Preview: Due November 7 - Canada November Employment - Trend near flat despite volatility

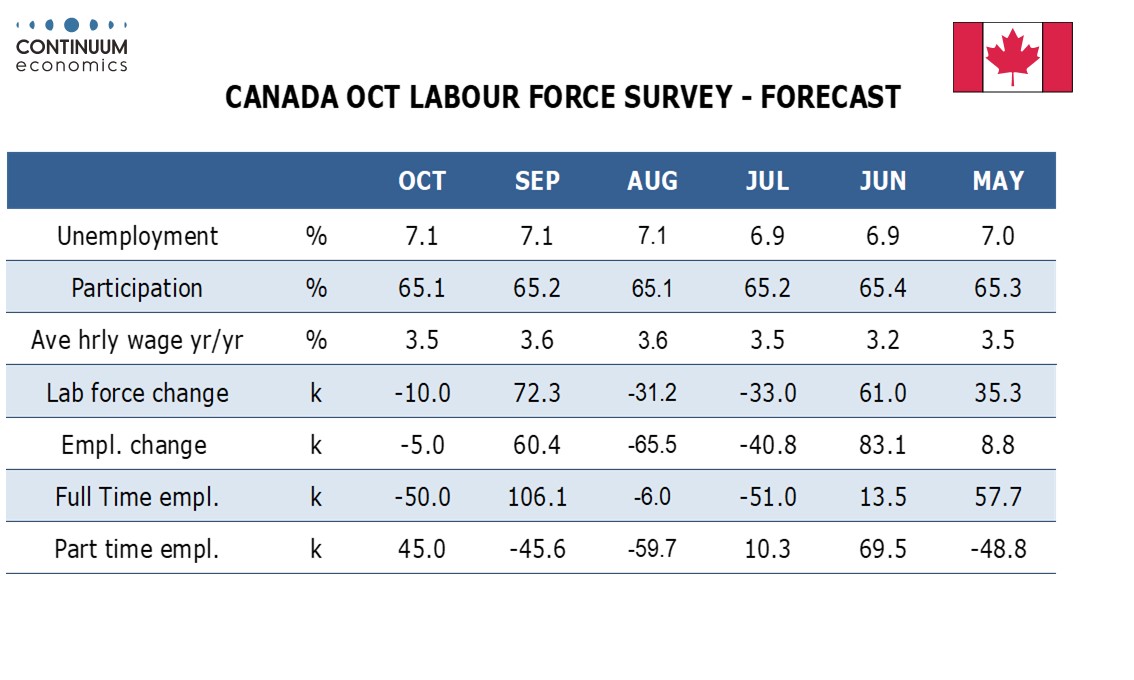

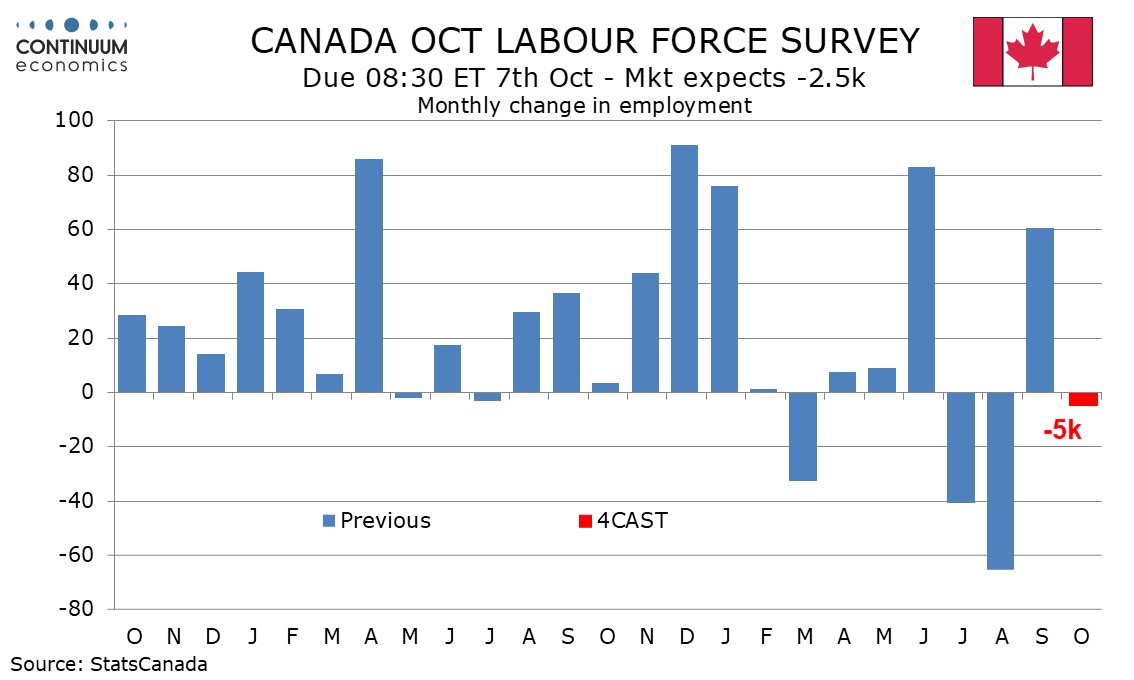

Canadian employment data has been volatile in recent months, but underlying trend looks fairly flat, consistent with weak but marginally positive GDP growth. We expect October to see a decline of 5k after a strong 60.4k increase in September with unemployment unchanged at 7.1%.

September’s strong employment gain failed to fully reverse declines seen in July and August, though with June having been strong the 4-month average is slightly positive. After the strong September however, risk is for a below trend October. We expect October to see a significant correction lower from a strong September in full-time employment, partially offset by part-time employment correcting higher after two straight steep declines. Looking at sectors, tariff-sensitive manufacturing looks likely to correct from a surprising September increase of 27.8k.

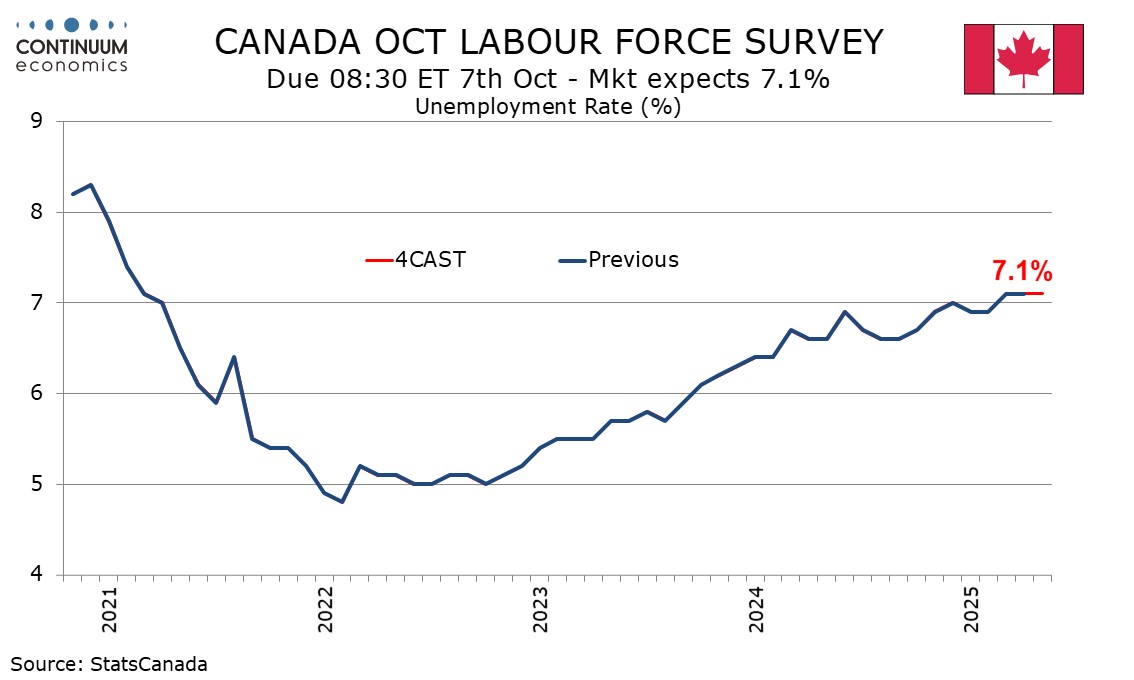

Despite the strong rise in September employment, unemployment was unchanged at 7.1% with the labor force also seeing a strong bounce after two straight declines. We expect the labor force to slip back with employment in October leaving the unemployment rate at 7.1% for a third straight month. Trend in unemployment however still appears to be moving slowly higher. GDP growth appears likely to be only marginally positive in the second half of the year after a dip in Q2, and not sufficient to see unemployment starting to fall.

Wages, as signaled by hourly wages for permanent employees, have been fairly stable at around 3.5% yr/yr since March, but risk is on the downside given the subdued state of the labor market. For October we expect a modest slowing to 3.5% after two months at 3.6%.