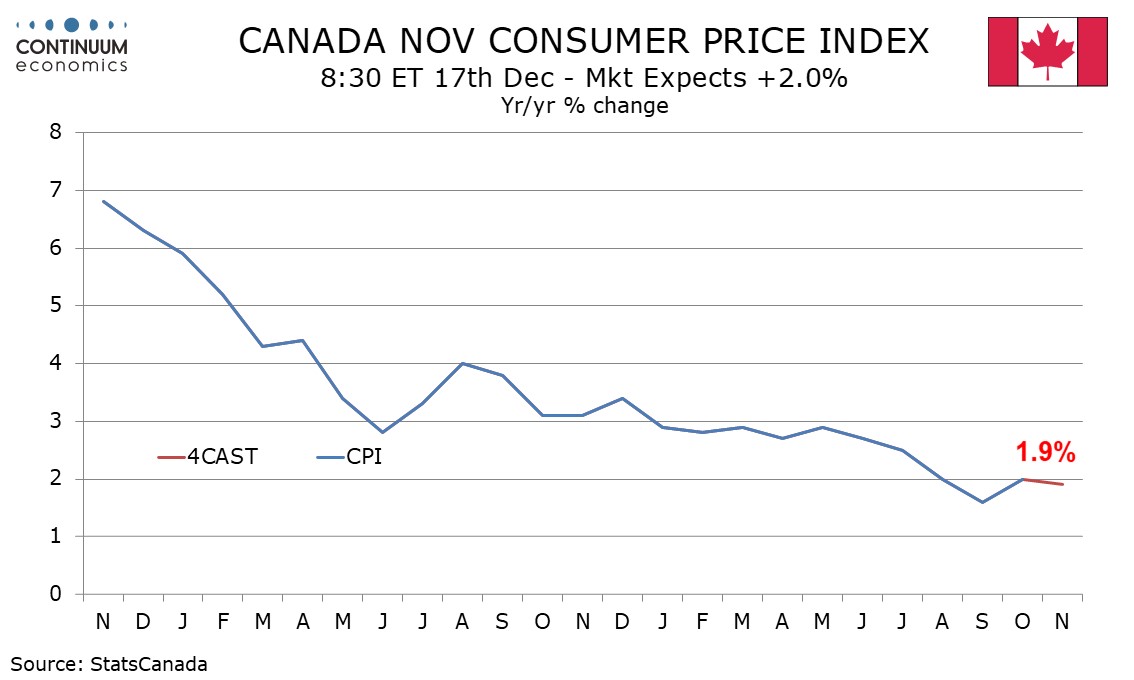

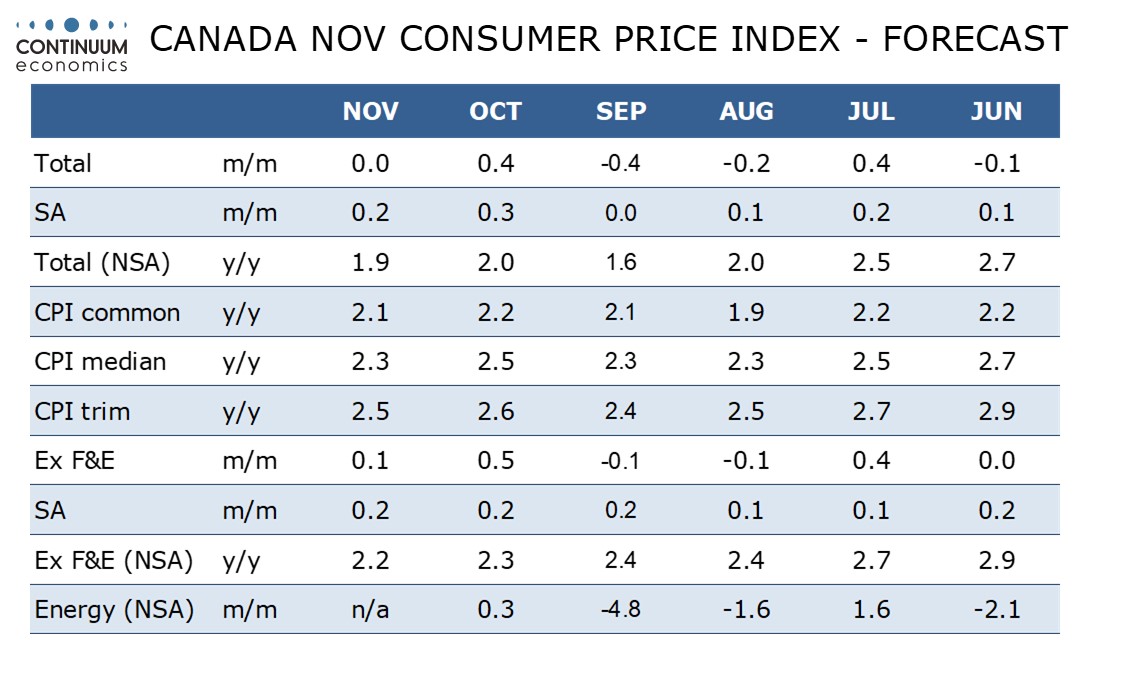

After an upward correction in October, we expect downward progress in Canadian CPI to resume in November, with the yr/yr rate slipping to 1.9% from 2.0%, while remaining above September’s 1.6%. We expect downward progress in the Bank of Canada’s three core rates to resume too.

On the month we expect CPI to be unchanged on the month before seasonal adjustments with a 0.1% increase ex food and energy, though seasonally adjusted we expect both series to see gains of 0.2%.

This would be the third straight 0.2% seasonally adjusted gain ex food and energy, implying a subdued underlying trend. The Bank of Canada’s core rates, measured on a yr/yr basis, bounced in October largely because October 2023 data was weak.

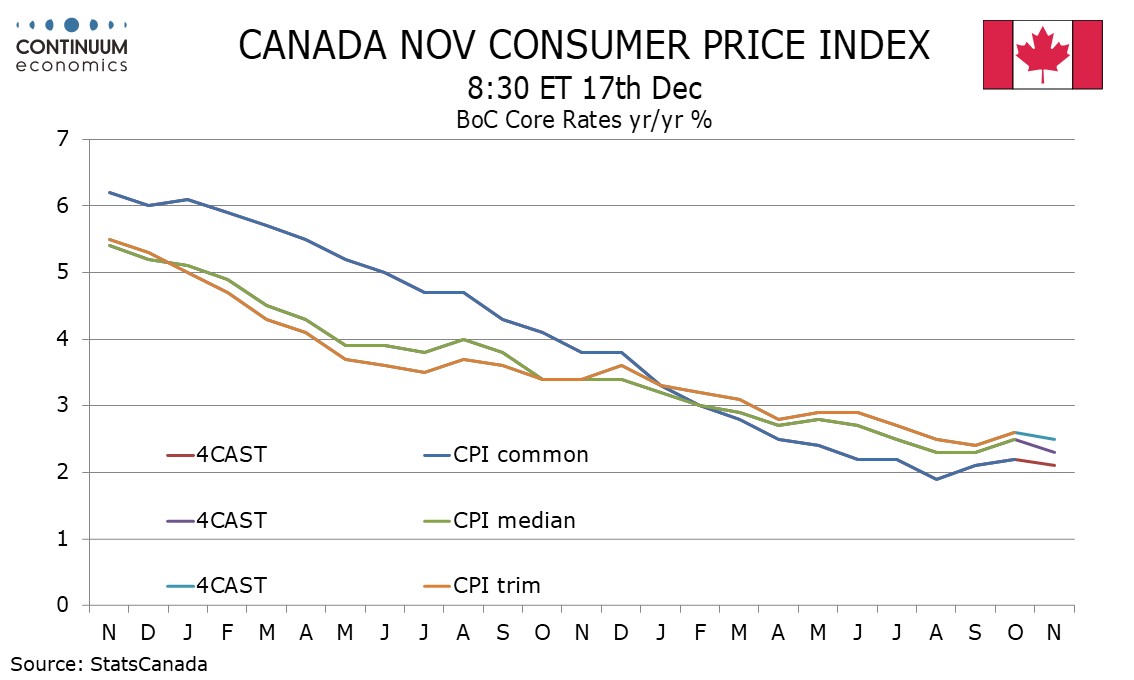

With less weak year ago data dropping out in November we expect renewed slippage in the BoC’s core rates, CPI-Median to 2.3% from 2.5%, CPI-Trim to 2.5% from 2.6% and CPI-Common to 1.9% from 2.0%.