Preview: Due October 24 - U.S. September New Home Sales - Extending a correction from a strong July

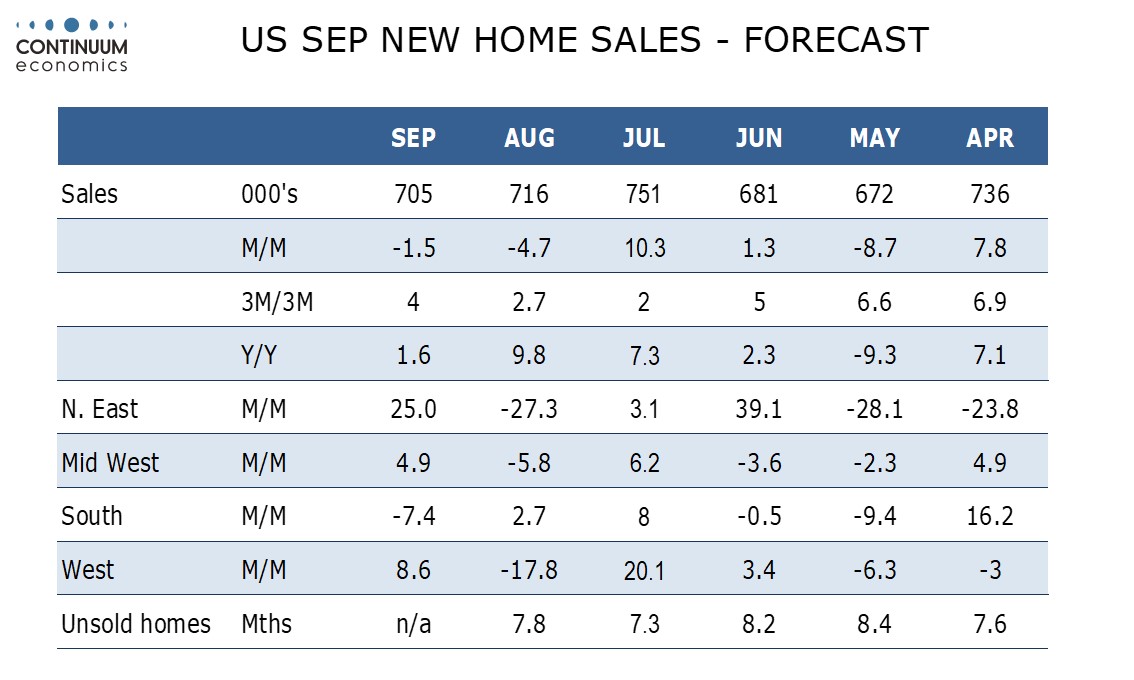

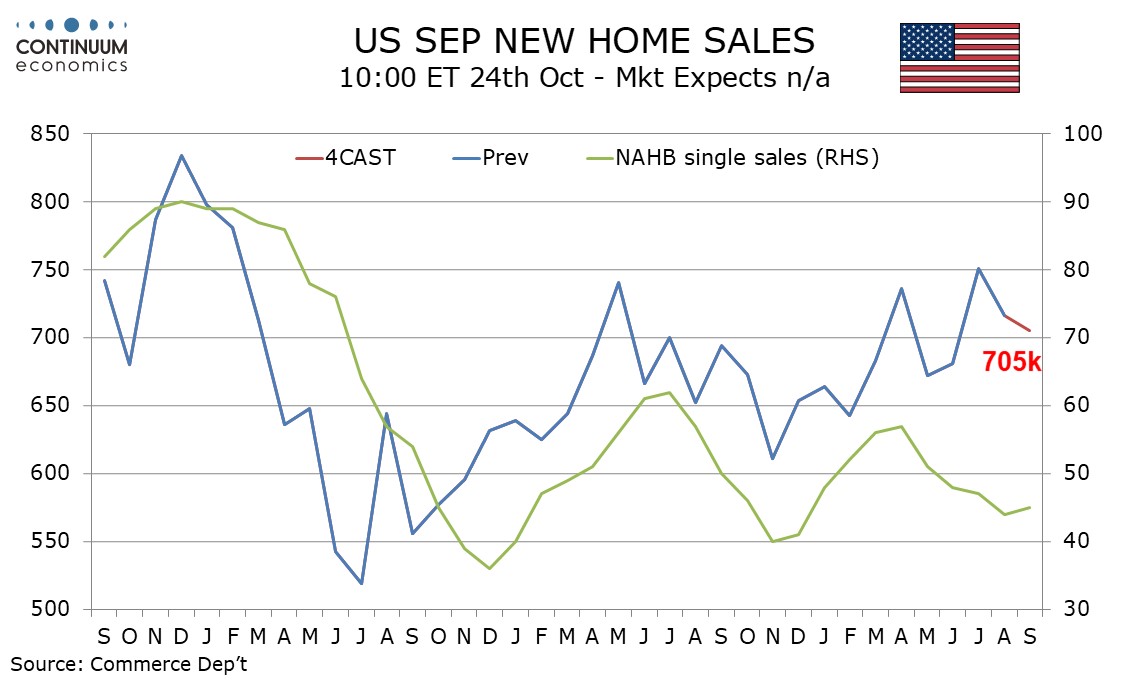

A September new home sales level of 705k, which would be a 1.5% decline if August’s 4.7% decline to 716k is unrevised, a decline that followed a strong 10.3% rise in July to 751k, the highest level since February 2022.

July and August data outperformed what was continued weakness in signals of housing sector demand from the NAHB and MBA surveys. September saw tentative hints of a recovery in demand as Fed easing started, but Hurricane Helene, which came in late September, could pose some downside risk to September sales, at least in the South. We expect the South to be the only region to report a decline in September, after being the only region to report an increase in August.

If Fed easing continues, there is probably limited downside risk to sales other than short term weather impacts. New home prices are likely to remain subdued, and we expect monthly declines in prices of 1.0% in both the median and average after increases seen in August. This would however see yr/yr data looking less negative, at -0.3% from -4.6% for the median and -3.4% from -7.1% for the average.