Published: 2024-03-01T15:24:02.000Z

U.S. February ISM Manufacturing - Unexpected slippage, Michigan CSI and Construction Spending also weaker

Senior Economist , North America

1

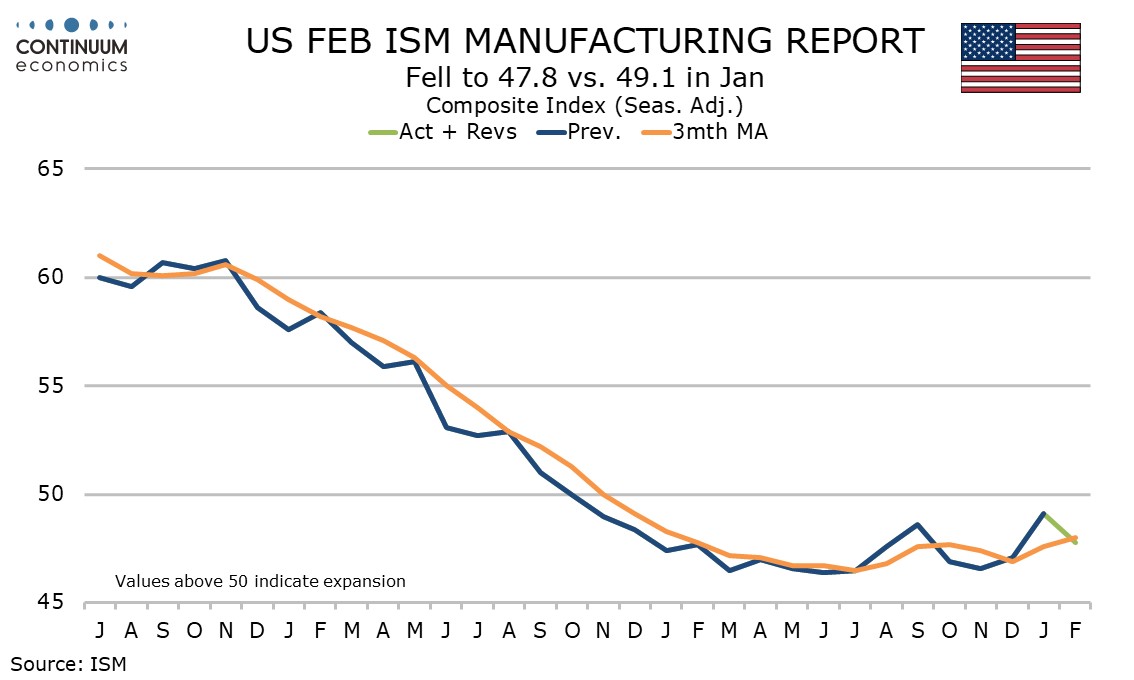

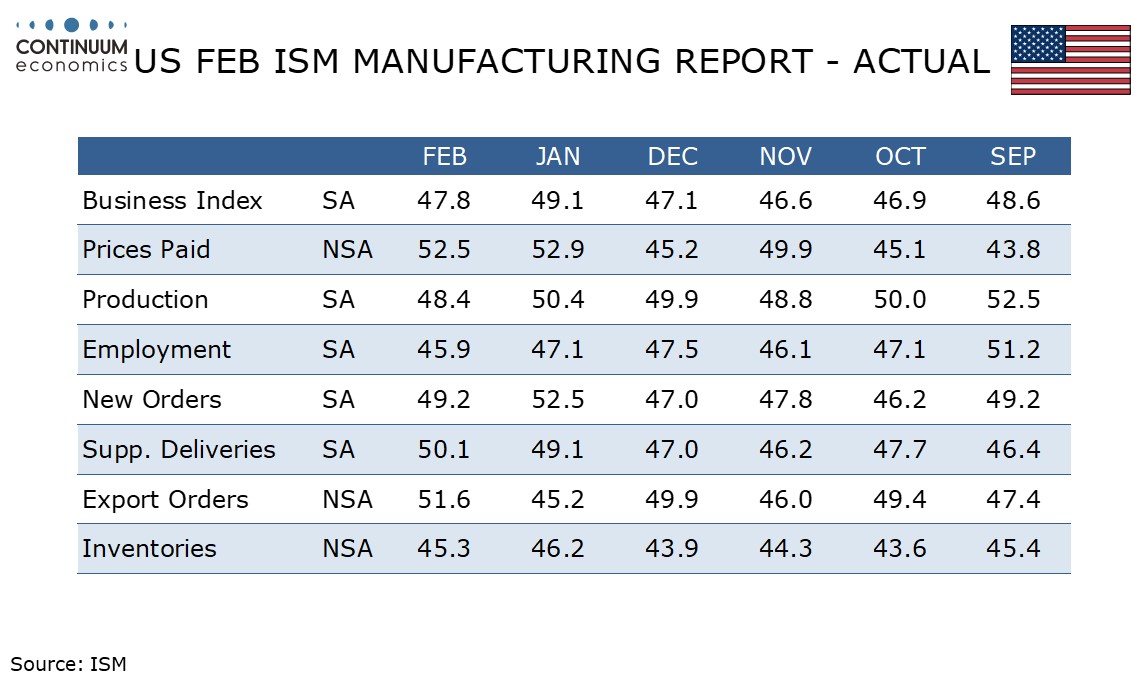

February’s ISM manufacturing index at 47.8 from 49.1 has unexpectedly slipped back without fully reversing January’s bounce from December’s 47.1. Other data released is also weaker, January construction spending at -0.2% and the Final February Michigan CSI revised down to 76.9 from 79.6.

The ISM slowing contrasts improvements in the S and P manufacturing PMI and most regional Fed surveys. Only one of the five contributors to the composite improved, delivery times edging above the neutral 50, but new orders and production fell back below 50 while employment and inventories moved further below neutral.

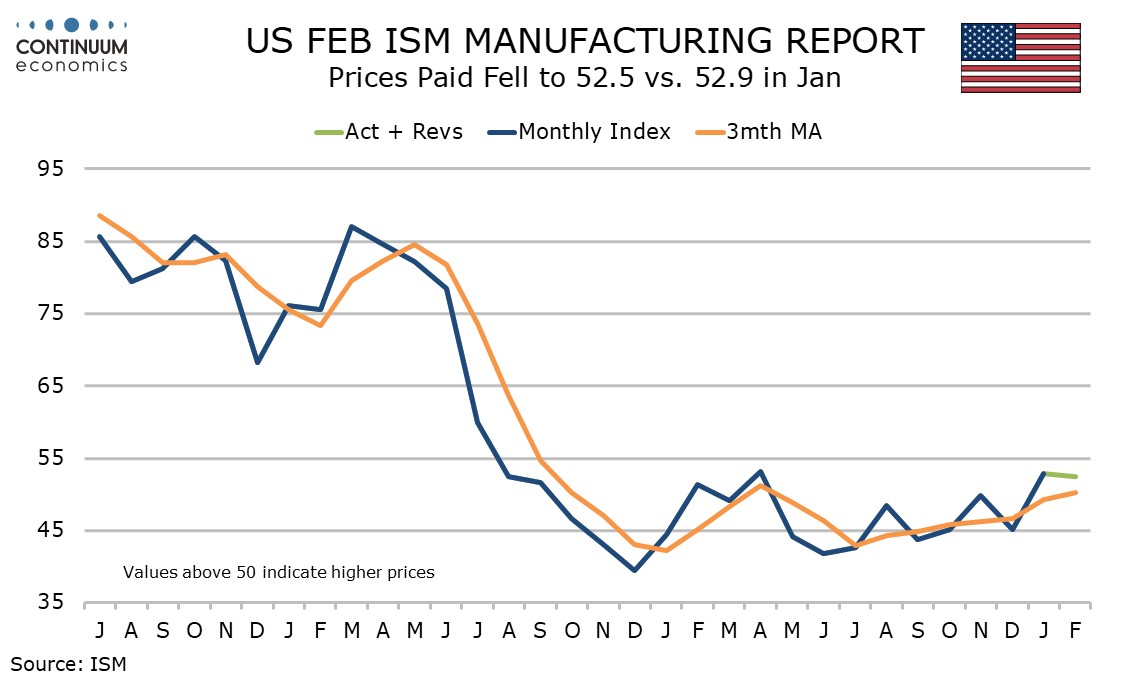

Prices paid do not contribute to the composite, and also slipped, but the dip to 52.5 from 59.9 was modest in comparison to January’s acceleration from December’s 45.2.

The downward revision to the Michigan CSI means the index at 76.9 is now below January’s sharply improved 79.0, if still well above November’s 61.3 and December’s 69.7. The Conference Board’s February consumer confidence data also shows a recent bounce starting to fade. Michigan CSI inflation expectations were unrevised, at 3.0% for the year and 2.9% for the 5-10 year view.

January construction spending at -0.2% corrects three straight strong gains seen in Q4, possibly on weather. Private construction rose by 0.1% but public spending fell by 0.9%.