Preview: Due July 15 - Canada June CPI - Subdued on the month but little progress yr/yr

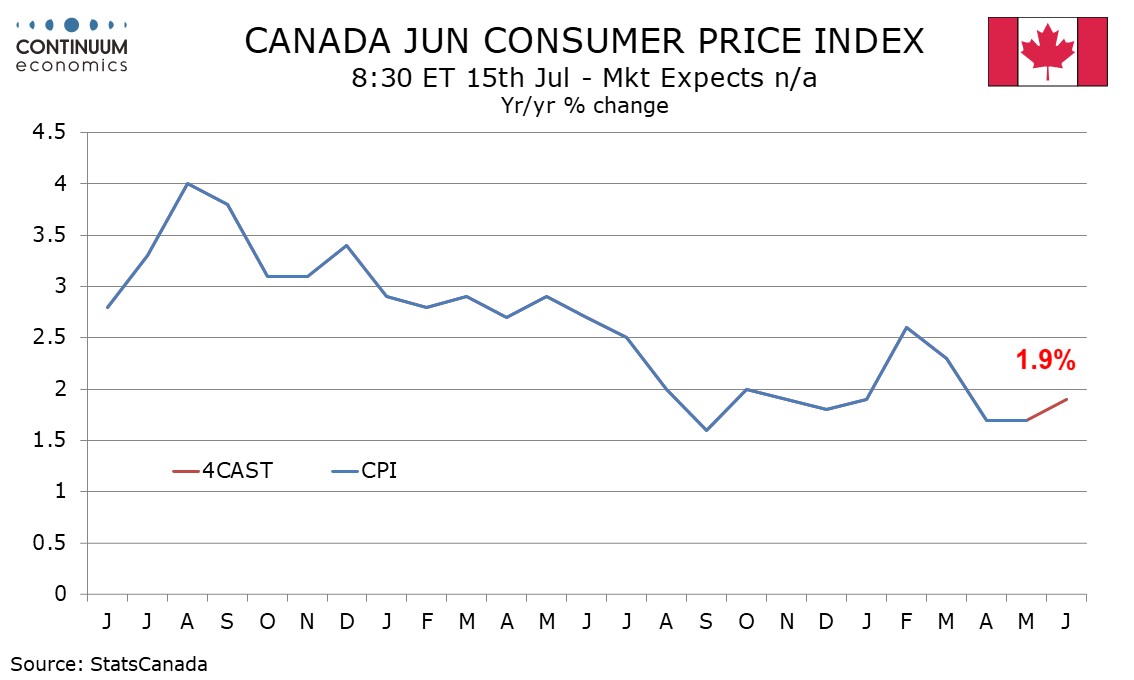

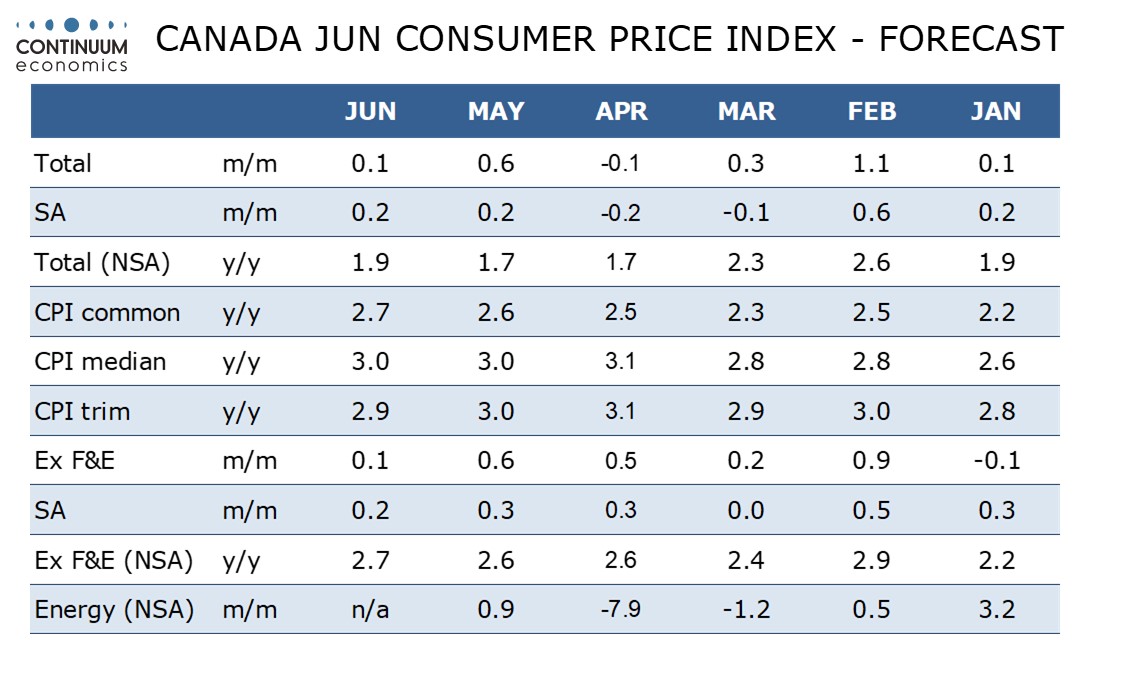

We expect June Canadian CPI to rise to 1.9% yr/yr after two straight months at 1.7%, the fall to 1.7% from 2.3% in March having been fully due to the abolition of the consumer carbon tax. We expect the Bank of Canada’s core rates to be on balance stable in June, and still above the 2.0% target.

On the month we expect subdued data for June, with gains of 0.1% overall and ex food and energy unadjusted, with the seasonally adjusted gains both slightly stronger at 0.2%, The seasonally adjusted ex food and energy rate would however be slowing from two straight gains of 0.3%. Recovery in the value of the CAD since April and a slowing economy will provide restraint.

Data will pick up on a yr/yr basis due to weak data in June 2024 dropping out. We expect the ex food and energy rate, not impacted by the abolition of the carbon tax, to rise to 2.7% from 2.6%. However, the ex food and energy rate is not one of the BoC’s three core rates.

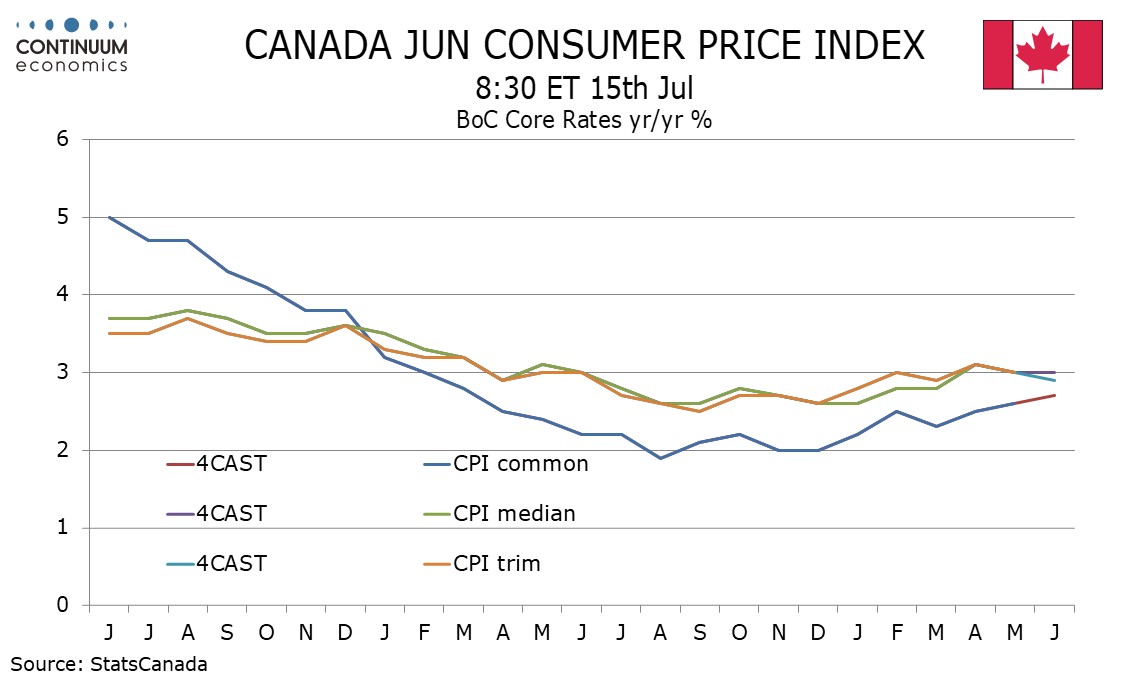

Here we expect CPI-Common to edge up to 2.7% from 2.6%, CPI-Median to be unchanged at 3.0%, and CPI-Trim to slip to 2.9% from 3.0%, leaving the average of the three unchanged. The differing directions of the core rates in June reflect their differing directions in June of 2024.