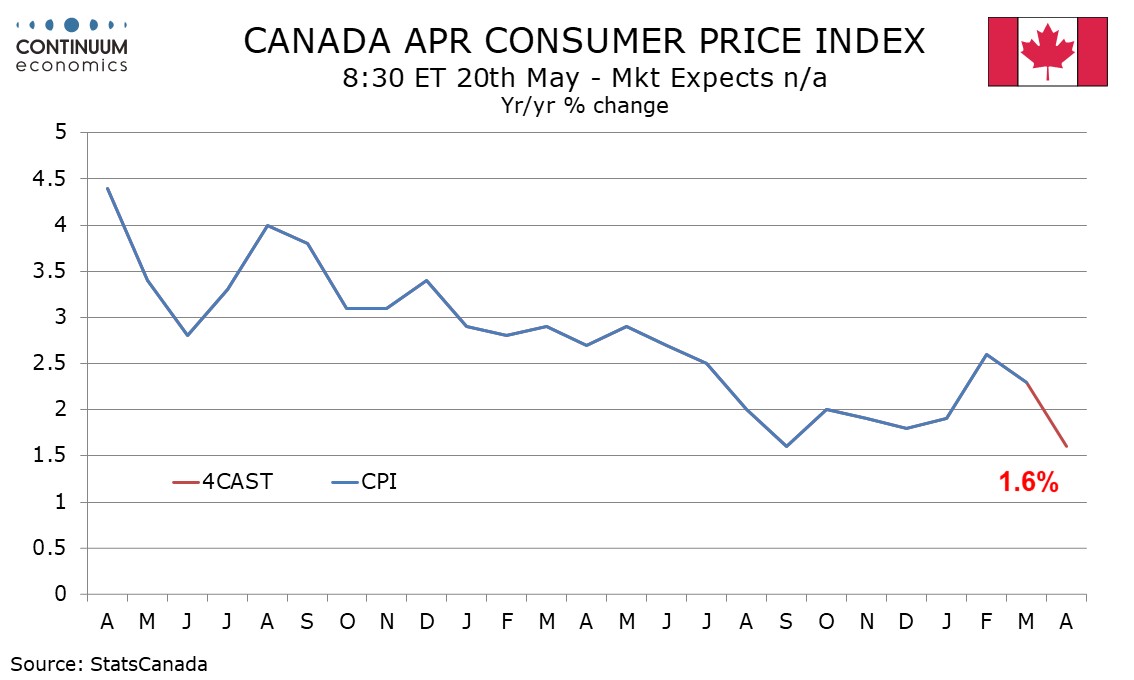

Preview: Due May 20 - Canada April CPI - To fall, but only on removal of carbon tax

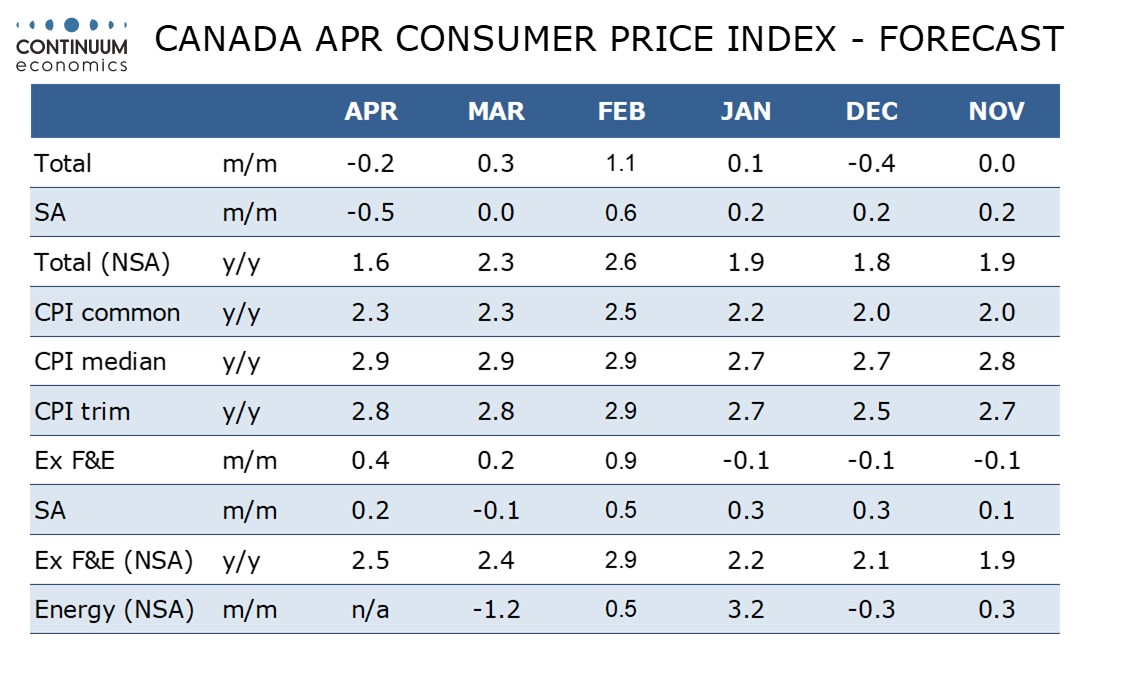

We expect April Canadian CPI to fall to 1.6% yr/yr from 2.3% with the fall entirely due to the April 1 removal of a carbon tax which the Bank of Canada estimates will reduce inflation by 0.7%, largely in gasoline. We expect the Bank of Canada’s core rates to be unchanged from March.

On the month we expect CPI to fall by 0.5% seasonally adjusted and by 0.2% unadjusted. Ex food and energy we expect a 0.2% increase seasonally adjusted and a 0.4% increase unadjusted.

The 0.2% seasonally adjusted ex food and energy gain would follow a 0.1% decline in March and represent a return to trend. Canadian retaliation against US tariffs is likely to have only a marginal impact on prices. We expect the yr/yr ex food and energy pace to edge up to 2.5% from 2.4%.

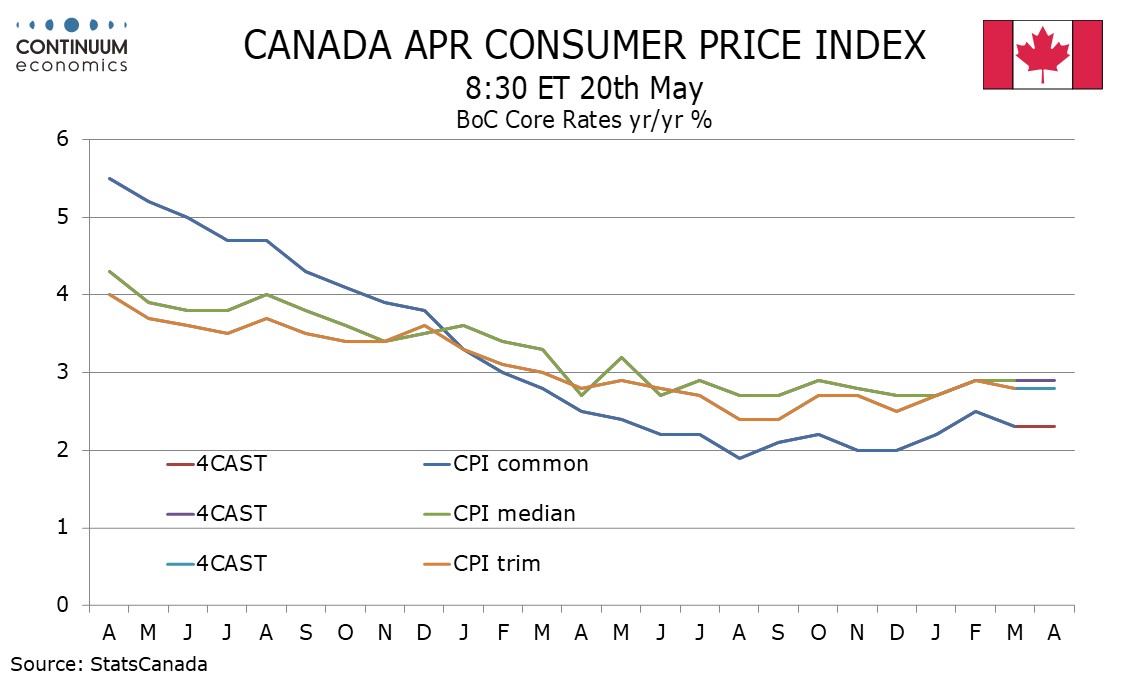

The ex-food and energy rate is not one of the BoC’s core rates. We expect these to be unchanged in April, CPI-Common at 2.3%, CPI-Median at 2.9% and CPI-Trim at 2.8%, all measured on a yr/yr basis and remaining above the BoC’s 2.0% target.