This week's five highlights

Trump 2024

FOMC eases by 25bps and statement avoids dovish hints

Gradualism Still the Order of the Day for BoE

RBA Still Waiting to ease

Norges Bank Tweaks in Policy Guidance

Sweden Riksbank Faster, But Not (Yet) Any Further Easing?

Policy uncertainty is high over tariffs on Trump being elected as the U.S. president, though the 2017 tax cuts will likely be renewed with some additional tax cuts elsewhere. Tackling immigration will also be a policy priority, but the scale of action is unclear. Two potential paths are either that Trump enjoys being reelected and policy action is less than feared or alternatively an aggressive tax cutting/tariff and deportation route is implemented that proves economically disruptive. House outcome/Cabinet and key personal appointees, but also executive orders after the inauguration in January will set the tone for policy and markets.

As Trump escalated his tax cut proposals, he also increasingly pushed tariffs as a means to pay for them, now suggesting 20% across the board rather than his original 10% suggestion with rates of 60% on China. A large increase in tariffs could, even with a reduction in imports, raise over 2% of GDP in revenues, but much of this would be a passed onto prices. Tariffs, which would surely see retaliation against US exports, would probably be a net negative on GDP. While the economy appears to have enough underlying strength to stay out of recession, Trump’s tariff proposals carry large risks.

Whether Trump would go ahead if highly uncertain. He has the authority to do so if he invokes national security concerns. However, some Republicans will warn him that aggressive tariffs would weigh on equities, which Trump cares about, and would boost inflation, a rise in which was very damaging to Biden. If Trump inherits a growing economy with falling interest rates he may simply decide to take the credit for a healthy economy and avoid major policy actions. Aggressive or limited action on tariffs are both possible. Compromise options could involve taking action against a few countries, China and Mexico being particularly vulnerable.

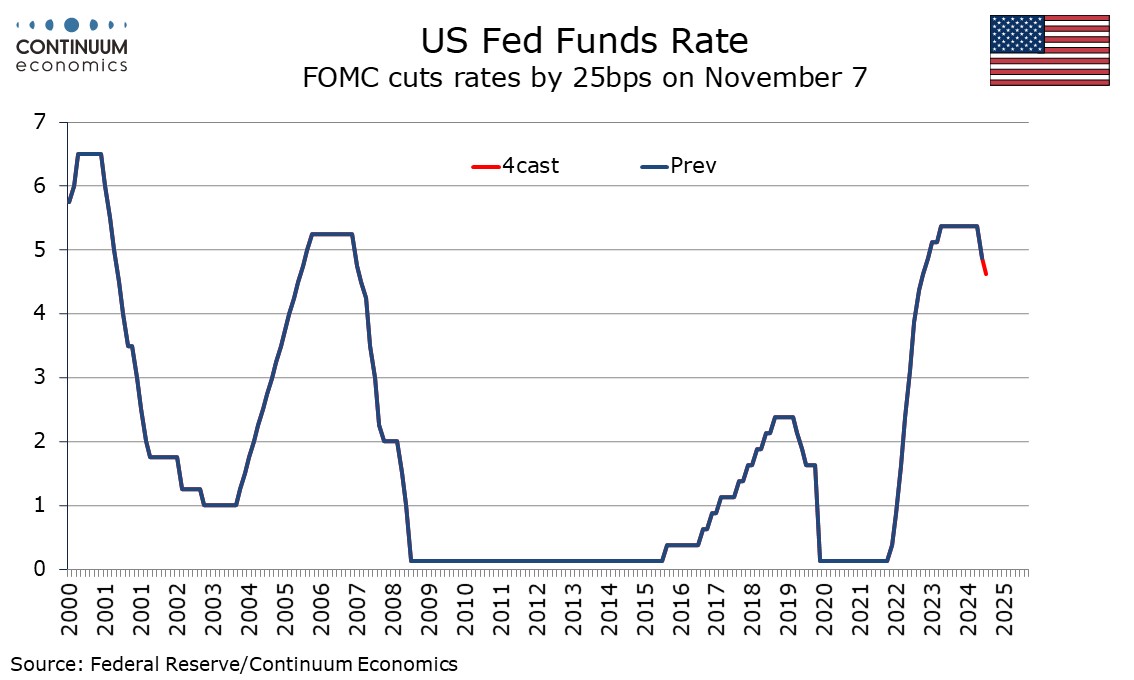

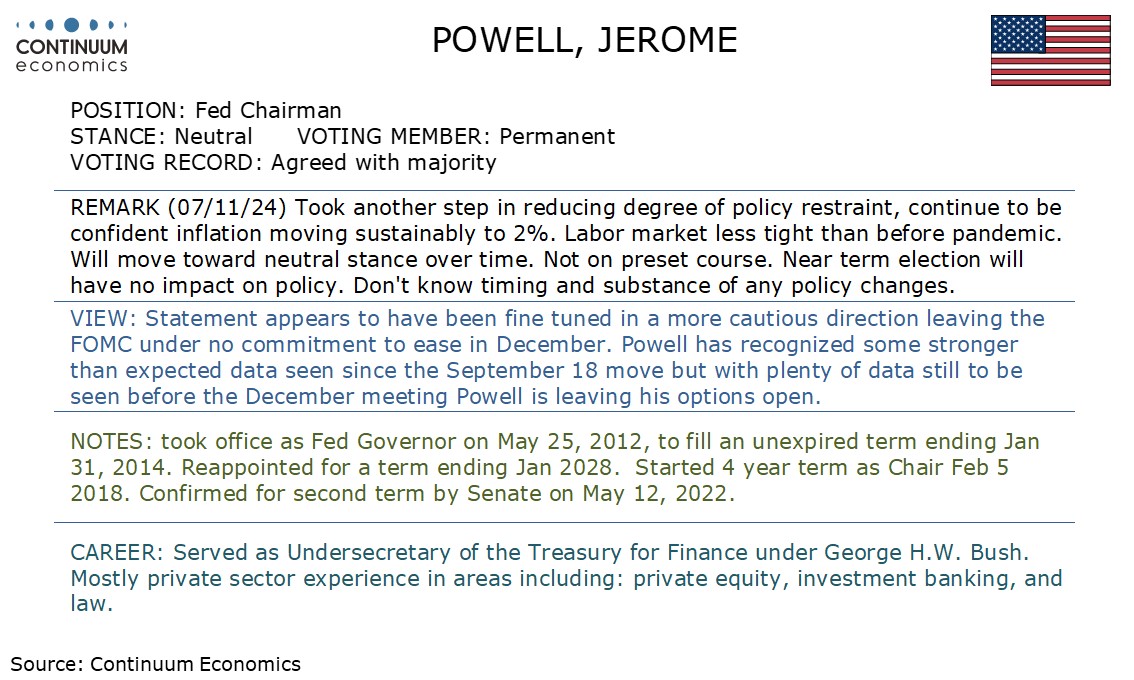

The FOMC eased rates by 25bps as expected with a statement that avoided making any further dovish signals beyond what were given on September 18. In his press conference Chairman Jerome Powell left his options open for December when the decision will be data-dependent. On balance we still lean towards a December ease, though we expect less easing in 2025 than previously given likely fiscal support. For 2026 tightening may resume if tariffs lift inflation.

On September 18 the FOMC stated that job gains have slowed. Today (Nov 8) it stated that since earlier in the year labor market conditions have generally eased. On September 18 the FOMC stated inflation has made further progress toward the 2% objective. Today they dropped the word further. The FOMC dropped a phase that it has gained greater confidence that inflation is moving sustainably toward 2%, though still judges risks to be roughly in balance. On September 18, before stating it had decided to ease by 50bps, it made a reference to progress on inflation and the balance of risks. Today it simply stated the 25bps move was in support of its goals.

In his press conference Powell noted data since September 18 leaving a feeling that downside economic risks had been diminished. Most recent data has been on the firm side of expectations, a weak payroll for October an exception but almost certainly depressed by hurricanes as well as a strike at Boeing. We expect that November’s payroll will rebound, but not so dramatically that it erases a sense that payroll trend has slowed. Inflation data will probably not provide any major scares before the December meeting. That leaves us leaning towards another 25bps move in December, though the decision will depend on incoming data.

Powell stated that in the near term the election will have no impact on policy as the timing and substance of any policy changes are unknown. However it is likely that Trump, even if not fully meeting his promises, will seek to cut taxes beyond simply extending the 2017 tax cuts, and that will provide support for the economy. That is likely to be done fairly quickly. Aggressive tax cuts will add to the budget deficit, probably sufficiently to cause some concern in the bond markets, and Trump’s most obvious method to raise revenues will be tariffs. He has few serious ideas on cutting spending. If tariffs are raised substantially, inflation is likely to receive a lift, and that is likely to be apparent in the data by 2026.

We continue to expect rates to end 2024 at 4.25% to 4.5%, 25bps lower than currently. Previously we had expected rates to fall to 3.0-3.25% by end 2025. A more expansionary fiscal policy has us now predicting only 75bps of easing in 2025, taking rates to 3.5-3.75%, with two 25bps moves in Q1 and one in Q2. As inflation rises, we expect tightening to resume in 2026, taking rates to 4.5-4.75% by Q3, after which we expect rates to stabilize with the economy likely to be then losing momentum after a strong 2025.

Figure 1: A Later and Smaller Inflation Undershoot on the Cards?

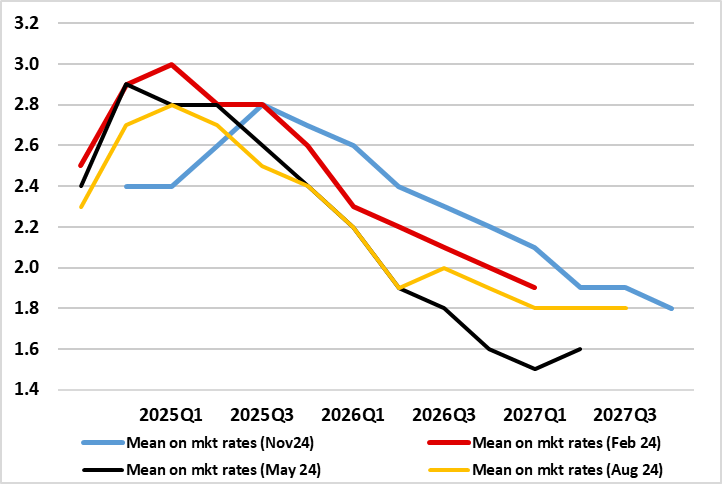

In what was something of a more hawkish assessment and outlook, the BoE nevertheless delivered the expected further 25 bp Bank Rate cut to 4.75% with only one (expected dissent against. But after what had been hints of a possibly more policy activism from Governor Bailey last month, the MPC instead adhered to its the gradualist approach, thereby conforming with the cautious approach long advocated by Chief Economist Pill. In contrast to our thinking, it does seem that the recent Budget boost has had a material impact on MPC thinking, to a degree that despite recent soft data and higher market rates, an inflation target undershoot is projected only from mid-2027 onwards (Figure). This is a full year later than previously projected and, as such, would suggest that the 3.7% rate markets assumed into 2026 may be a little inconsistent with meeting target. All of which makes it unlikely that the December MPC meeting will see more easing. Regardless, given the below-consensus outlook we still envisage for both growth and inflation, we still see an additional 125 bp of easing by end-2025.

Amid its continued uncertainty, the BoE has more formal scenarios for the inflation outlook, an upside and downside and a central case, the latter used as the basis for the MPR projections and encompassing more price pressures than envisaged in August. Indeed, there is no upside risks premium in these in the updated Monetary Policy Report (MPR) forecasts as the mode and mean CPI projections have coincided this time around. This embodies that a period of economic slack may be required in order for pay and price-setting dynamics to normalise fully.

But it is clear that the Budget has had an impact, alongside revisions to GDP data and perhaps even more clear cut worries about price persistence. What is puzzling is that the while he Budget boost the level of GDP by almost 1 ppt, the next upward revisions to GDP growth out to 2027 is minimal, ie around 0.25 ppt. Yet there is an even larger revision (ie higher) in the output gap. Otherwise, it is notable that the Budget measures (unlike OBR thinking) is see boost wage growth on a more persistent basis.

The RBA kept the cash rate on hold at 4.35% as we forecast despite headline CPI heading closer to the upper band of target range. The forward guidance statement remained the same in the September statement, citing "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA has not changed their view since. The RBA viewed the headline moderation of Q3 CPI to be partially attributed from the government subsidy of energy prices and stated that underlying inflation did not show the same pace of moderation. The preliminary growth of Australia in the second half seems to have eased RBA's mind that the long period of restrictive rates would hurt the Australian economy significantly. The growth in wage has spurred consumption growth for local residents while international students and tourist spending is steadily strong. Such balanced dynamic, even with certain outlook uncertainty, has provided the RBA with less pressure to ease.

The decision broadly aligns with RBA's rhetoric on data dependency and the cumulative impact of tightening. Yet, the RBA has subtly referred to the mid point of target range and underlying inflation (RBA trimmed mean CPI), instead of headline CPI and target range in their statement, seems to preview that the headline inflation will likely continue to moderate in the coming quarters. And to avoid sending the wrong signal to market participants and subsequently forcing their hand, the RBA now seems to have tilted towards underlying inflation sustainably reaching the middle point of target range at 2.5% before easing when the RBA forecast to be at mid 2025. The household balance sheet's restraint from mortgage cost and inflationary living pressure have been partially eased by higher wage. The labor market remains solid and will likely contribute to steady wage growth. But the pace maybe limited as the labor market has long peaked with little room to increase productivity.

Given the current inflation trajectory, the only direction of monetary policy is south. As the RBA pivot towards mid inflation target range of 2.5%, we now see the first cut to be in Q1 2025 with terminal rate at 3% by year end 2025.

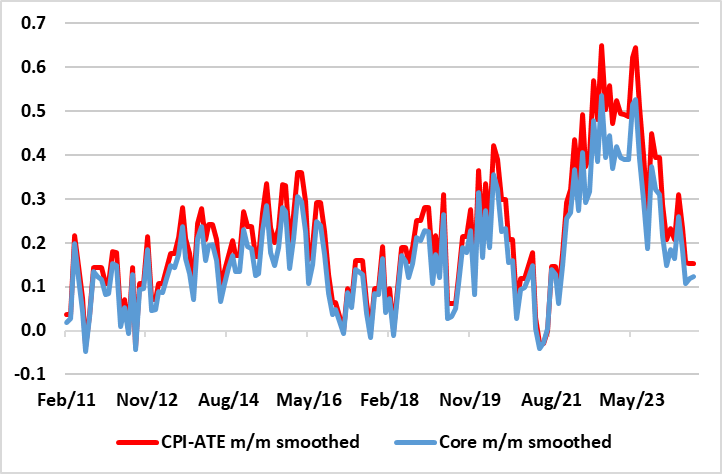

Figure: Inflation – What Inflation?

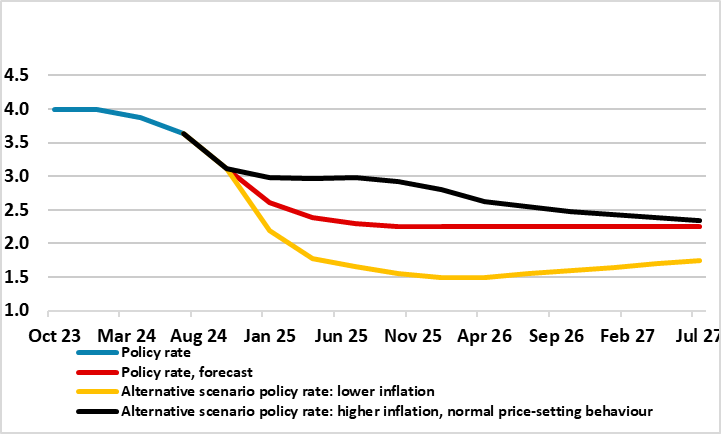

Aided by more downside inflation surprises and the accelerated pace of central bank easing nearby, speculation that the Norges Bank would ease by year –end had grown, but have now largely dissipated. However, after the widely expected stable policy decision today, the possibility that a cut may be made at the remaining on Dec 19 has increased. Once again, and as with the six previous policy meetings, the Norges Bank kept its policy rate at 4.5% but amended its policy guidance a touch, possibly in recognition of soft inflation outcomes of late (Figure). This was very much as we thought and gives the Board a little more policy flexibility, as in December, it will be armed with fresh forecast which could make a policy cut at that juncture more explainable. The scheduled decision on Jan 23 looks set to see the first rate cut, although this is not fully consistent with the little-revised official policy outlook, which indicates a slightly faster decline through 2025. We still see some 150 bp of rate cuts in 2025 – 50 bp more than the Norges Banks is advertising!

The Norges Bank probably still sees policy risks being balanced, despite a slightly disappointing mainland real economy backdrop and what have been broadly softer than (Norges Bank) expectations for CPI data of late, and where underling price dynamics are very weak (Figure). This is not fully acknowledged by the Board, which suggested that the outlook for the Norwegian economy does not appear to have changed materially since the previous monetary policy meeting. However, possibly why the Board gave itself more flexibility was that it gave weight to the fact that inflation has slowed faster than expected over the past year and that it was also lower in September than projected. On the other hand, it noted international policy rate expectations have increased, and the krone has been a little weaker than assumed.

Figure: Alternative Official Policy Outlooks Suggest Deeper Cuts Are Possible

A fourth successive rate cut was widely seen at this Riksbank meeting, but rather than the 25 bp moves seen hitherto, there was the 50 bp move (to 2.75%) that was hinted at as part of the two further cuts advertised at the last (September) meeting. What seems clear is that inflation worries have subsided against a backdrop on below target recent CPI readings only to be replaced by clearer worries about the (still contracting) real economy. This was an interim meeting with no formal updates of forecasts, so we are not surprised there will was different policy guidance at this juncture and no indication that a lower terminal rate is being considered, merely getting there a little faster. But we now still see the policy rate at 2.5% by year end and adhere to our long-standing policy rate forecasts of 2.25% by mid-2025, now the same as the Riksbank’s terminal rate but one we seeing being arrived at two quarters earlier. But deeper cuts are possible as even the Riksbank acknowledges.

Indeed, it is clear that while lower inflation has provided the scope to ease policy in this speedier manner, the rationale is increasingly that from a weak economy. This time around the Board statement was clear that ‘there are still few clear signs of a recovery. To further support economic activity, the policy rate needs to be cut somewhat faster than was assessed in September. It is important in itself that economic activity strengthens, but it is also a necessary condition for inflation to stabilize close to the target’.