Preview: Due June 12 - U.S. May PPI - A correction from a weak April, which may be revised

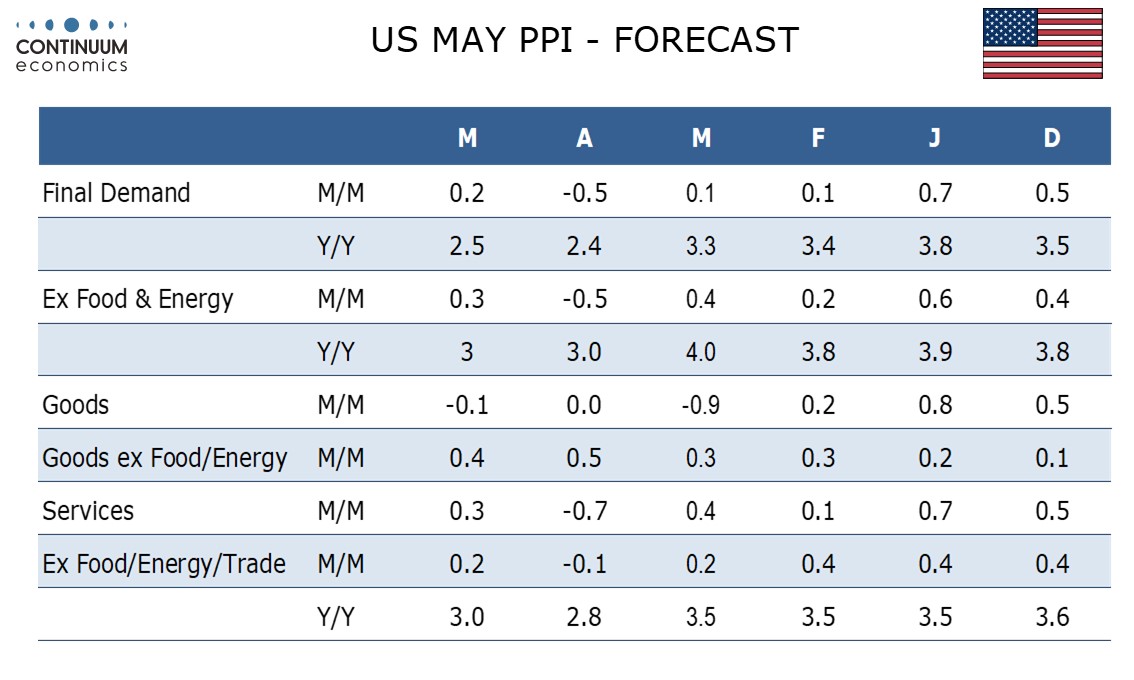

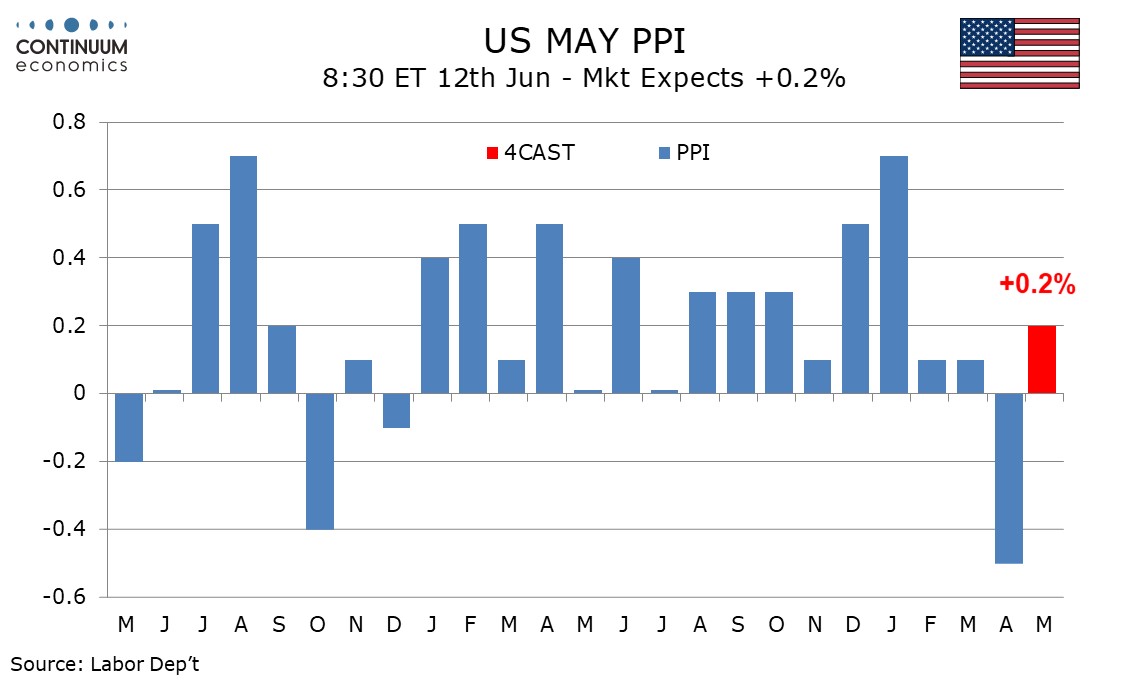

We expect May PPI to see a modest bounce from a weak April with a 0.2% rise overall and a 0.3% increase ex food and energy. Ex food, energy and trade, we expect a rise of 0.2%. April fell by 0.5% overall and ex food and energy, but by only 0.1% ex food, energy and trade. A weak March was revised up with April’s report so April revisions should be watched this month.

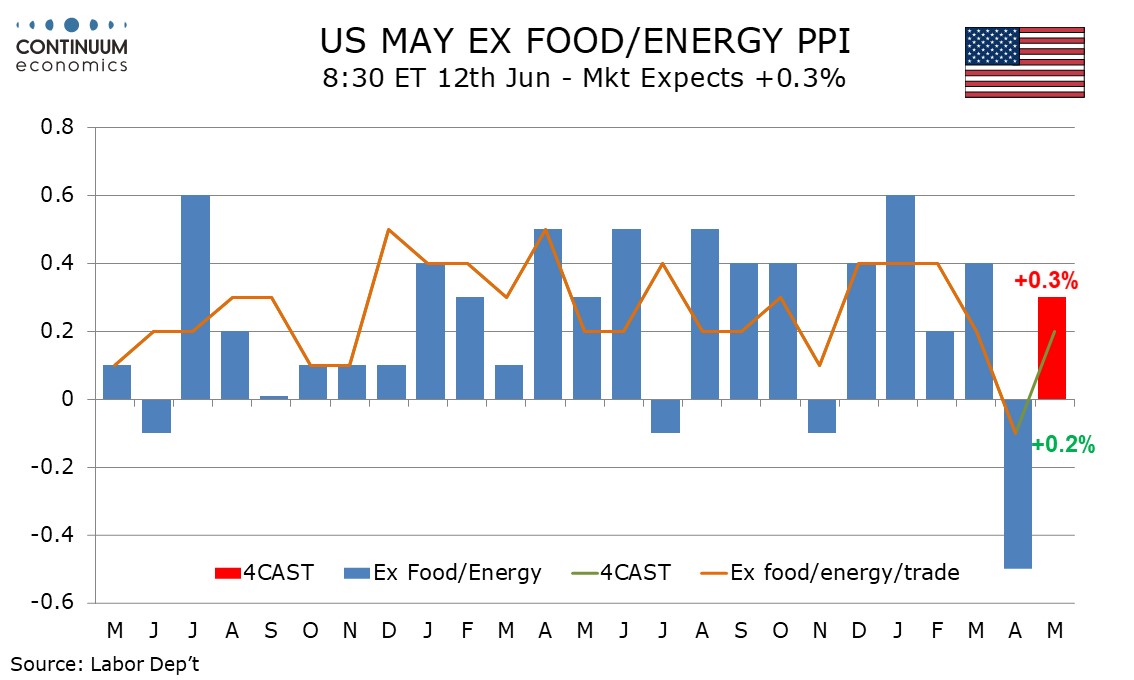

Recent months have seen strength in core goods prices, with gains of 0.3% in February and March and 0.4% in April, but weakness in services, which rose by 0.1% in March and 0.4% in April, followed by a 0.7% plunge in May. Despite a lack of pass-through to CPI, core goods are being lifted by tariffs and should continue to be so, and we expect a 0.4% rise in May. We however expect overall goods prices to fall by 0.1%, with energy to fall on gasoline and food to fall on a continued reversal from recent highs in eggs.

Services are getting hit by weak demand with weakness also being seen in intermediate service prices. We expect May services to see only a modest bounce of 0.3%, led by trade. Ex food, energy and trade we expect PPI to see a 0.2% increase, which would follow a 0.1% decline in April and a 0.2% increase in March. With December, January and February all having seen gains of 0.4%, trend ex food, energy and trade has lost momentum in recent months.

We expect yr/yr growth rates of 2.5% overall, up from 2.4% in April, 3.0% ex food and energy, unchanged from April, and 3.0% ex food, energy and trade, up from 2.8% in April, though this assumes no revisions to April. Without revisions to April, yr/yr rates will be well below those of March, at 3.3% overall, 4.0% ex food and energy, and 3.5% ex food, energy and trade.