This week's five highlights

Trump now Front-Runner for President

UK Election Shows Labour’s Solid Victory

June FOMC Minutes Saw Cooling Economy but Little Discussion of Easing

U.S. Non-Farm Payrolls may suggest some loss of momentum

EZ HICP Disinflation Resumes Amid Services Resilience

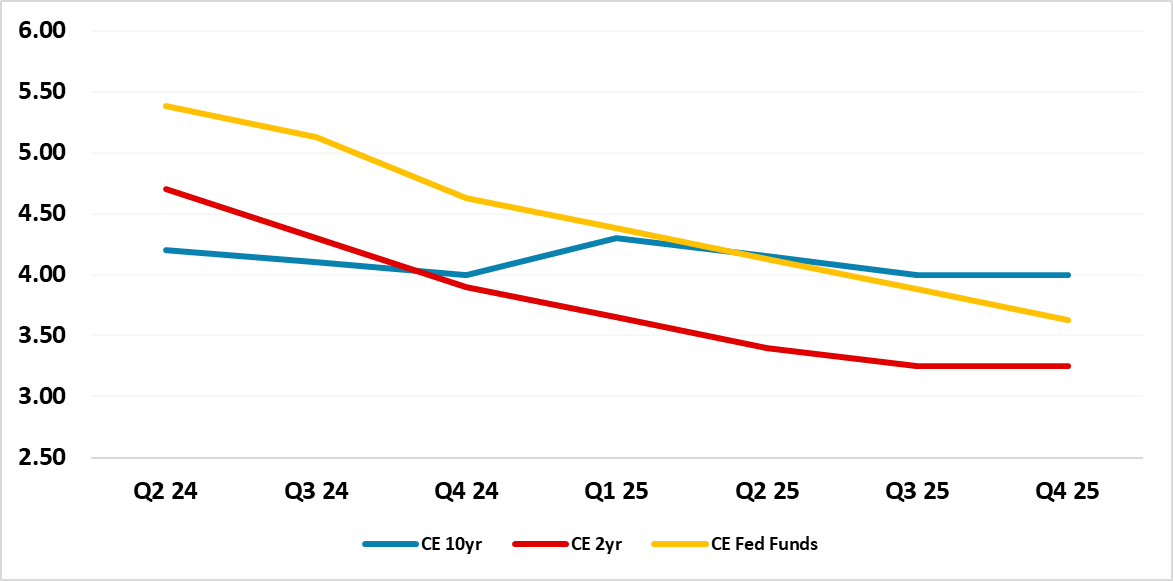

Figure: CE Forecasts for Fed Funds, 2 and 10yr Government Bond Yields

Source Continuum Economics

There is little sign yet that President Joe Biden is willing to step down after his disastrous debate performance though opinion polls will need to be watched for signs that the Democrats could do better with another candidate. The debate has left former President Donald Trump as the more likely, but not certain, winner in November, something that may persist even if Biden does step down.

In terms of markets, we have already included fiscal stress in H1 2025 in our 10yr government bond yield forecast (Figure 1) and yield curve steepening. For U.S. equities, optimism about extending parts of the 2017 tax cuts could be overdone, given the current overvaluation in contrast to 2017.

Opinion polls clearly judge Trump as the winner of the debate and also show an increasing majority expressing concerns about Biden’s age. However there has so far not been much change in voting intentions between Trump and Biden, with most voters having already made up their minds and Trump’s own debate performance, while less damaging than Biden’s, not winning much praise from neutral observers. Still, the polls do show Trump maintaining a narrow lead overall and in most of the key swing states, and it is going to be harder for Biden to close the gap now. In what had been a race too close to call, Trump is now the clear favorite, even if the gap is still narrow.

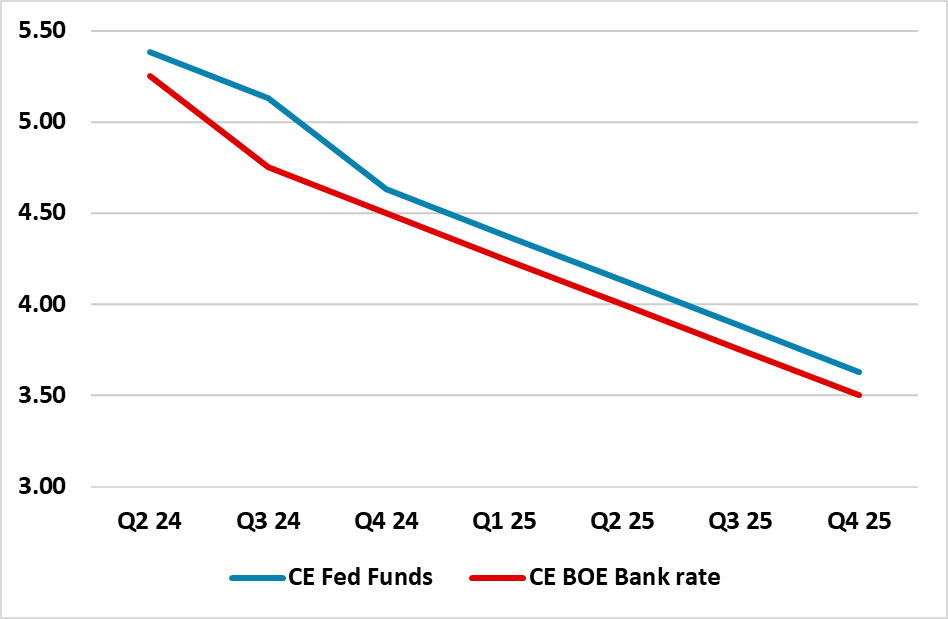

Figure: CE BOE and Fed Policy Rate Forecasts

Source Continuum Economics

Labour have won a large seat majority, though with a modest vote share. This should provide political stability in the UK for the next 5 years. The key question for market remains how the fiscal rule will be meet and how slowly or quickly Labour will take actions to boost long-term growth. The UK election results to 6am GMT are Labour 409 seats, Conservatives 118 and Liberal Democrats 70 seats. This compares to recent opinion polls seat by seat that had Labour between 430 and 516 seats; Conservatives between 53 and 126 and Liberal Democrats between 50 and 72. The prospective result is thus below the lower end of projected seats for Labour, though still leaves they with a large absolute majority. The Conservative prospects are not as bad as the worst case disaster projections, but still awful and point to a coming civil war for the direction of the party and how it can stop the other right wing party Reform before a 2029 election that is projected to take 15% of votes compared to 24% for the Conservatives. Finally, Labour 35-36% projected vote share is low for such a large seat majority, which reflects the swing against the Conservatives.

The focus will now switch to the cabinet appointment for hints on policy. Though Labour have been clear in their manifesto on their priorities, the last Labour government quickly surprised with 1997 BOE independence -- though for now we are not expecting major surprises. Our baseline view is that the next few weeks and months will be focused on rolling out some of the policies and preparing for the budget that is expected in September or October. One issue we will watch closely is whether a Labour government is slow or quick to take actions on measures to boost long-term growth prospects, which is not clear at this juncture and will have an impact for sentiment on the UK equity market. For non UK clients, the biggest issue to highlight is that overall projected government spending has to be allocated by department, but independent think tanks questioning whether this could end up revising overall budget spending up by £30-40bln by 2028-29 as healthcare commitments will likely require 3-4% real expenditure increase on the UK NHS. Does the size of majority mean anything for markets?

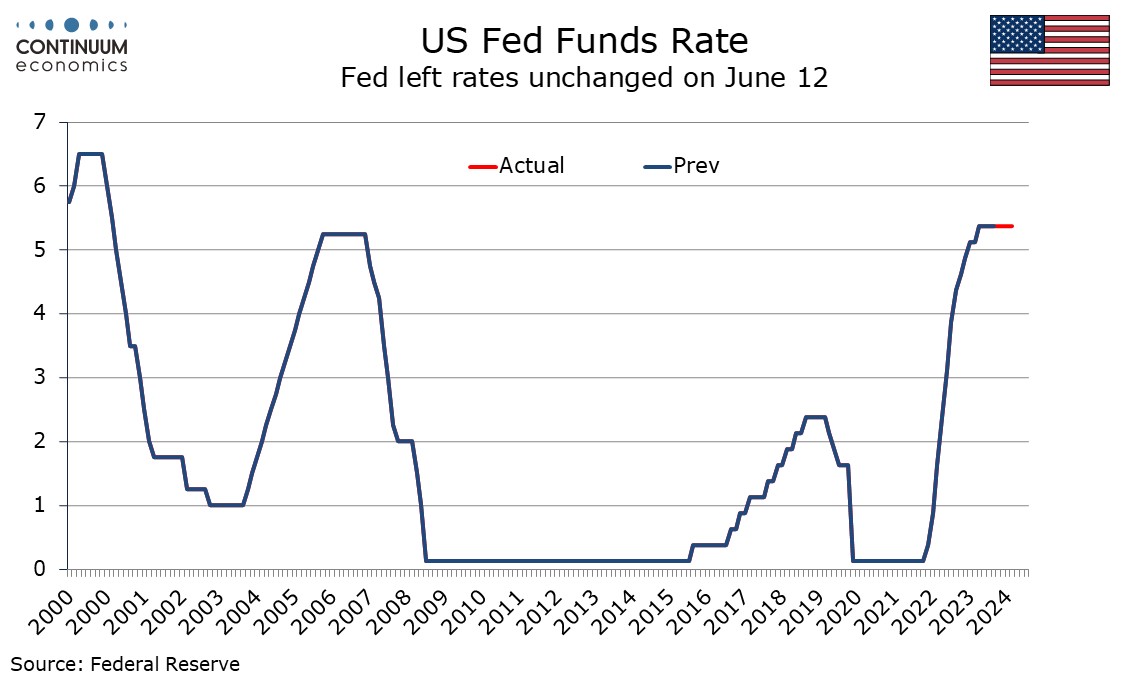

FOMC minutes from June 12 show that the vast majority assessed that growth in economic activity appeared to be gradually cooling and the views expressed on inflation are cautiously optimistic. However there was agreement that easing would not be appropriate until they had gained greater confidence on inflation moving sustainably to 2%. There is in fact little discussion on easing in response to the cautious optimism on inflation, though a number remarked that policy should stand ready to respond to unexpected economic weakness, while several emphasized that with the labor market normalizing a further weakening of demand could generate a larger unemployment response than in the recent past. However some emphasized the need for patience in allowing restrictive policy to restrain aggregate demand and several observed that were inflation to persist at an elevated level or to incase further, rates might need to be raised. This suggests the risk of tightening might be greater than most recent Fed comments have suggested.

However, it is clear that the conditions that might prompt further tightening are not what the FOMC is expecting. Participants judged that while inflation remained elevated that there had been modest progress towards to 2% goal in recent months, with the May CPI that was released on the day of the decision noted. Participants suggested that a number of developments in the labor and product markets supported their judgement that price pressures were diminishing. These include easing of demand-supply pressures, delayed response of shelter prices to rental developments and prospect of additional supply-side improvements.

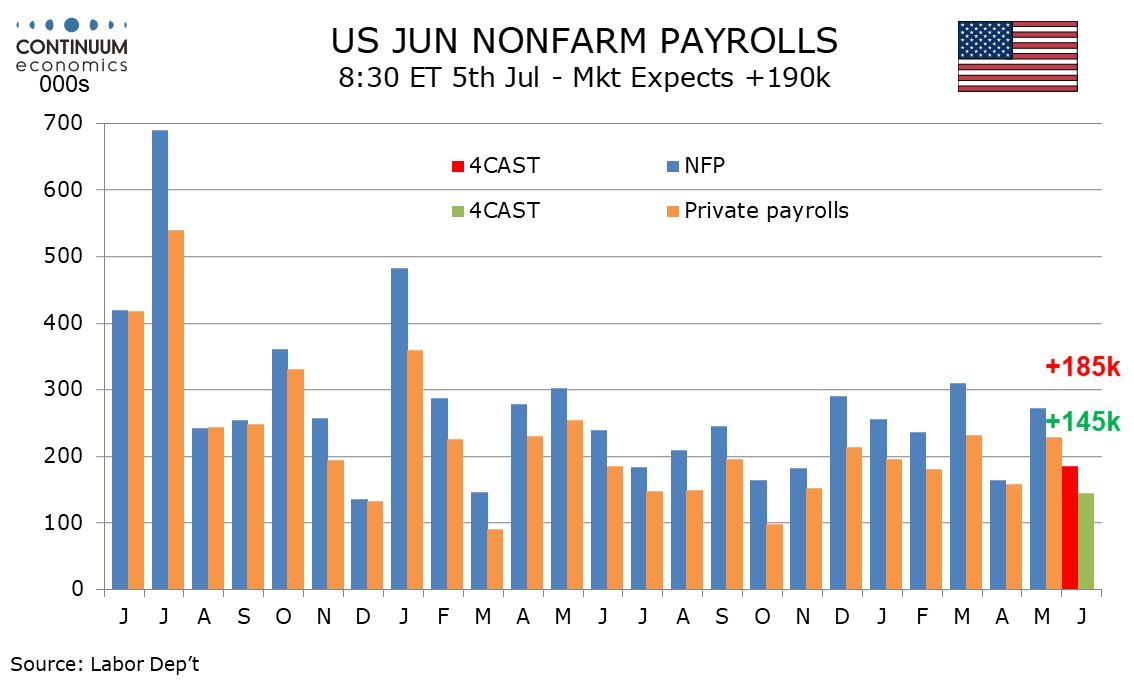

We expect June’s non-farm payroll to hint at some loss of labor market momentum, with a 185k increase overall and 145k in the private sector, the latter the slowest since October 2023. We expect average hourly earnings to follow a strong 0.4% May increase with a rise of 0.3% and less before rounding, though we expect unemployment to reverse a May increase to 4.0% and fall back to 3.9%. The main reason to expect a loss of labor market momentum is a recent pick up in the initial claims trend, with continued claims edging higher too. Our forecasts would see the 6-month averages slowing for the first time since November 2023, overall to 237k from 255k in May with the private sector at 190k from 202k.

We expect a modest slowing across the board though business and professional merits particular attention after rising by a 12-month high of 47k in May, the main reason May data was on the firm side of trend at 272k overall and 249k in the private sector. Government is likely to continue contributing positively in June, led by state and local. Negative seasonal adjustments provide some downside risk overall. May’s strong non-farm payroll was not matched by the household survey which calculates the unemployment rate, which rose on a 408k decline in employment despite a 250k dip in the labor force. We expect both those series to bounce back in June, sending unemployment back down to April’s rate of 3.9% after a rise to 4.0% in May.

Figure: Headline Falls Afresh?

Source: Eurostat, % chg y/y unless suggested otherwise

The clear disinflation trend was still evident even after higher and higher-than-expected May numbers, where the headline moved up from 2.4% to a three-month high of 2.6%. That trend looks more discernible after the partial drop back to 2.5% seen in the June flash HICP, albeit with some far from reassuring signs of resilience in a stable core of 2.9%, partly driven by stable services inflation at 4.1% (Figure). The data are a little higher than we anticipated, but partly reflect unfavourable base effects. Indeed, it is perhaps more notable is that these data are consistent with a fresh slowing in shorter-term price dynamics as monthly seasonally adjusted numbers may be softer on both a core and services basis.

Very clearly these HICP data will not have much impact on ECB thinking, at least in easing lingering price persistent worries. But much of this is also related to part of the discussion at the current ECB Forum on Central Banking in Sintra, Portugal where we side with an ECB view that suggests recent inflation pressures have been driven much more by supply than demand.

Regardless, anticipating these HICP numbers, Chief Economist Lane suggested that the data implied the ECB still had questions on services inflation, this in turn adding to hints that he was not going to push for a further rate cut at the looming July 18 Council meeting - if he ever was! He did note that the economy would instead dominate discussion at that meeting. In this regard, weaker money and credit data and more mixed to soft business survey data will make for an interesting n discussion.