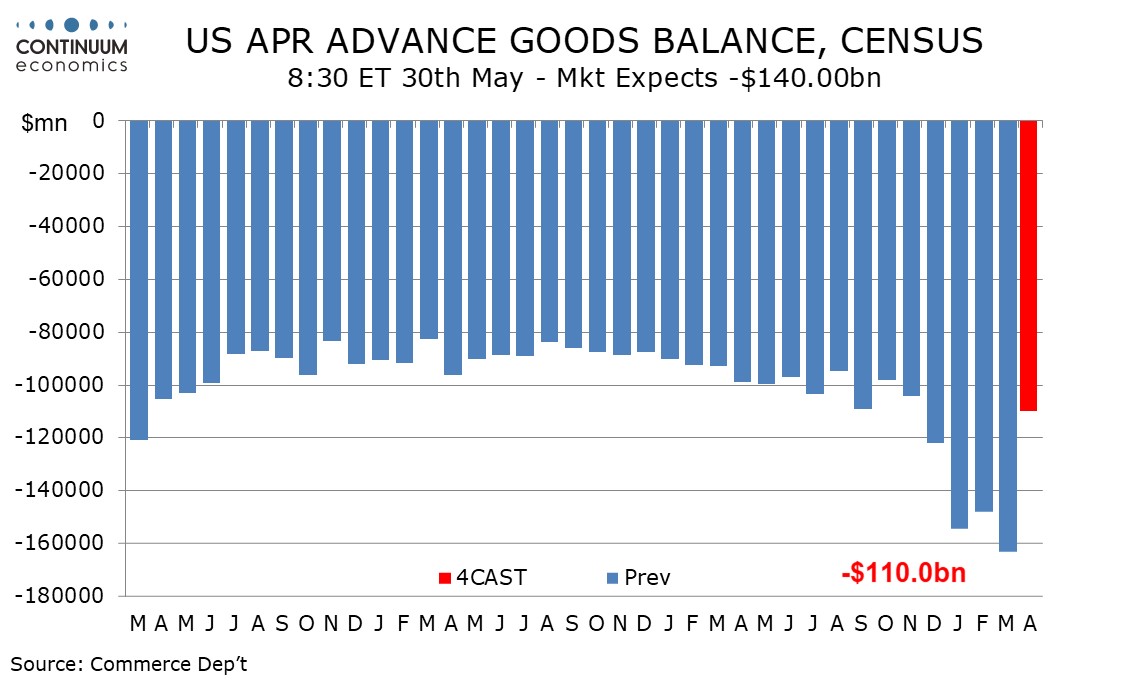

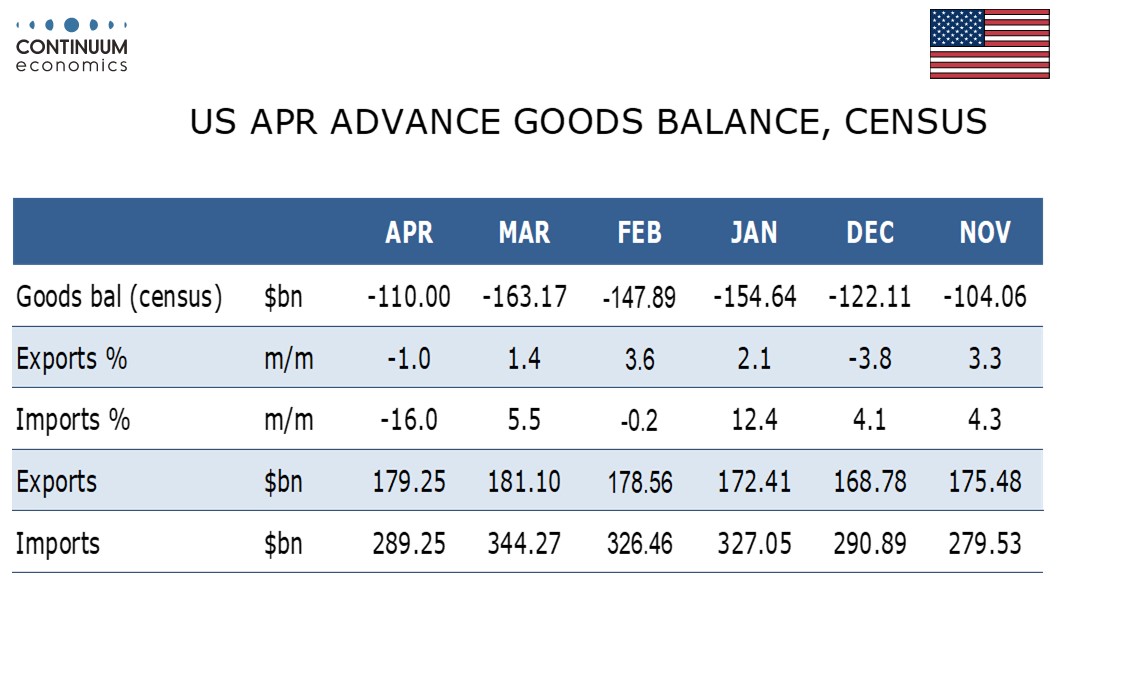

Preview: Due May 30 - U.S. April Advance Goods Trade Balance - Deficit to fall on a post-tariff reversal in imports

We expect April’s advance goods trade deficit to fall sharply to $110bn from March’s record $163.2bn. While this would be below the deficits seen from December through March, it would remain above each month of 2024 excluding December. In coming months deficits are likely to slip below the pre-December trend.

The surging trade deficit in the last four months came on a pre-tariff surge in imports and a sharp decline in imports is likely following the April 2 tariff announcement. Our forecast sees exports down by 1.0% in a correction from three straight gains but imports down by 16.0%, with the falls due almost entirely to volumes with both import and export prices having been almost unchanged in April.

On a yr/yr basis imports would still be up by 7.1% yr/yr, ahead of exports at 4.7%. Data from southern California Ports in Long Beach and Los Angeles shows imports still up on a yr/yr basis while exports have turned negative. However a sharp fall in imports from the EU looks likely in April after rising by almost $30bn in March, led by pharmaceutical preparations. Finished metal shapes, which led the imports surge of January, have moved off their highs and should continue to do so.

Advance retail and wholesale inventory data will be released with advance trade data. If inventories are weak, it could offset any positive GDP implications from a narrowing trade deficit.