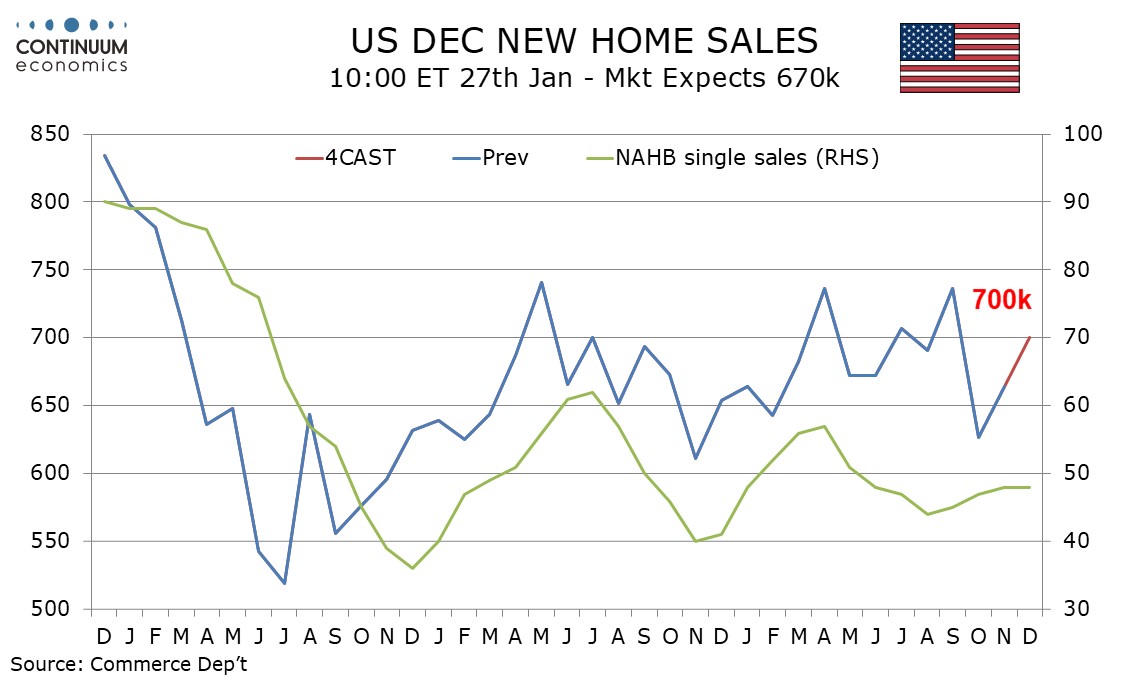

Preview: Due January 27 - U.S. December New Home Sales - Post-hurricane rebound not yet done

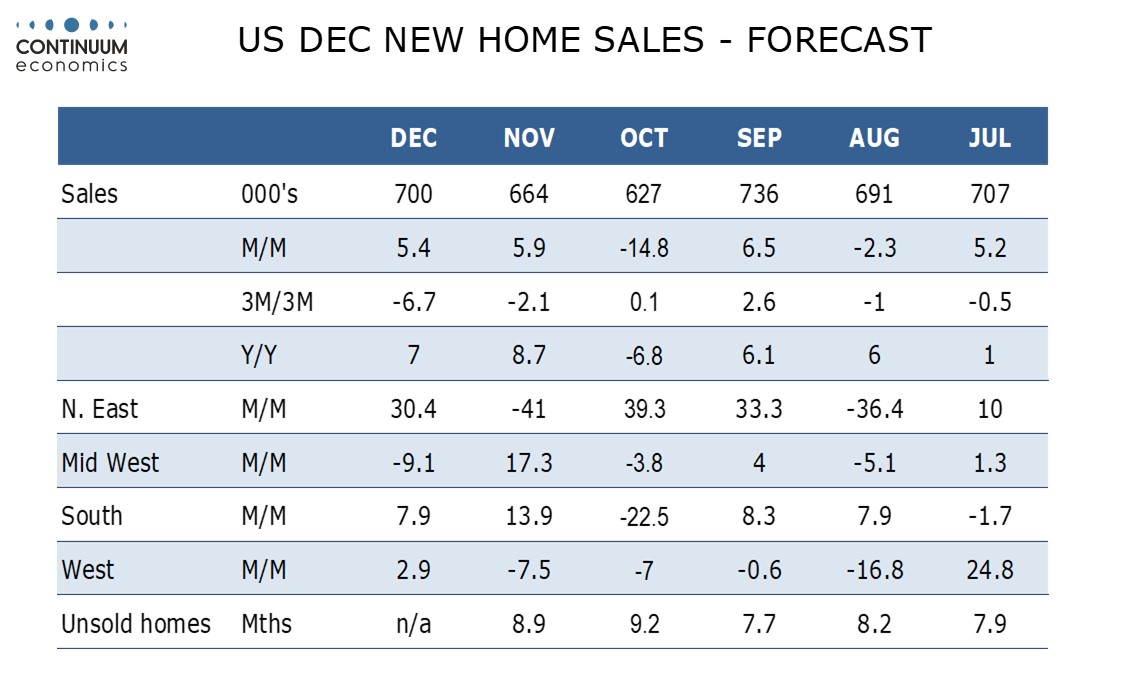

We expect a December new home sales level of 700k, which would be a 5.4% increase if November’s 5.9% increase is unrevised. The two straight gains will still not fully reverse October’s 14.8% decline, a fall that was led by the hurricane-impacted South.

December’s gain is likely to see a continued recovery in the South after a steep October drop. Elsewhere the Northeast and West should pick up after slippage in November but the Midwest may struggle to fully sustain a November increase.

October’s sharp slide in new home sales was inconsistent with most surveys of housing demand, suggesting that November’s partial correction higher will be extended further, with risks for November’s revision also on the upside. Higher UST yields and fading hopes for Fed easing could however bring slippage in early 2025.

We expect monthly rebounds in prices of 4.0% in the median and 5.0% in the average after respective November declines of 5.4% and 7.7%. This would see yr/yr growth picking up to a still subdued 0.1% for the median from -6.3%, and to 3.2% from -0.9% for the average.