NOK, SEK flows: Little changed after data

Norwegian CPI data marginally soft, Swedish data mixed, little immediate FX impact.

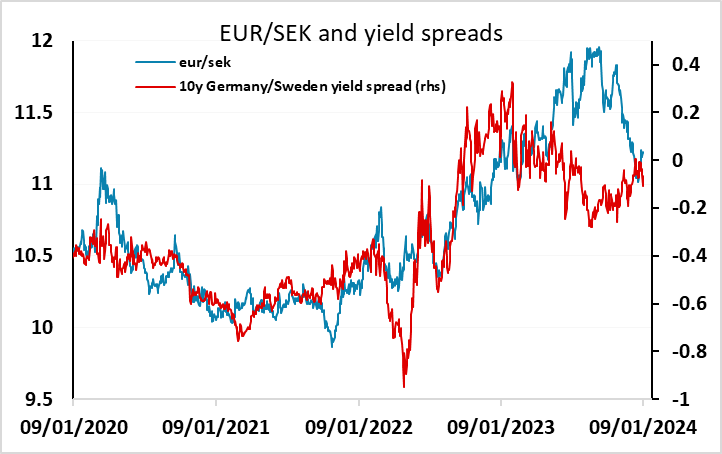

Lots of Scandi data this morning. The Norwegian CPI numbers were slightly on the soft side of expectations, but Q4 core CPI is only marginally below the Norges Bank forecast of 5.8% published in the December Monetary Policy Report. Norges Bank in that report also indicated that they were likely to keep rates steady in Q1. EUR/NOK is not much changed on the data, but we still prefer the downside medium term, with there still being some scope for yield spreads to move in favour of the NOK, and EUR/NOK starting at a point that still looks a little high relative to the historic yield spread correlation.

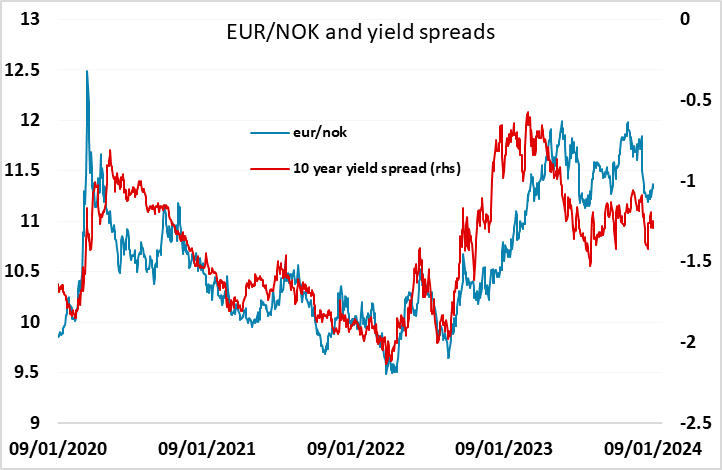

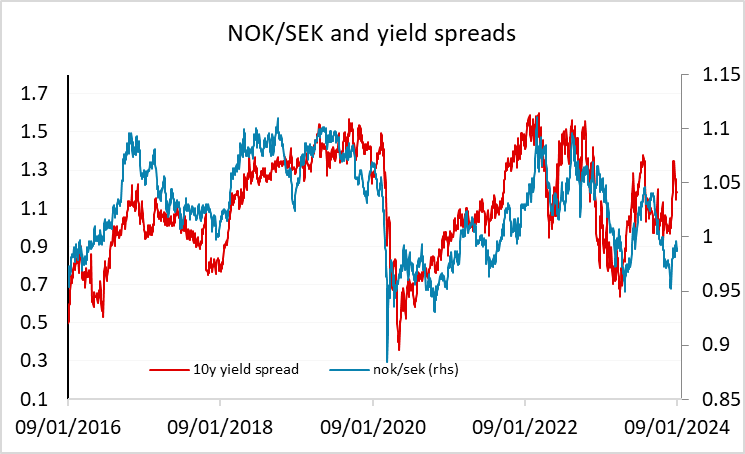

EUR/SEK is also little changed after a barrage of Swedish numbers, which don’t really give a clear view of the progress of the Swedish economy. The 0.2% rise in November GDP is notable after the (unrevised) rise of 1.0% in October – this makes the growth picture for Q4 look encouraging. But these monthly GDP data are quite unreliable, and the other data released this morning – confidence, industrial production, new orders and retail sales – generally suggest weakness, with the exception of a better new orders number. EUR/SEK has fallen in recent weeks back to a level that looks consistent with yield spreads, so we wouldn’t look for a significant move. However, NOK/SEK still looks to have upside potential medium term, though today's data are unlikely to trigger a move.