U.S. August Existing Home Sales - Underlying picture near flat, base may be forming

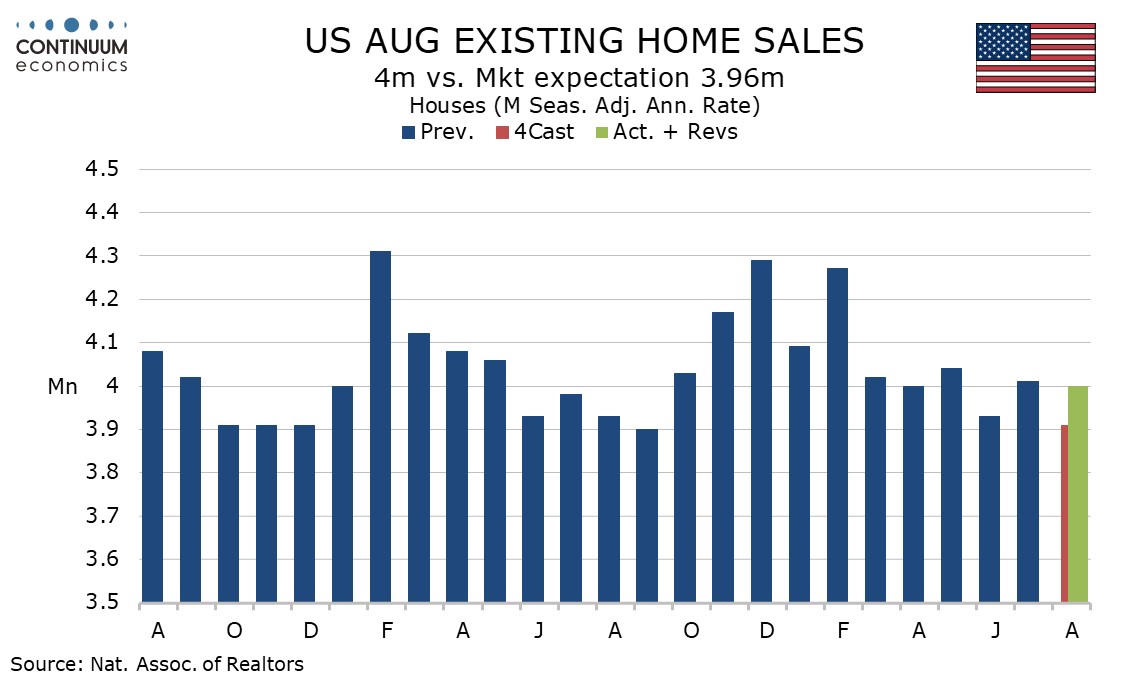

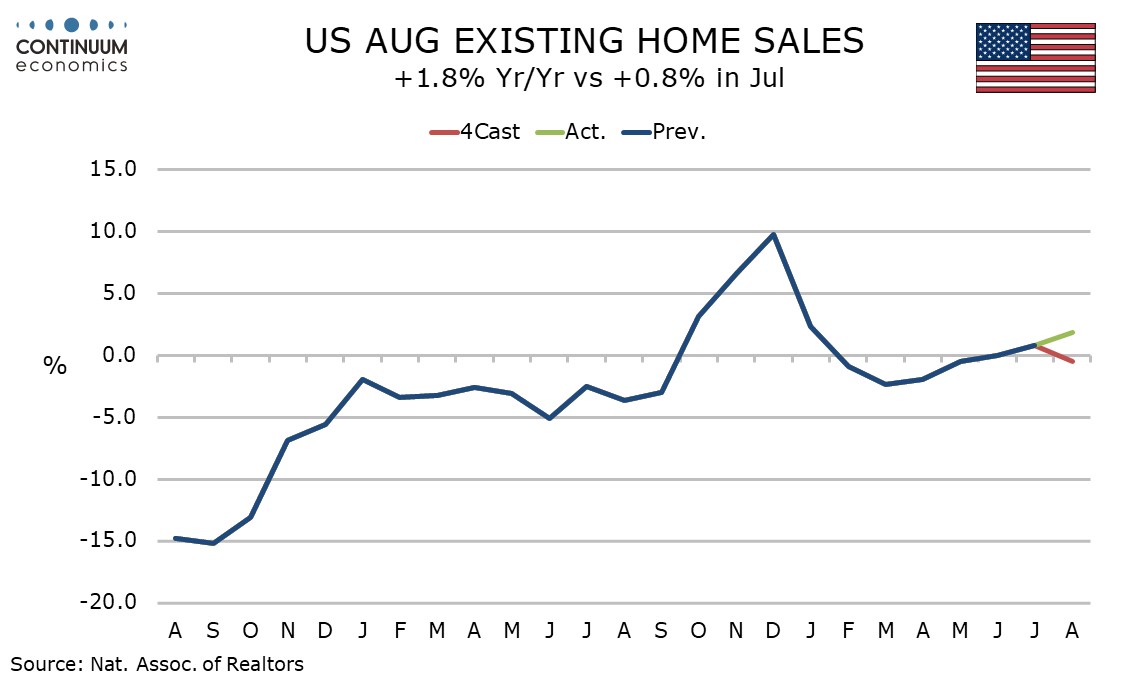

August existing home sales are slightly stronger than expected but at 4.00m are down 0.2% from July, with the underlying picture looking fairly flat in recent months. Yr/yr growth is modest at 1.8%, and no longer negative as it was in February, March, April and May.

A 20.5% surge in new home sales to 800k released yesterday is probably in part erratic even if falling long term rates in anticipation of Fed easing, which was delivered in September, are supportive. There are positive signals in weekly MBA house purchase indices but the NAHB homebuilders’ survey remained weak in September (surveyed before the Fed rate cut).

The 0.2% fall in existing home sales follows a 2.0% July rise that corrected a 2.7% decline in June. The picture looks fairly flat and should be supported, albeit probably modestly despite the new home sales surge, by Fed easing.

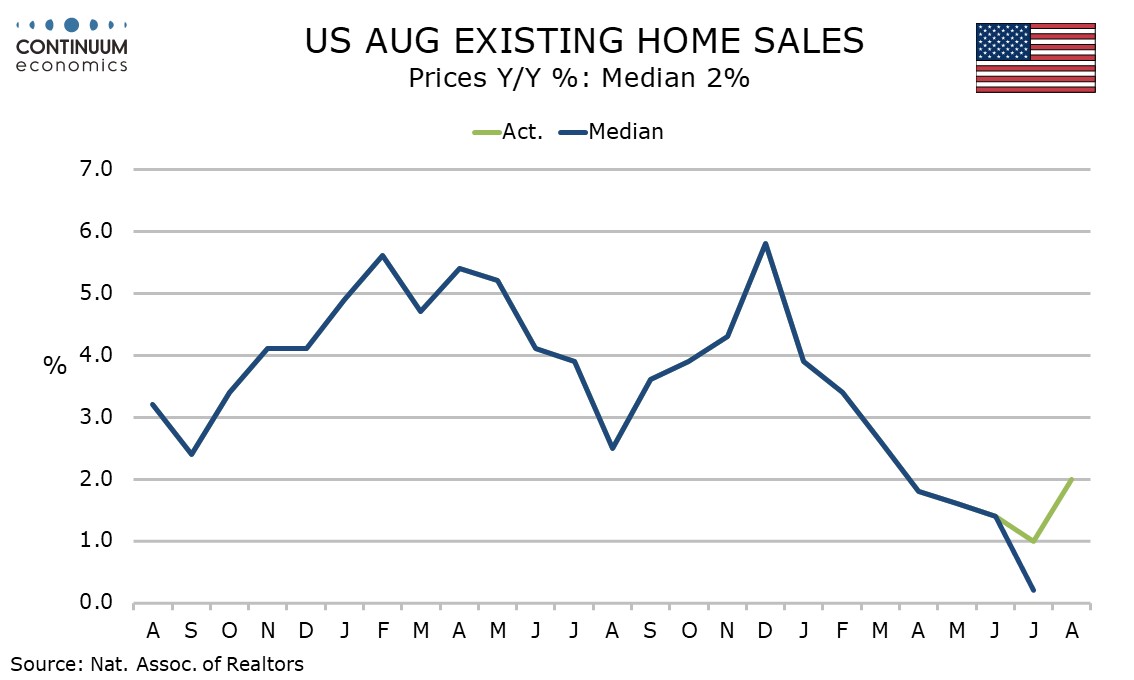

The median price fell by 0.7% on the month after a 1.6% July decline though these falls are seasonal awhile July’s decline was revised up from -2.4%. Yr/yr prices at 2.0% are up from 1.0% in July which was revised up from 0.2% and a downtrend may be finding a base in still marginally positive territory.