EUR flows: EUR edging lower post ECB

EUR lower post ECB, especially against the CHF, but little reaction in EUR yields

The market has initially taken the ECB statement as fairly neutral. The two key comments within the statement are “Domestic price pressures are strong and are keeping services price inflation high.”, and “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.”. However, they dropped the phrase about maintaining rates for a sufficiently long time. This suggests that we may need to see a little more progress on declining domestic inflation between now and the June meeting to ensure a rate cut, but that is likely on a y/y basis in any case due to base effects, with a chunky increase seen in April last year. We would continue to expect a cut in June in the absence of significant surprises.

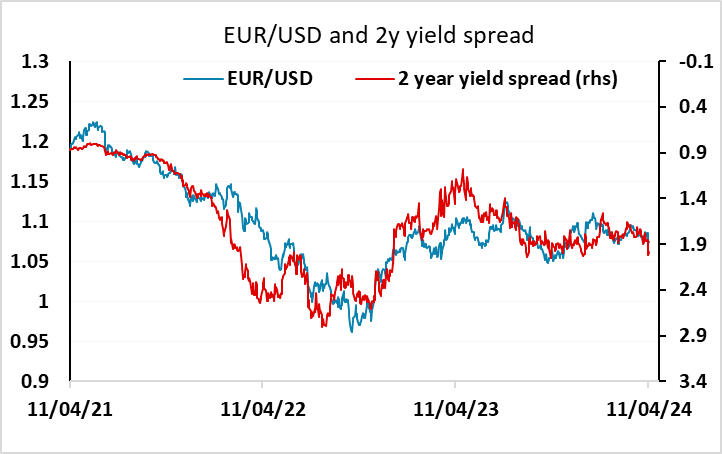

For FX, this suggests there is still some downside risk for EUR/USD unless US yields reverse the rise seen yesterday after the CPI data. The 1.0695 low for the year should come under threat, but initially the bigger move has been in the European crosses, with EUR/CHF in particular dipping half a figure. Given the lack of reaction in EUR yields, this may be an overreaction, but we would favour the EUR downside against the USD and GBP, where rates look less likely to fall sharply.