U.S. March Michigan CSI - 5-10 year inflation view highest since 1993

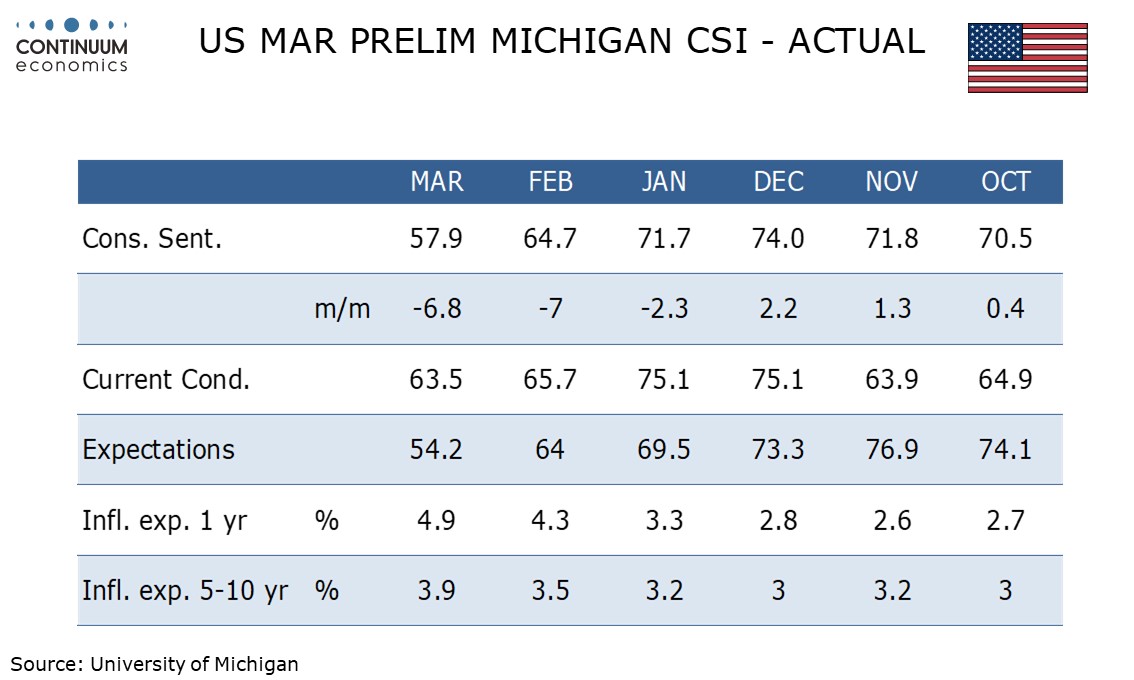

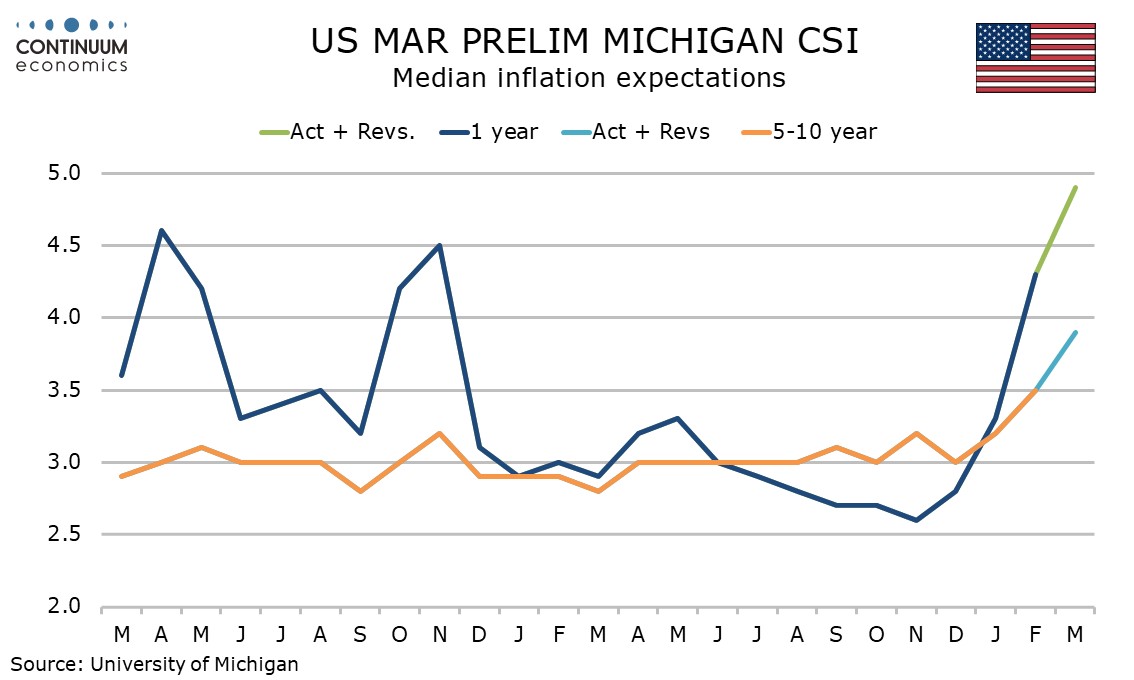

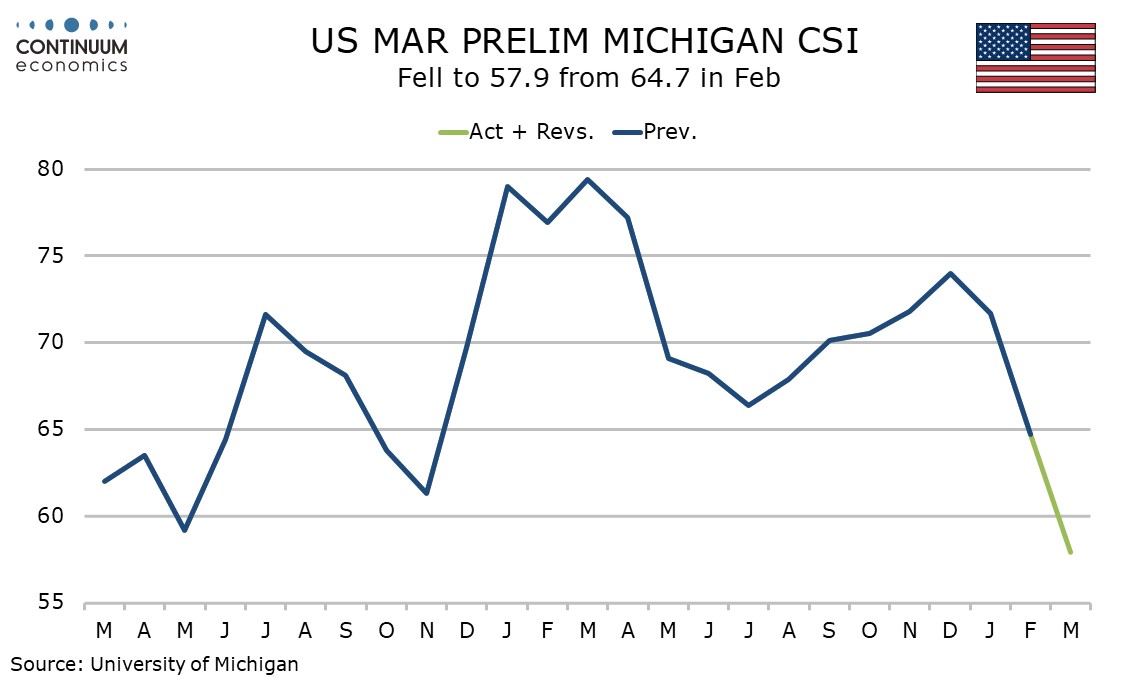

March’s preliminary Michigan CSI of 57.9 from 64.7 is the weakest since November 2022 with the fall led by future expectations. Consumers are particularly worried about inflation, with the 1-year view up to 4.9% from 4.3% and the more closely watched 5-10 year view at 3.9% from 3.5%.

Inflation expectations have accelerated dramatically in the last two months after having been previously stable in the 5-10 year view near 3.0% for several years. The latest 1-year view is the highest since November 2022 but the 5-10 year view has not been this high since 1993. Tariffs are clearly causing substantial concern. Eggs will be a factor too.

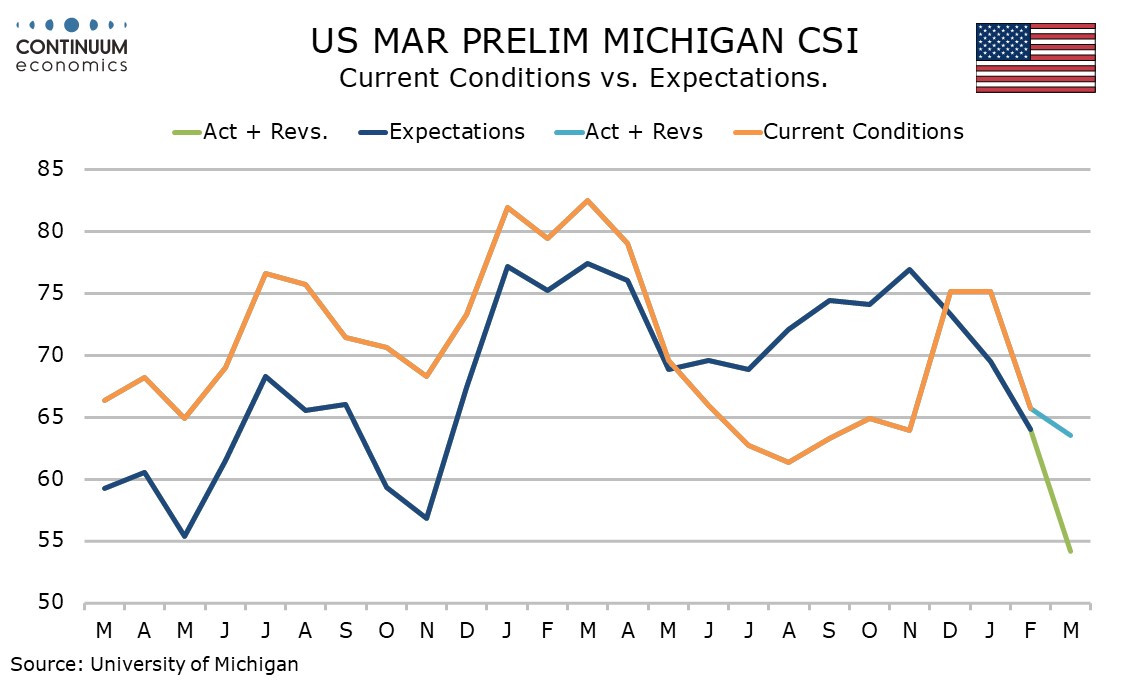

Looking at the breakdown of the composite index, current conditions saw only a modest drop, to 63.5 from 65.7, and are at their lowest level since September 2024. Future expectations however at 54.2 from 64.0 are at their lowest since July 2022. Equity weakness is surely adding to concerns.

There is no question that political bias plays a large role in consumer responses with the index for Democrats of 41.4 comparing to 91.4 in October before the election and that for Republicans at 83.9 comparing to 53.6 before the election. However both weakened in March, Democrats from 51.3 and Republicans from 86.7, while independents slipped to 57.2 from 62.6.

One factor pushing up inflation expectations may be that with Republican expectations having fallen to near zero after the election there is now little further downside, but there is little upside limit to Democratic pessimism.