Published: 2024-08-02T15:38:35.000Z

Preview: Due August 15 - U.S. July Industrial Production - A weak month after two stronger ones

5

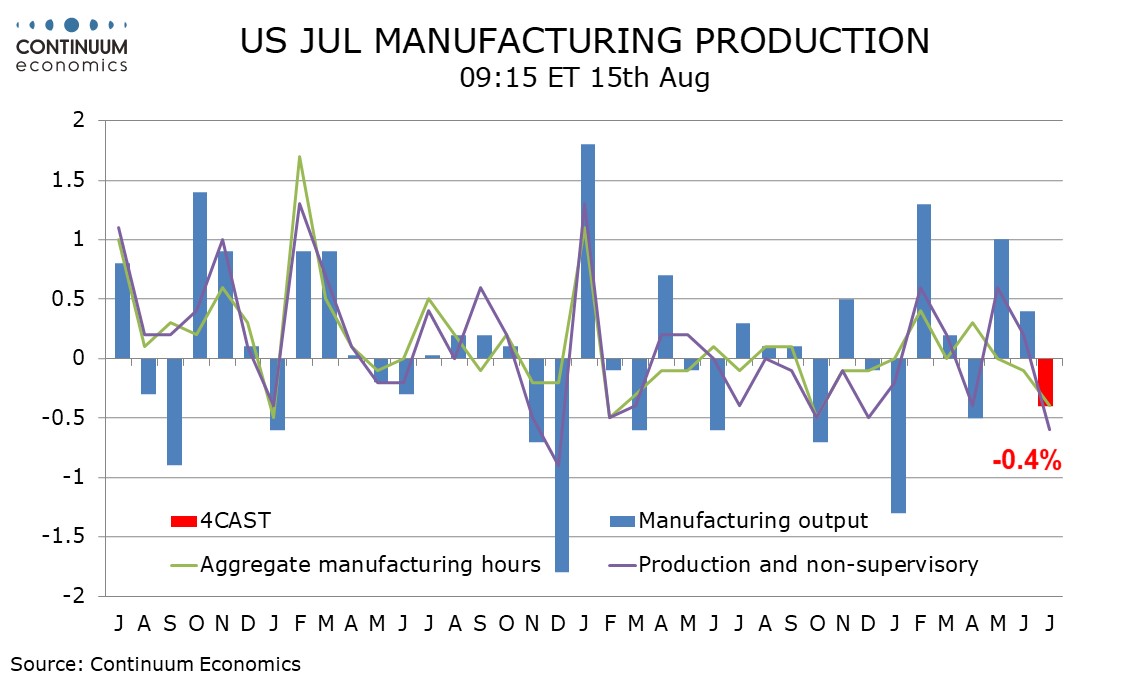

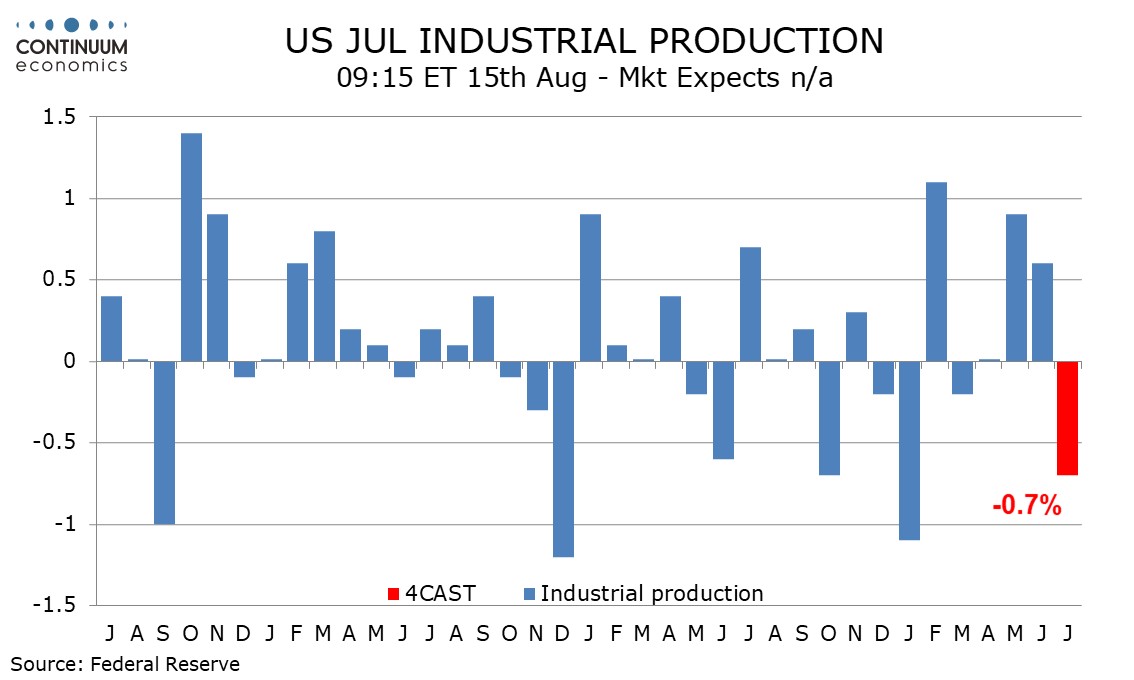

After two strong months, we expect a weak industrial production report for July, with a 0.7% decline overall and a 0.4% decline in manufacturing.

ISM manufacturing data was weaker in July and the non-farm payroll showed a decline in aggregate manufacturing hours worked. This suggests a weak month for manufacturing, though autos may benefit from positive seasonal adjustments. We expect manufacturing output to decline by 0.4%, with a 0.5% decline ex autos.

Weekly electrical output data suggests a correction from there straight gains in utilities, while non-farm payroll details suggest a decline in mining. Hurricane Beryl is a downside risk for oil production in the Gulf of Mexico.