Published: 2026-01-09T17:36:44.000Z

Preview: Due January 23 - U.S. Q3 Current Account - Correction from record pre-tariff deficit extending further

7

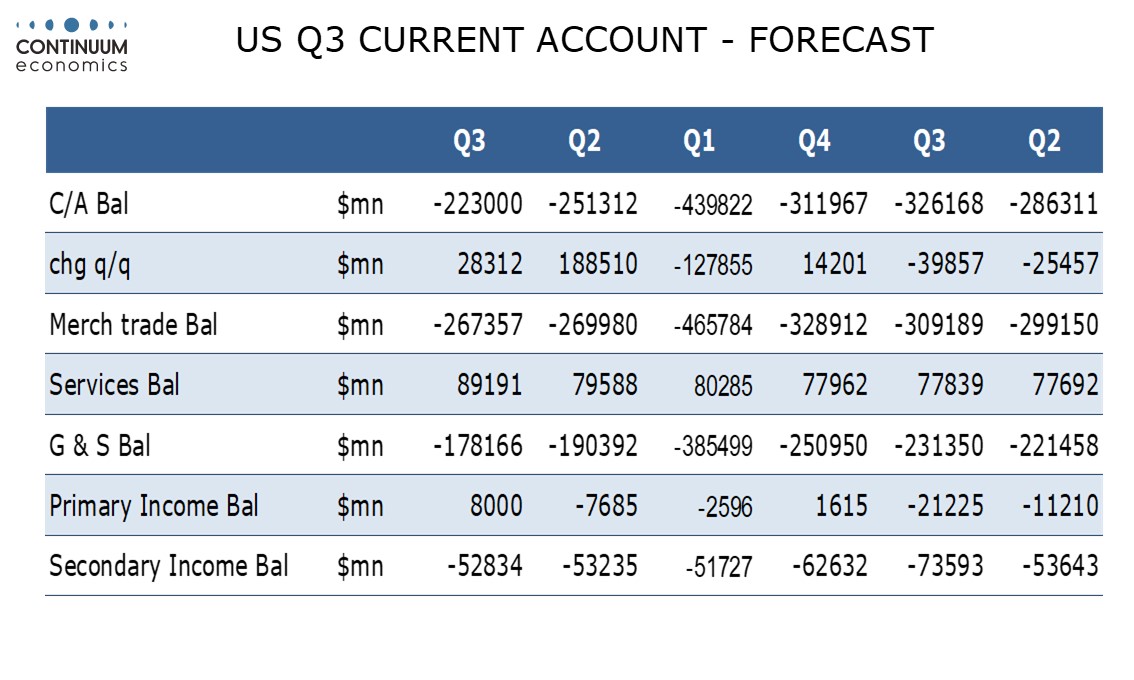

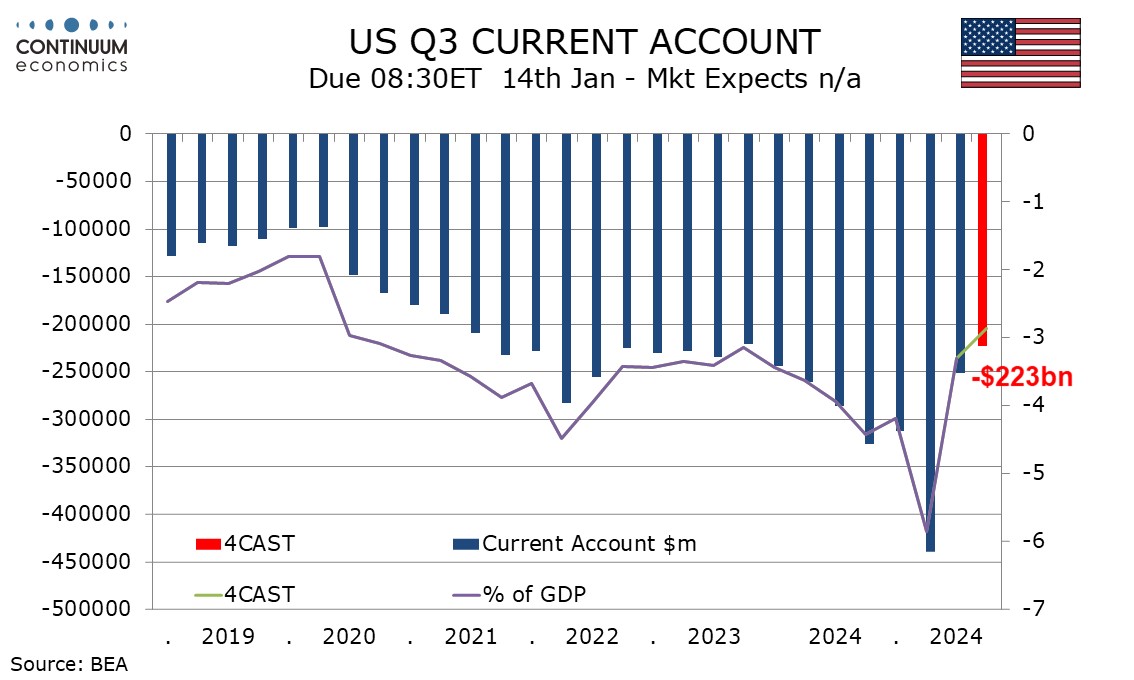

We expect a Q3 US current account deficit of $223bn, down from $251.3bn in Q2 and the narrowest since Q3 2023. As a proportion of GDP the deficit would be 2.9%, down from 3.3% in Q2 and the narrowest since Q1 2020. The correction from the record $439.8bn pre-tariff deficit in Q1 continues.

Monthly trade data on goods and services has already been released. The Q3 goods deficit fell marginally to $267.4bn from $270.0bn (which is set to be revised to $270.4bn). The Q3 services surplus bounced to $89.2bn from $79.6bn (which looks set to be revised to $80.6bn).

Still to be released are data on primary (investment) income and secondary (unilateral transfers) income. Fed flow of funds data however suggests the firmer will produce a surplus of around $8.0bn, after a deficit of $7.7bn in Q2. The latter looks set to see only a marginal narrowing of the deficit, to $52.8bn from $53.2bn in Q2.