NOK, SEK, EUR flows: NOK marginally higher after CPI, tariff news awaited

NOK still has scope for gains after modest post CPI rise. Tariff news awaited

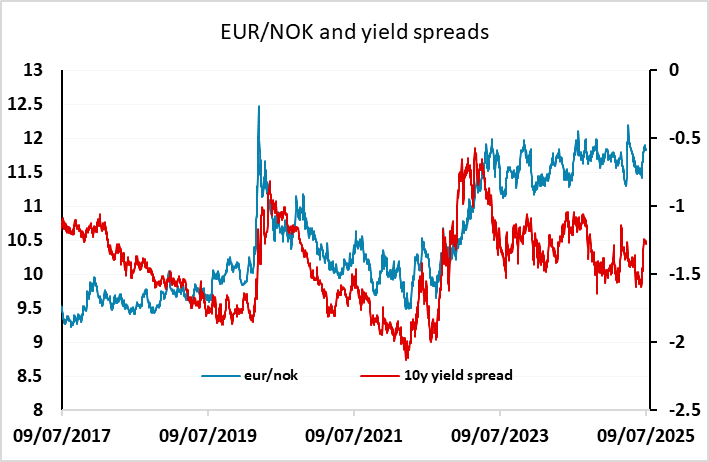

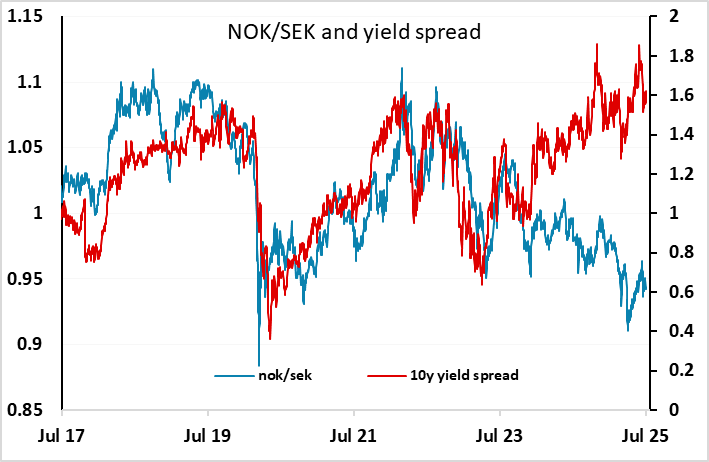

There has been only modest FX impact from the Scandinavian data released this morning. EUR/NOK is slightly softer, down 0.1-0.2%, following CPI data which showed sore 0.1% above consensus although headline was 0.1% below. EUR/NOK continues to trade close to the all time highs, threatening the 12 area without a strong rationale for NOK weakness, but persistent flows from NOK into foreign currency from the government pension fund may be the underlying reason. EUR/SEK is little changed after the Swedish data, which showed a 0.2% drop in GDP in May and declining household confidence, but solid industrial production data. We still like NOK/SEK higher longer term, but today’s numbers only provide marginal support for that view.

Elsewhere, the USD is slightly softer overnight, but the market will be on watch for more tariff announcements, particularly relating to Europe, which Trump suggested would come this week. We see European currencies as potentially vulnerable, particularly if Trump follows through on threats of pharma tariffs.