USD, JPY, EUR flows: USD softer as US government shuts down

USD softer and JPY stronger as US government shuts

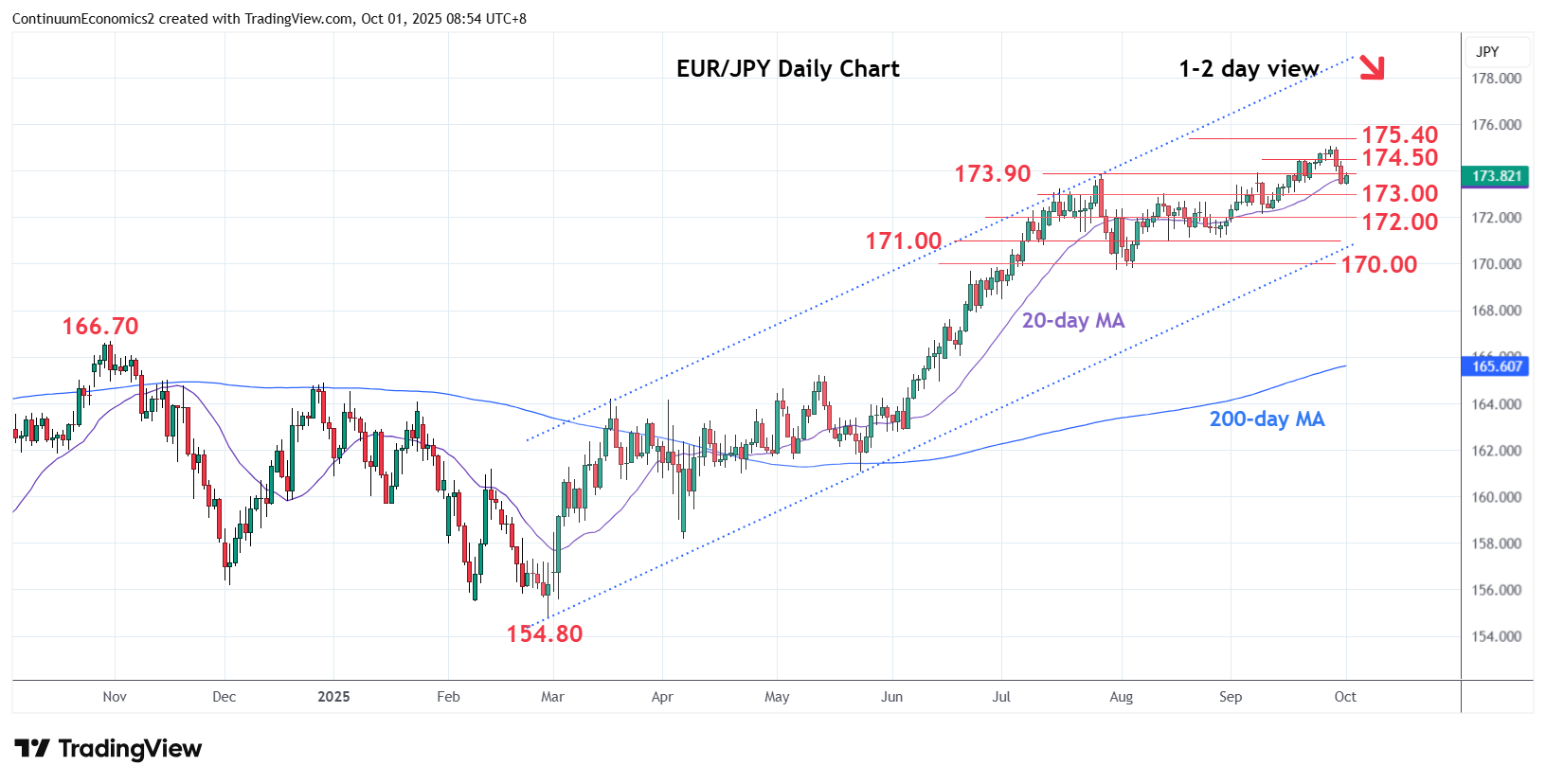

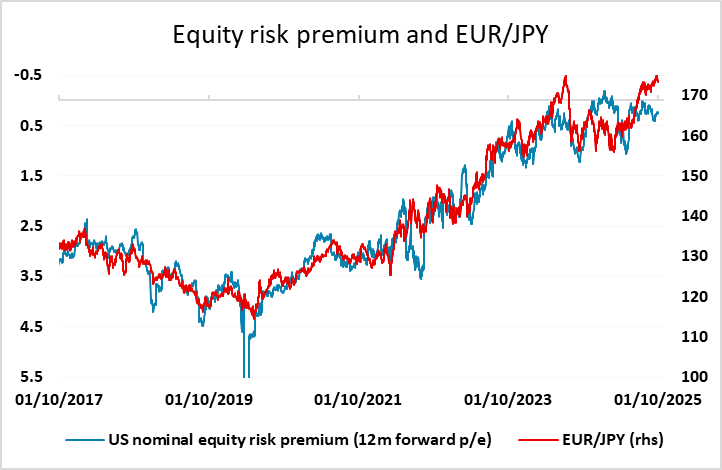

USD/JPY has fallen back in late Asian trading as the US government shutdown has come into operation after Congress failed to pass a funding bill by the end of Tuesday. Whether there is further USD downside will depend on how long and how significant the shutdown is. The previous shutdown of 34 days from December 22 2018 to January 25 2019 had little net impact on markets. However, equities did weaken ahead of the shutdown, before rebounding, while USDJPY fell sharply at year end 2018 before recovering into 2019. However, this time could be different, as Trump has threatened to permanently lay-off workers, and we are starting from a very extended level for both equity markets and the JPY. But so far the impact has been modest, with equities just slipping slightly from the highs, and USD/JPY correcting a little lower after recent gains. EUR/JPY would also be vulnerable to any dip in risk sentiment, having tested all time highs last week, and having exceeded the usual correlation with equity risk premia. But while EUR/JPY has corrected a little lower, it hasn’t made a clear break of the uptrend seen since early August, and implied equity risk premia are so far not much changed, so at the moment this looks like a correction rather than a turn in the trend. However, there is scope for a larger correction below 170 just to reconnect with the current level of risk premia.