US December ISM Manufacturing slightly stronger, November JOLTS Openings slightly weaker

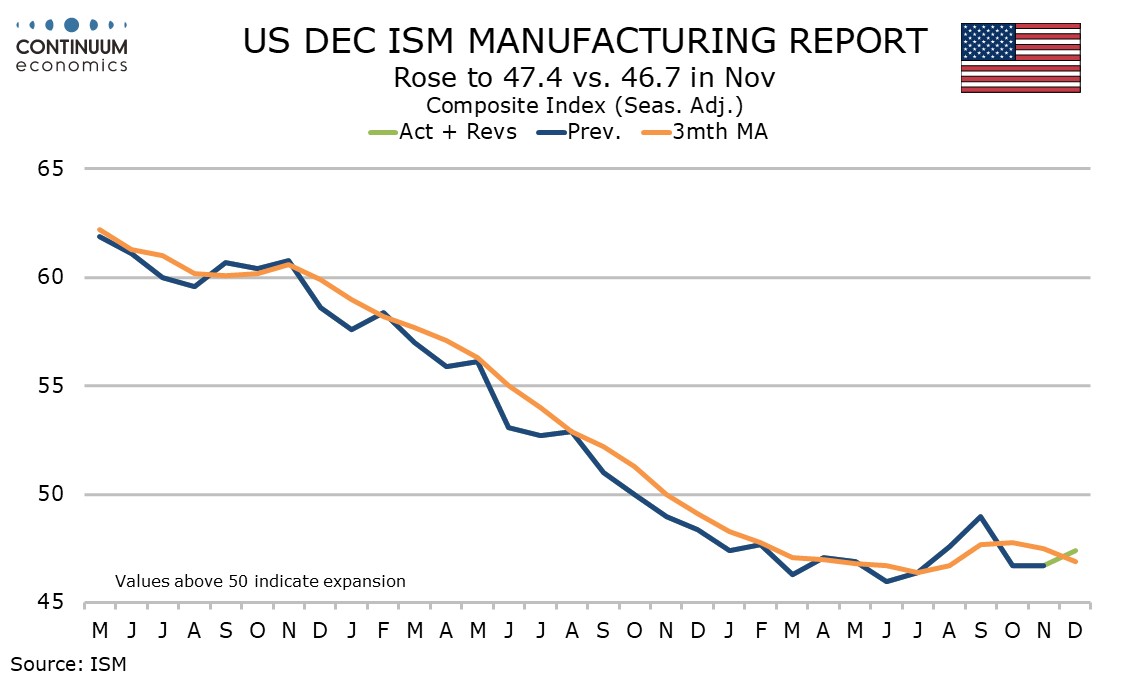

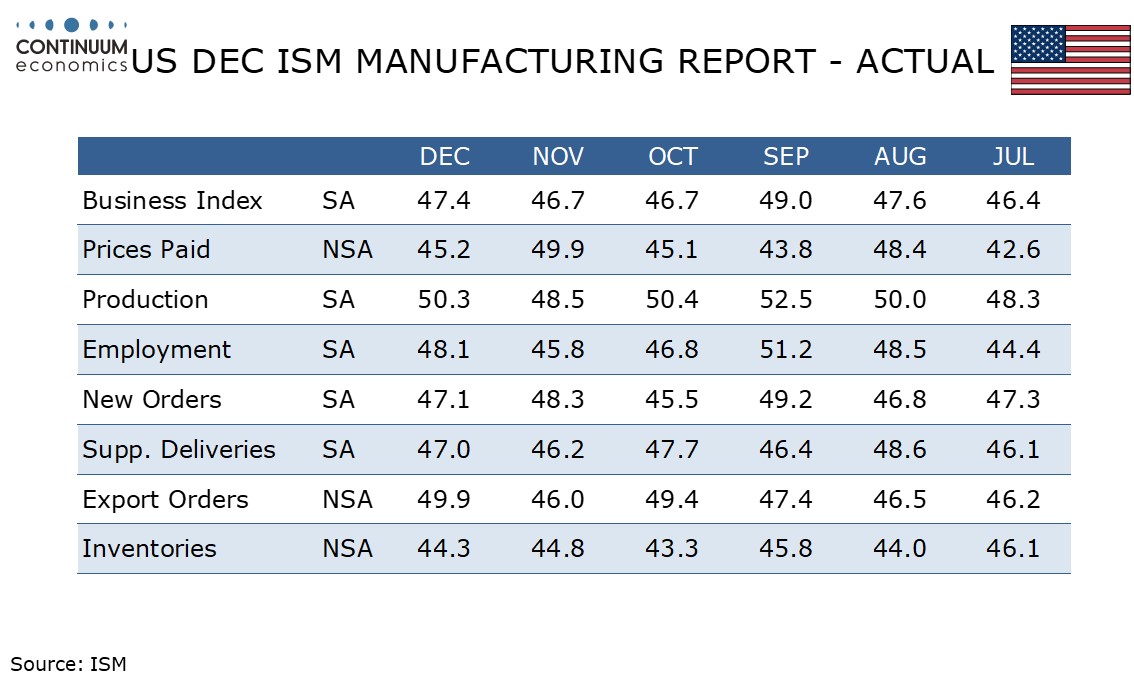

December’s ISM manufacturing index at 47.4 from 46.7 and November JOLTS job openings at 8.79m from 8.852m are not far from consensus, the latter down only because October was revised up from 8.733m.

Three of the five components that make up the ISM composite increased, production to 50.3 from 48.5 and employment at 48.1 from 45.8, both picking up from weaker November data. Deliveries also increased to 47.0 from 46.2.

New orders however slipped to 47.1 from a firmer November reading of 48.3 while inventories at 44.3 slipped from November’s 44.8. Prices paid are not a contributor to the composite, but at 45.2 from 49.9 reversed a November bounce.

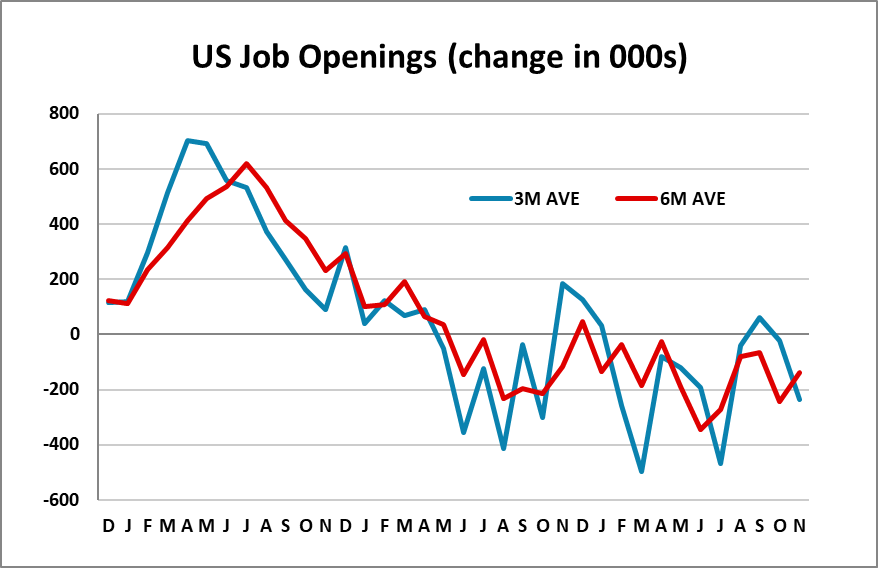

November JOLTS data shows a modest 62k decline after a steep 498k decline in October. Monthly data is volatile but trend shows a steady downtrend without any signs of a sharp slowing.

The other components of the report were quite soft, with hirings seeing quote a steep 363k decline while separations fell by 292k. Most of the fall in separations was due to a 157k fall in quits. Fewer quits suggests jobs ae becoming harder to find.