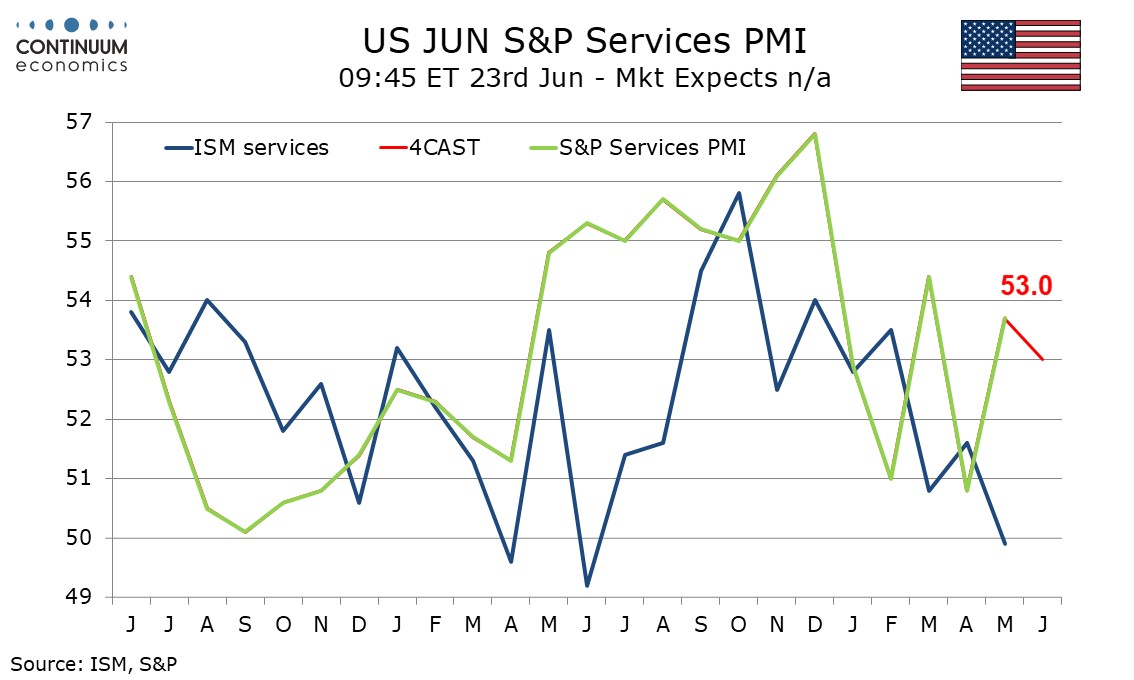

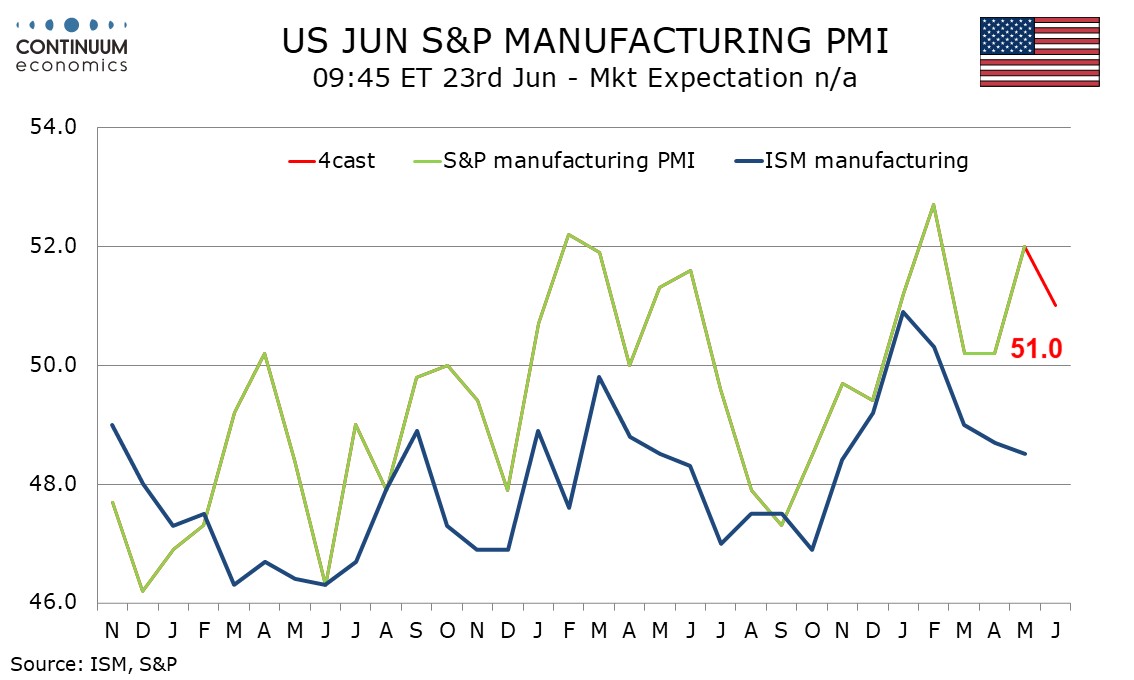

Preview: Due June 23 - U.S. June S&P PMIs - Corrections lower after May gains, but remaining positive

We expect June’s S and P PMIs to show modest corrections lower to correct May improvements, which contrasted weaker data from the ISM surveys in May. However the corrections, manufacturing to 51.0 from 52.0, and services to 53.0 from 53.7, should be moderate enough to suggest scope for gains in June’s ISM indices.

Tariff fears eased after the sharp reduction in tariffs on China which may have lifted the May S and P data, though that makes the weakness in the ISM surveys, which came later, somewhat surprising. Still, the May ISM manufacturing survey had some improvement in the details, outside a sharp slide in inventories, and some regional manufacturing surveys were less weak. We expect June’s S and P manufacturing index, while slipping to 51.0 from 52.0, to remain above neutral, and also the near neutral 50.2 outcomes seen in March and April.

The ISM services index turned negative in May contrasting stronger services data from S and P. There was also a contrast between Michigan CSI data, which remained weak in May (though less so in its final reading) and the Conference Board’s consumer confidence survey, which saw a significant bounce in May. The Michigan CSI did show a significant bounce in June, and that suggests an ISM services index back above neutral. However the S and P index may fail to fully sustain its May bounce, falling to a still positive 53.0 from 53.7. Higher energy prices due to the Israel-Iran conflict may have a negative impact.