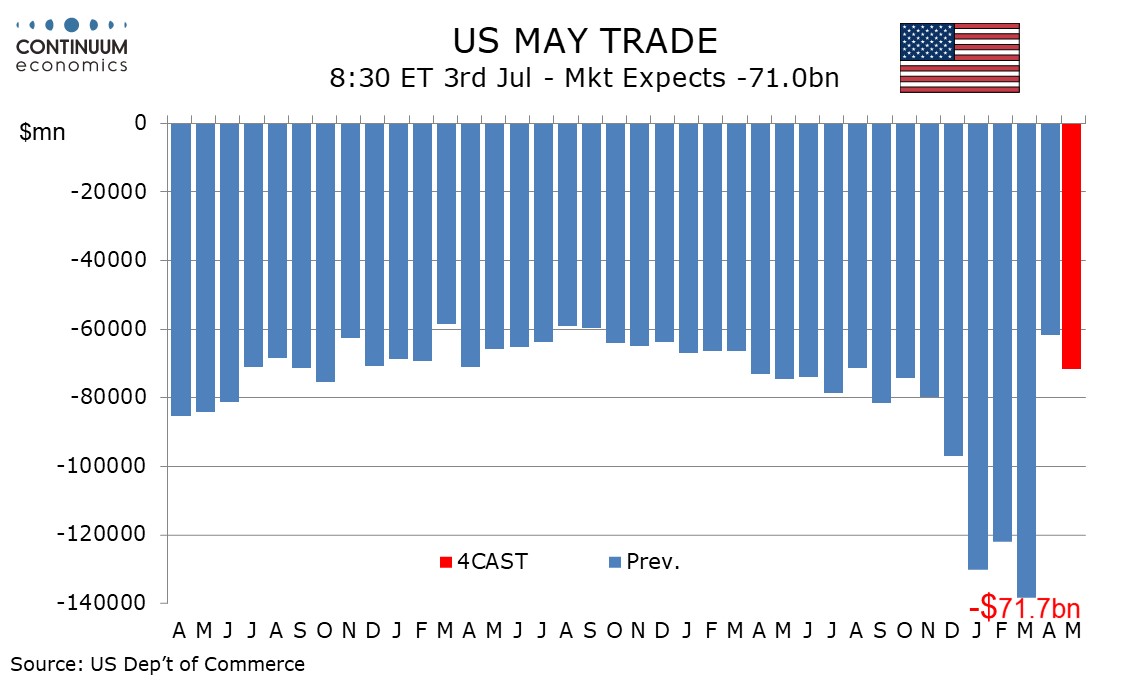

Preview: Due July 3 - U.S. May Trade Balance - Bank to near pre-election levels

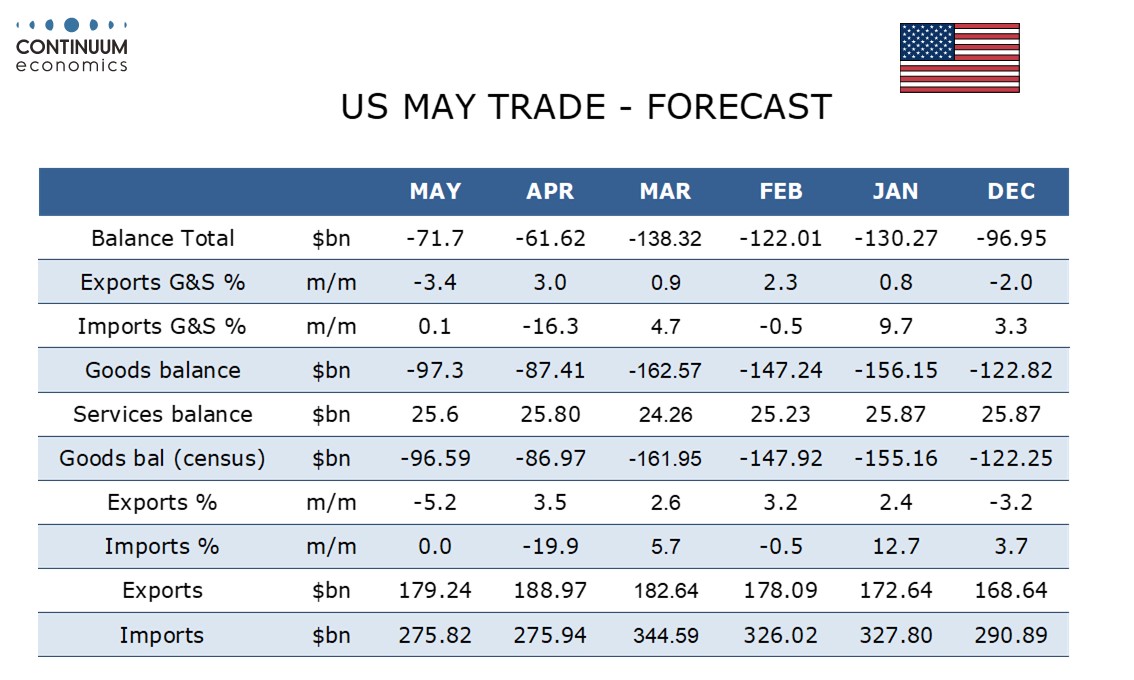

We expect May trade deficit to increase to $71.7bn from $61.6bn in April, which was the lowest deficit since September 2023, following a record $138.3bn in March. May’s deficit will be only a little below the pre-election trend and Q2’s deficit looks set to be less sharply below the pre-election trend than the Q1 deficits were above it.

Advance goods data showed a 5.2% decline in exports after four straight gains while imports were unchanged after a 19.9% April decline. That took goods imports to their lowest level since October after surging in Q1 in anticipation of tariffs. We expect goods data to be consistent with the advance report.

We expect services to show exports unchanged after a 2.1% April increase that corrected three straight declines, while we expect a modest 0.3% increase in service imports after an above trend rise of 0.7% in April. This will leave overall exports down by 3.4% after a 3.0% April increase and overall imports up by 0.1% after a 16.3% April decline. On a yr/yr basis, exports will be up 5.5% and imports up 3.5%.