Published: 2024-03-18T14:57:20.000Z

Preview: Due March 25 - U.S. February New Home Sales - Potential for further gains

Senior Economist , North America

2

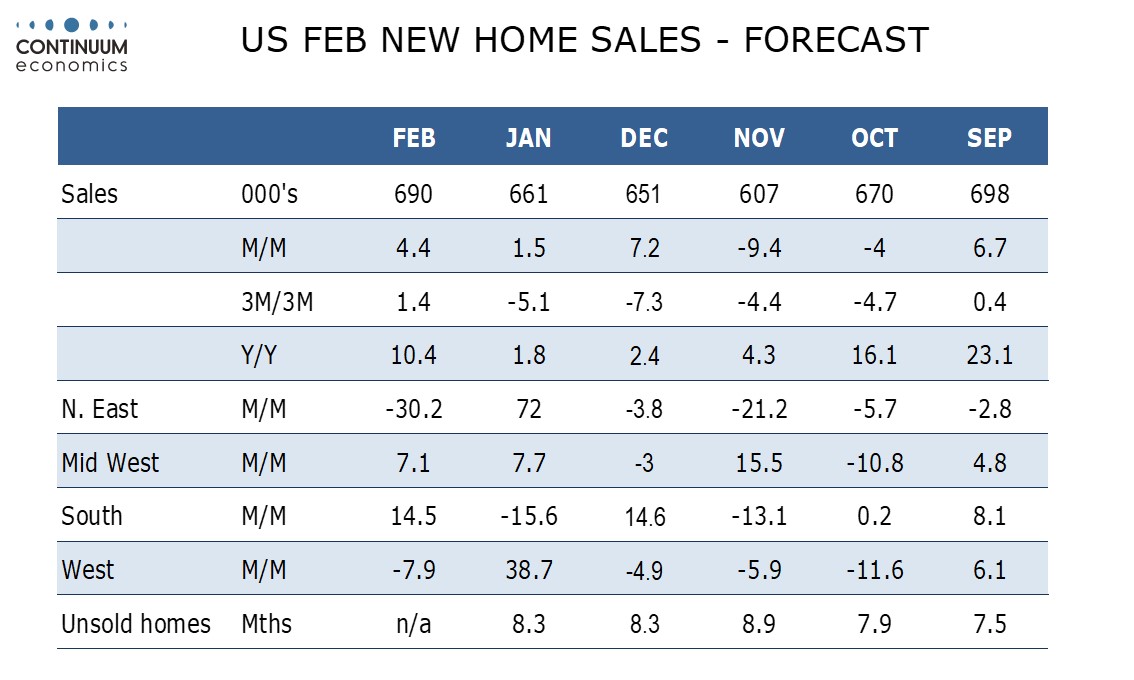

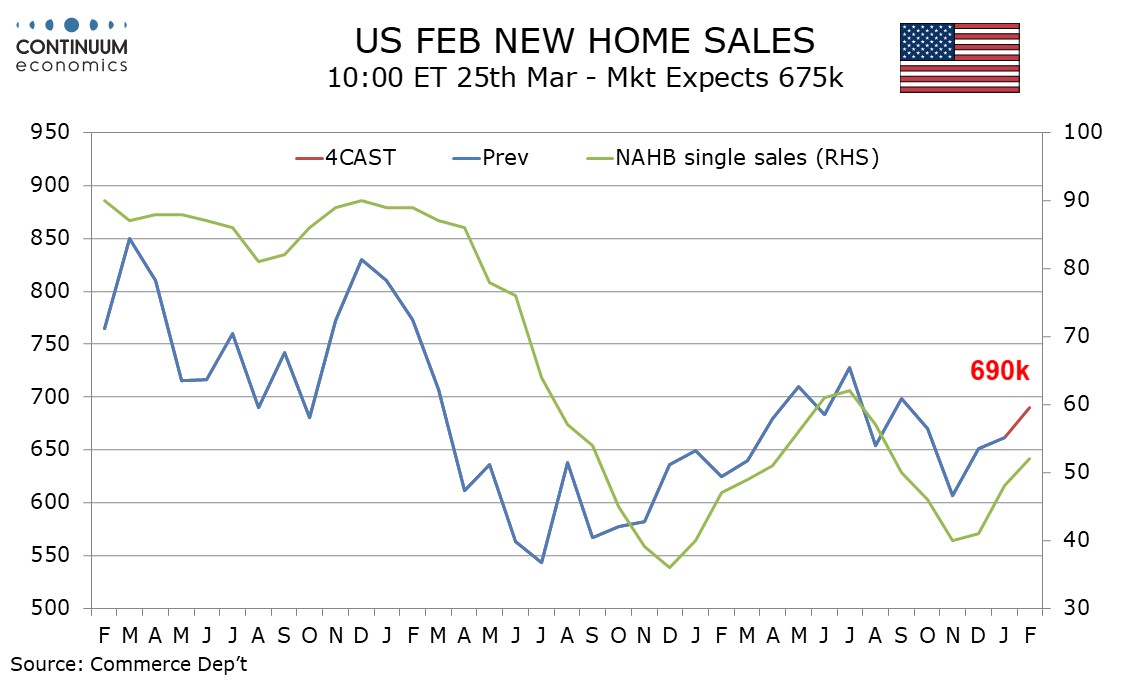

We expect a February new home sales total of 690k, which would be a 4.4% increase if January’s 1.5% increase to 661k is unrevised. This would be a third straight increase if still below 2023’s high of 728k seen in July.

February’s NAHB homebuilders’ index saw a third straight increase and continued to improve in March. Some other housing sector data, suggest gains in mortgage rates in early 2024 are starting to restrain demand, but improving supply is supportive for new home sales, which is particularly well correlated with the NAHB data. Sales in the South, the largest region, are due for a bounce after falling in January, but the Northeast and West are likely to correct from sharp January gains.

We expect slippage in the median and average prices on the month, correcting from January gains. We expect the median to fall by 1.0% after a 1.4% January gain and the average to fall by 5.0% after a sharp 8.3% increase in January. This would leave yr/yr data at -3.9% for the median but up by 1.7% for the average, compared with -2.6% and up 7.8% respectively in January.