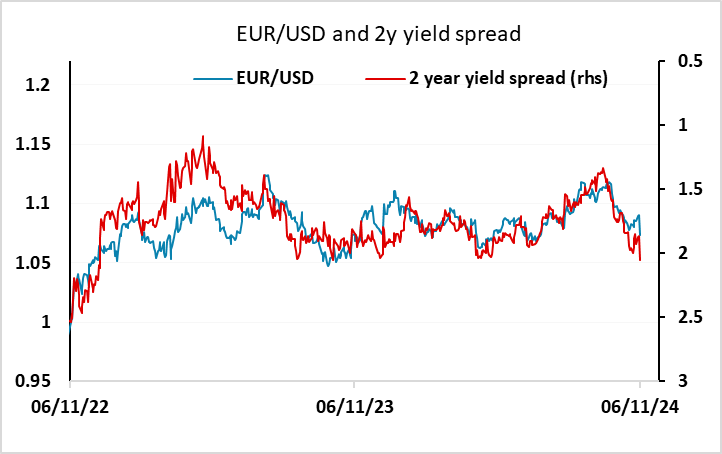

EUR flows: EUR downside risks as 2 year yield drops

EUR 2 year yields drop after US election, possibly on tariff concers, suggesting EUR downside risks.

EUR front end yields are noticeable lower this morning while US yields are higher after the election. The rationale looks to be based on the expectation of Trump raising tariffs, which is seen as undermining global trade and consequently the Eurozone economy. While the negative impact on the US is likely to be greater, the US impact of tariffs is likely to be offset by tax cuts, while the same is less likely to be true in Europe. There has been a significant widening of USD/EUR front end spreads as a result, so that there is scope for EUR/USD to see further declines. While the EUR may gain some support from a risk positive response to the election, the relatively stronger gains in the US market still favours the USD. So there is scope for a test lower to 1.07.