Preview: Due February 20 - U.S. November and December New Home Sales - Improvement in trend to continue

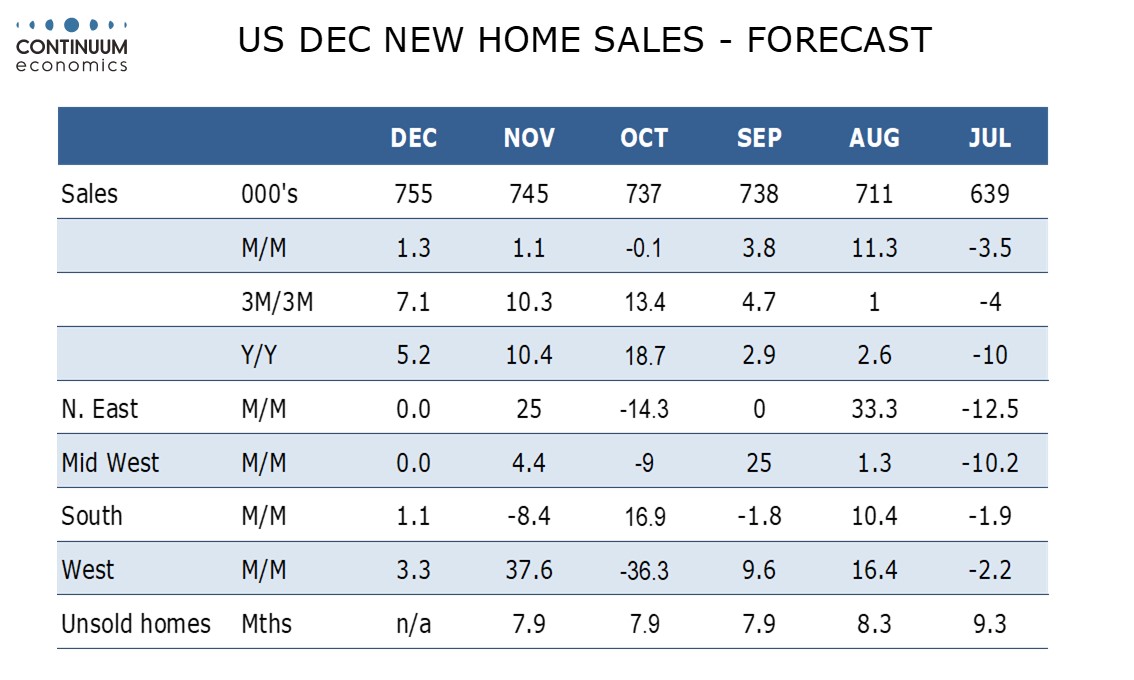

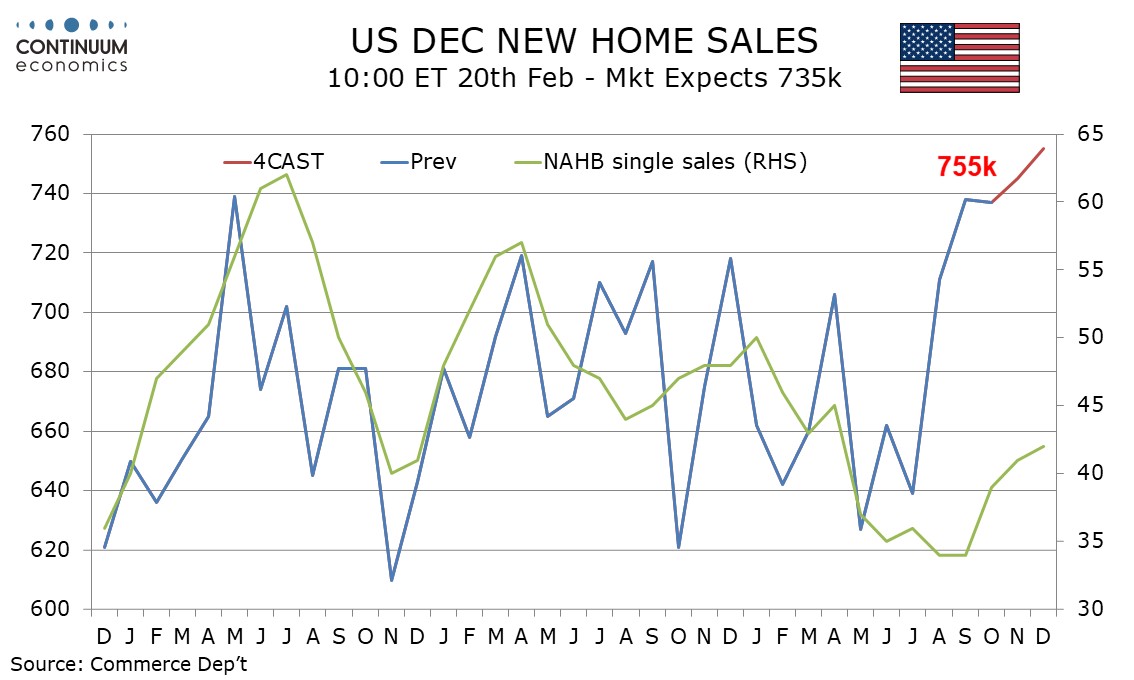

November and December new home sales data will be released on February 20. We expect moderate continuations of a recent improvement in trend, with November rising by 1.1% to 745k and December rising by 1.3% to 755k. This would be the highest level since February 2022.

A recent pick up in housing demand has been supported by Fed easing. The NAHB homebuilders survey was picking up into December, if not particularly impressively, and slippage in January suggests new home sales momentum may fade in early 2026. December pending home sales, designed to predict existing rather than new home sales, slipped sharply in December, erasing four straight gains.

October new home sales saw the Northeast and West below trend but the South (the largest region) above trend. We expect November to see the regions return to trend. We expect prices to show marginal gains, with both the median and average rising by 1.0% over the two months. This would see the median price remain negative on a yr/yr basis, at -0.4% in November and -6.3% in December, but the average turning positive at 3.1% in December, before slipping by 1.2% in December.