JPY, SEK flows: New high in USD/JPY, SEK in focus as Riksbank meets

USD/JPY traded a new 24 year high overnight and has retreated only modestly. SEK in focus as the Riksbank meets, SEK upsde risks seen

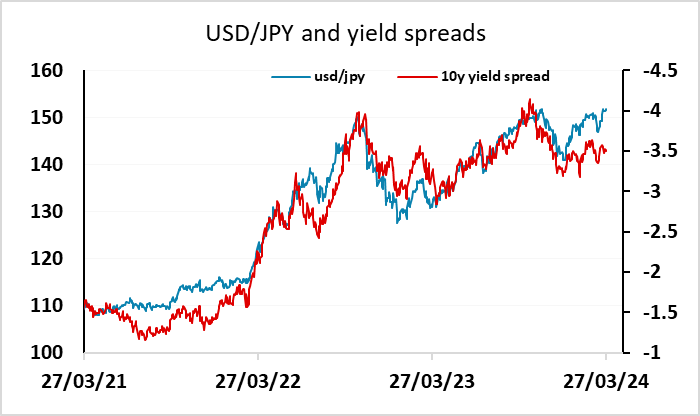

The main news overnight is USD/JPY making a new post-1990 high at 151.97. This was met with more verbal intervention from finance minister Suzuki, and USD/JPY has since retreated, but not by much. The JPY is not much changed on the crosses, with the USD generally slightly firmer, and given the resistance from the Japanese authorities, it is hard to make the case for USD/JPY gains unless there is general USD strength. We continue to see these levels of USD/JPY as unsustainable, as even the nominal correlation with yield spreads doesn’t support this high a level, while in real terms USD/JPY is at its highest in the floating era.

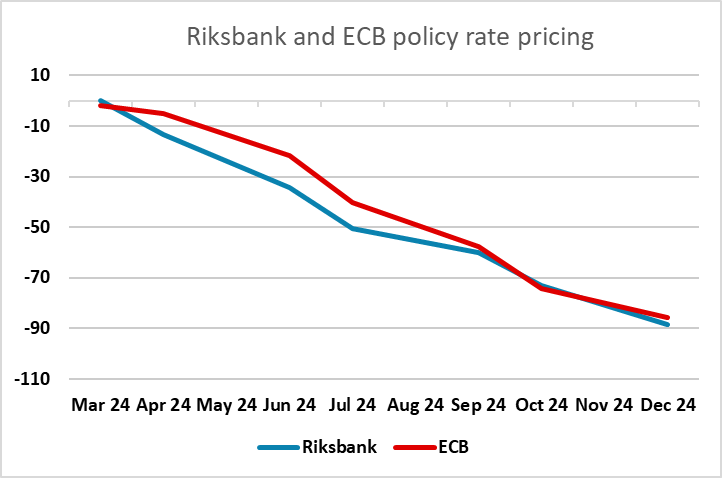

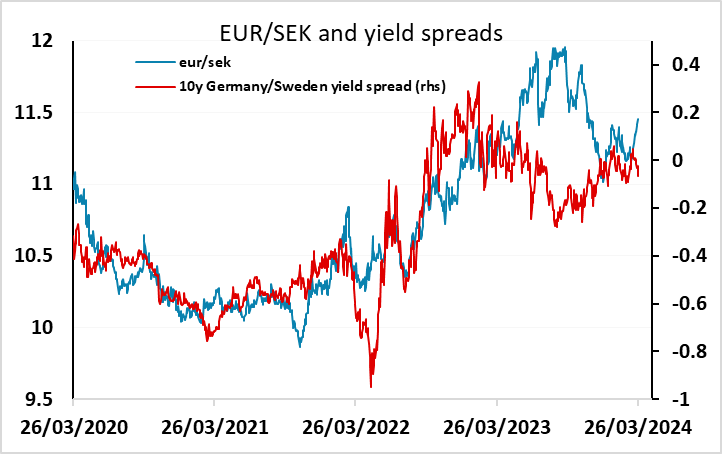

The focus this morning should be on the Riksbank meeting at 08:30 GMT. EUR/SEK has traded higher over the last week, but there seems to be little case for SEK weakness against the EUR based n yield spreads, while yesterday’s Swedish economic tendency survey suggested we are starting to see a recovery in Sweden, which could restore outperformance relative to the Eurozone. The market is pricing somewhat faster rate cuts from the Riksbank than the ECB, but this may prove overoptimistic, and risks look to be to the EUR/SEK downside.