Published: 2025-03-24T14:00:12.000Z

U.S. March S&P PMIs - Manufacturing slips below neutral but Services rebound

1

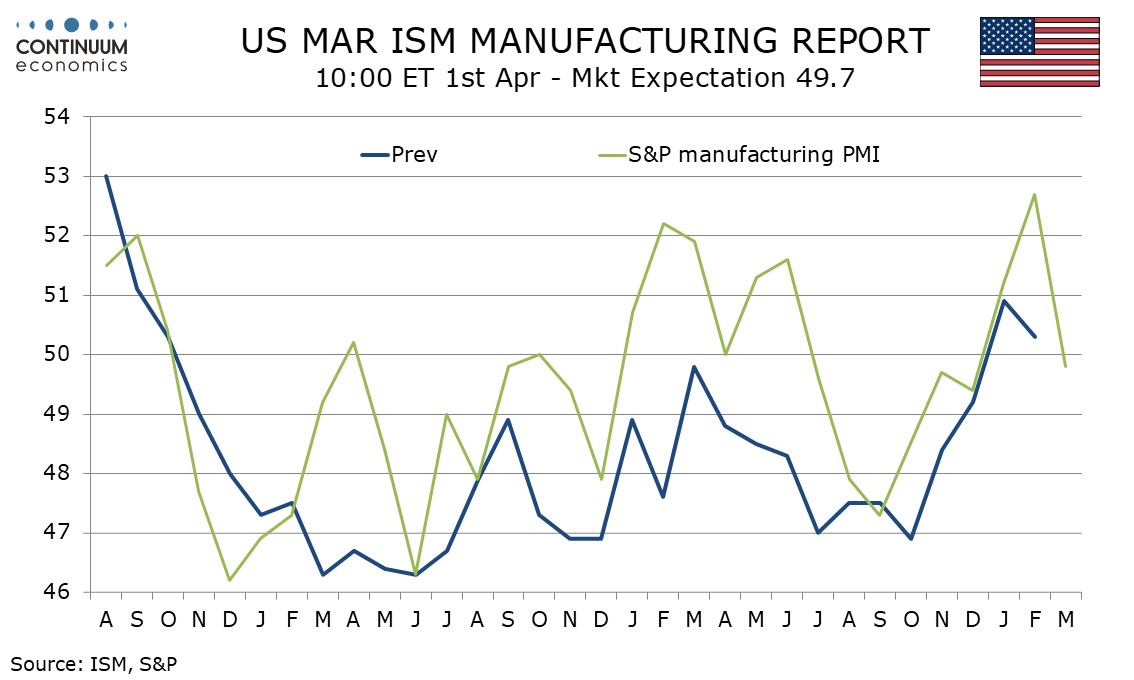

March’s preliminary S and P PMIs are mixed, with manufacturing slipping back below neutral to 49.8 from 52.7, a sign that tariff concerns are having a negative impact, but services, less sensitive to tariffs, improved at 54.3 from 51.6.

.

The softer manufacturing index follows a weak March Empire State manufacturing survey and a slower, but still positive Philly Fed. An upturn in manufacturing peaked in February in 2024 too, but in 2024 the index remained above 50 through Q2, making this latest index a clearly negative signal.

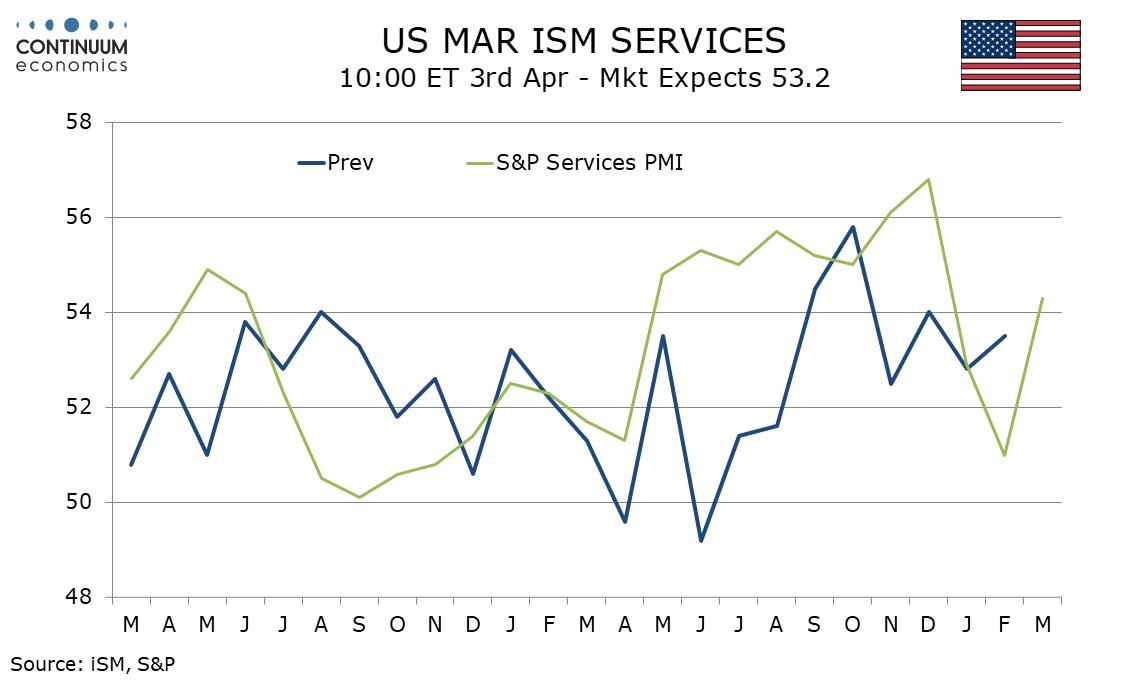

The services index is up from January and February data but still softer than those seen from May through December of 2024. January and February data may have been restrained by weather. Lower mortgage rates reply may also have provided support, with the S and P services index appearing more interest-sensitive than the ISM’s, with which it is not well correlated.