USD, CHF, EUR, JPY flows: USD weakness extends on Trump Fed talk

USD remains weak as WSJ reports Trump considering an early announcement of Powell's replacement as Fed Chair.

A WSJ report that Trump is considering naming Powell’s replacement as Fed Chair as early as September or October has undermined the USD overnight. Trump has often expressed frustration at the Fed’s slow pace of rate cuts, but has also said he won’t remove Powell as Chair before his term ends in May 2026. An early announcement of his successor could undermine Powell’s position to some extent, but it’s far from clear that Trump could achieve the early rate cuts he wants by this method. Powell continued to sound cautious about rate cuts in his testimony this week, but the market has increased its expectations of easing and has now fully priced in a 25bp rate cut in September, while a July cut is priced as a 25% chance. In practice, clearly very weak data will be required in the next month to trigger a July cut, while whether the Fed can cut in September will depend on the impact of tariffs on growth and inflation in the next few months. It’s hard to see more than 25bps by September, so the risks from here may be towards higher front end US yields.

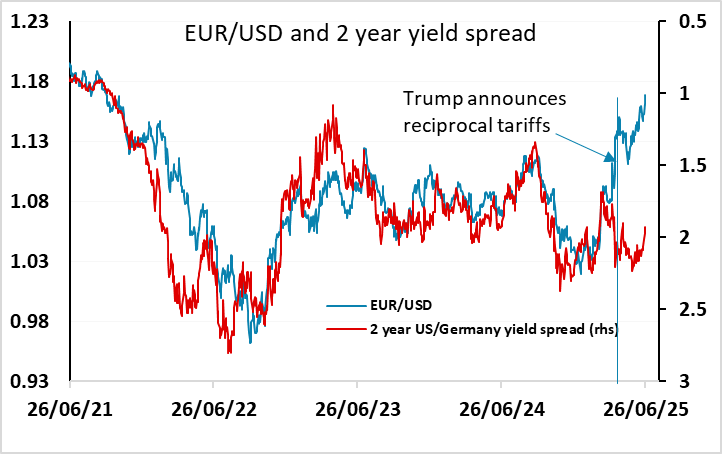

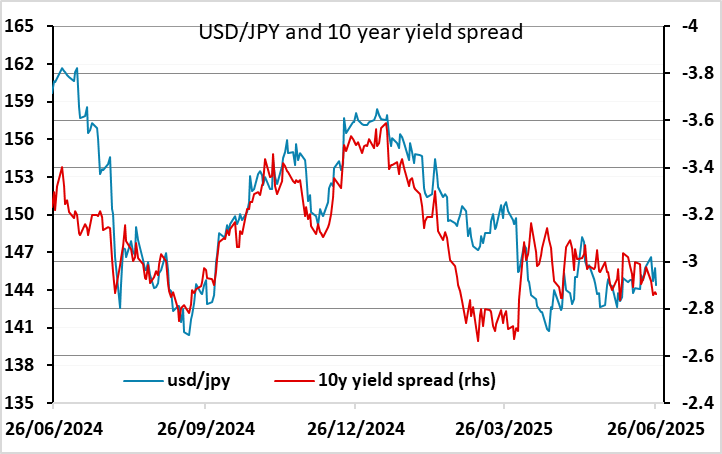

The USD is weaker across the board on the story, with US yields lower. EUR/USD has made a new 4 year high and USD/CHF a new 10 year low, while USD/JPY has dropped a big figure since European close yesterday. There isn’t much on today’s calendar to move the market, with the US jobless claims data later possibly offering the most interest. USD/JPY should still have downside risk with yield spreads pointing lower, but upside for EUR/USD could prove more difficult as the EUR has already progressed well beyond the level suggested by spreads and its high level to some extent depends on a belief that tariffs will damage the US economy. Another high initial claims number this afternoon may be necessary to maintain EUR/USD strength.