This week's five highlights

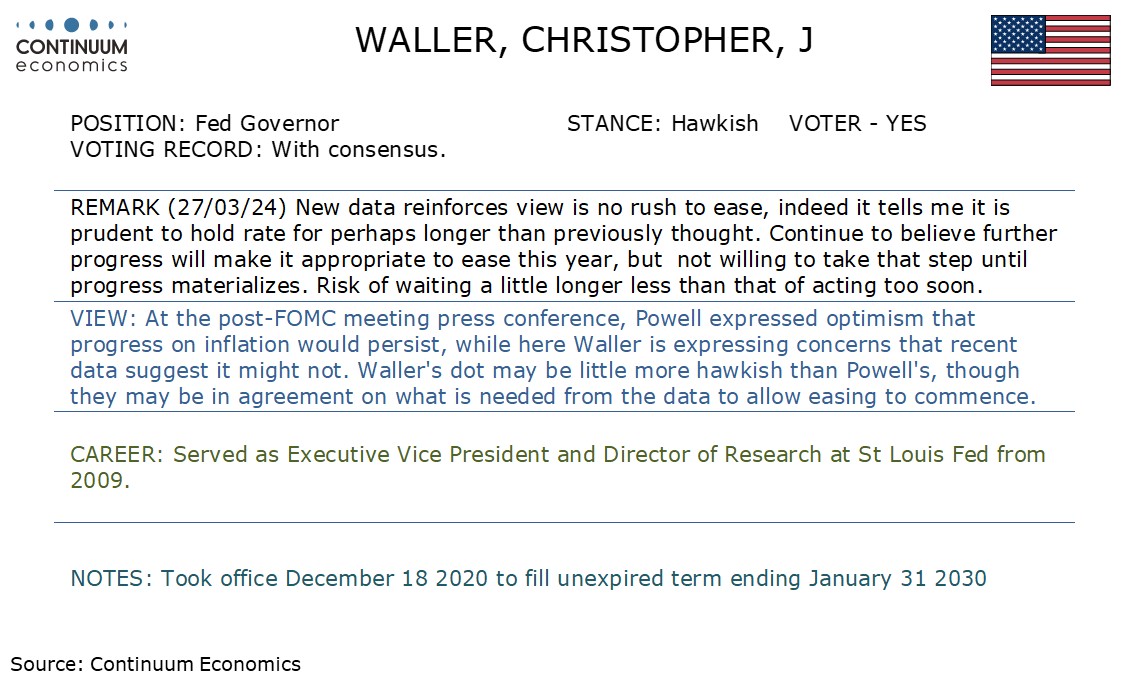

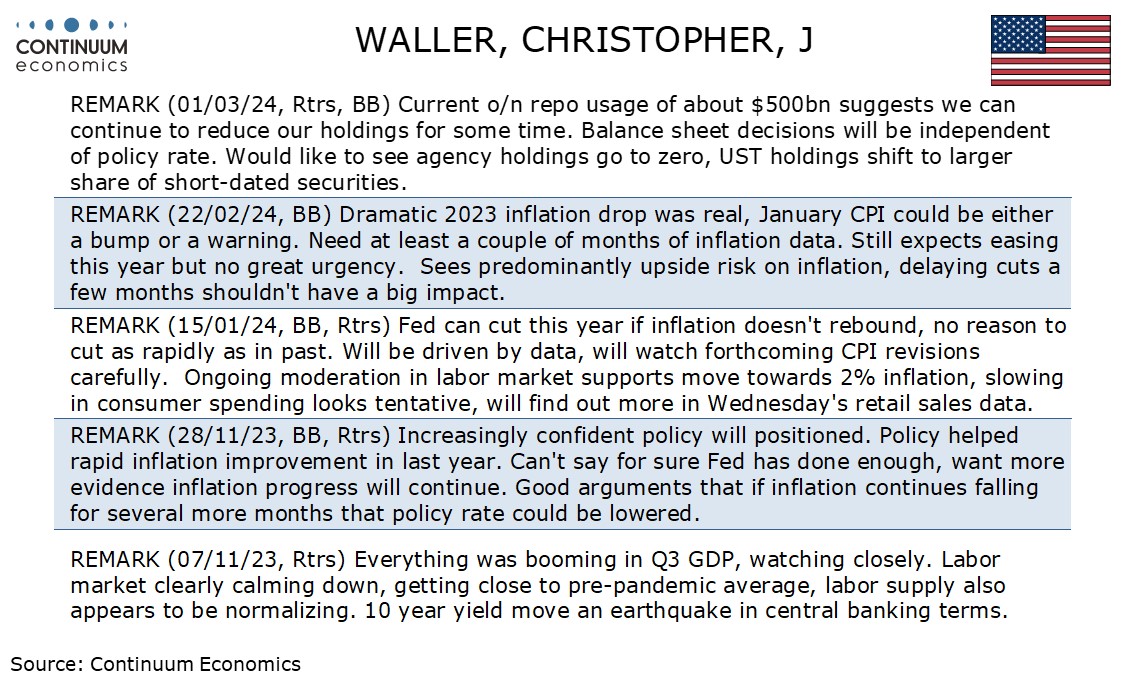

U.S. Fed's Waller Signals Caution towards Easing

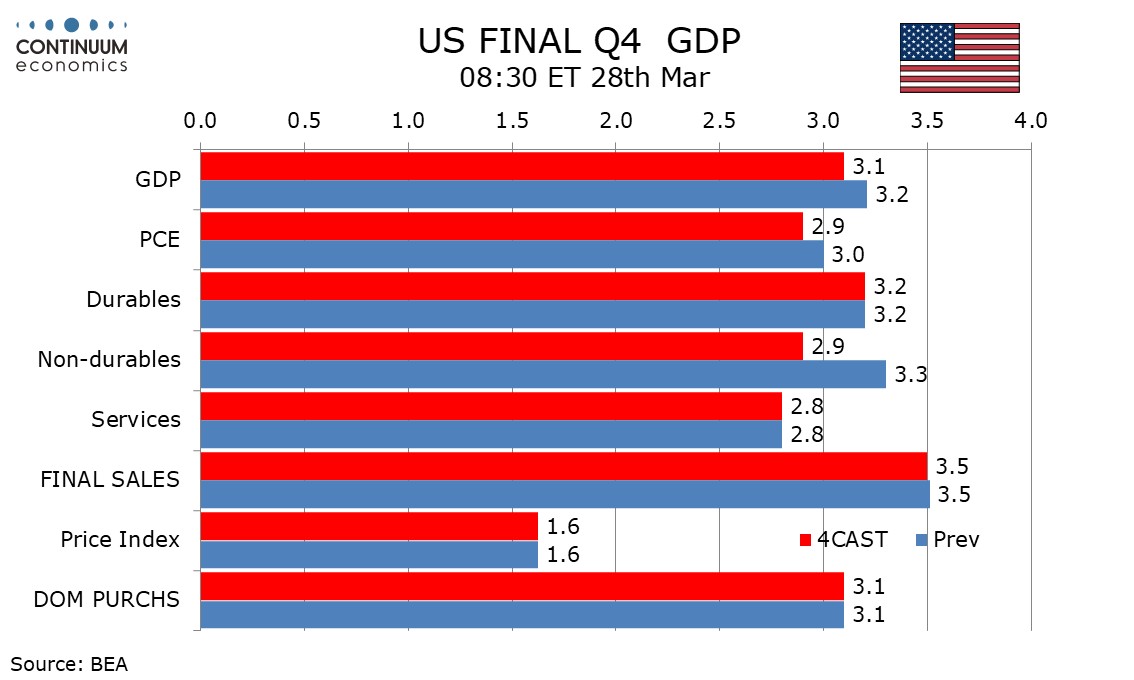

U.S. Final Q4 GDP To be Revised Marginally Lower

BoJ Summary of Opinion Little Surprise

USD/JPY Continues to March North

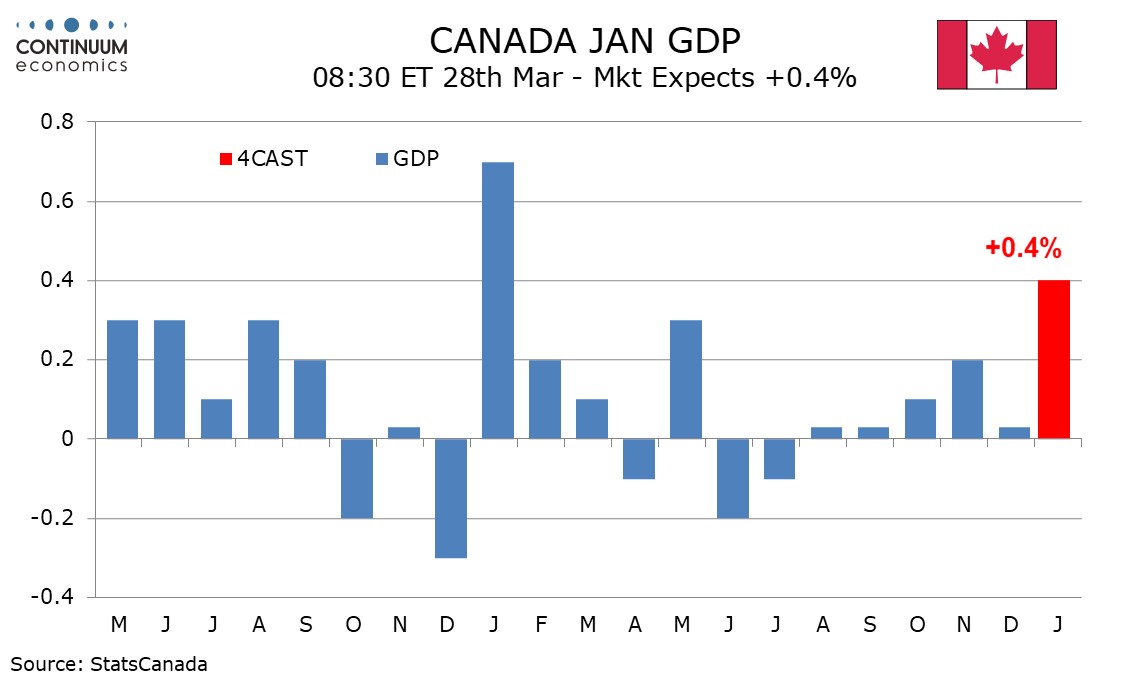

Canada January GDP to Bounce

We expect the third (final) estimate for Q4 GDP to be revised marginally lower to a still strong 3.1% from second (preliminary) estimate of 3.2%. We expect downward revisions to retail sales, housing construction, inventories and net exports, the latter largely on a downward revision to the services surplus. Upward revisions are likely to business investment, on private non-residential construction, and government, also on construction. We expect final sales (GDP less inventories) to be unrevised at 3.5%, and final sales to domestic buyers (GDP less inventories and net exports) to be unrevised at 3.1%. We do not expect any revisions to the price indices, from 1.6% for GDP, 1.8% for overall PCE and 2.1% for core PCE.

BoJ's Summary of Opinions for the March meeting has given us no surprise. The board is divided on the outlook of Japanese economy but mostly see "virtuous cycle between wages and prices has become more solid" and inflation target being met. Most BoJ members agree that the pace of future hikes would preferably be slow and some suggest that it is better for the BoJ to remain accommodative. There are nothing from the summary of opinion that was not expected by the market. The key takeaway would be the future pace of tightening, if any, would be slow.

USD/JPY has been hovering at recent high despite BoJ exiting negative interest rate and multiple verbal intervention. The clear gesture of slow tightening from the BoJ is well read by market participants and fueled the weakness of JPY after more "sell the fact" trades. U.S. Treasury Yields has been relatively steady while JGB yields treads lower after the BoJ decision. However, this short term volatility does not changes the medium term picture. With BoJ exiting negative rates and further tightens, albeit slowly, yields differentials are going to narrow and see the cost of carry/funding trades to rise. It should see a strong pullback of JPY if the sentiment soars in the risk asset space.

On the chart, there is no follow-through on break to fresh multi-year high with gains limited to 151.97 ahead of pullback to the 151.00/150.88 support. Overbought intraday and daily studies expected to limit the upside and deeper pullback below the latter cannot be ruled out. Lower will see room to the 150.00 level. Meanwhile, consolidation continue to trace out a small ascending triangle and suggest scope for break to extend gains from the 146.48, March low. Clear break above 151.97 high and the 152.00 level will further extend the underlying bull trend and see scope for extension to the 153.00/35 congestion from June 1990.

We expect Canadian GDP to increase by 0.4% in January, matching an estimate made with December’s report. This would be the strongest rise since January 2023, but the strong year ago data would still see yr/yr growth slipping, to 0.8% from 1.1%. We expect gains of 0.4% in both goods and services output. For services the gain would come largely from rebounds from recent weakness in educational services, and to a lesser extent health care and social assistance, caused by strikes in Quebec which concluded in December.

For goods we expect gains in manufacturing as suggested by monthly data and utilities due to colder weather to outweigh declines seen in mining and construction.