Published: 2025-04-02T13:40:03.000Z

Preview: Due April 3 - U.S. March ISM Services - Regional surveys suggest weakness

3

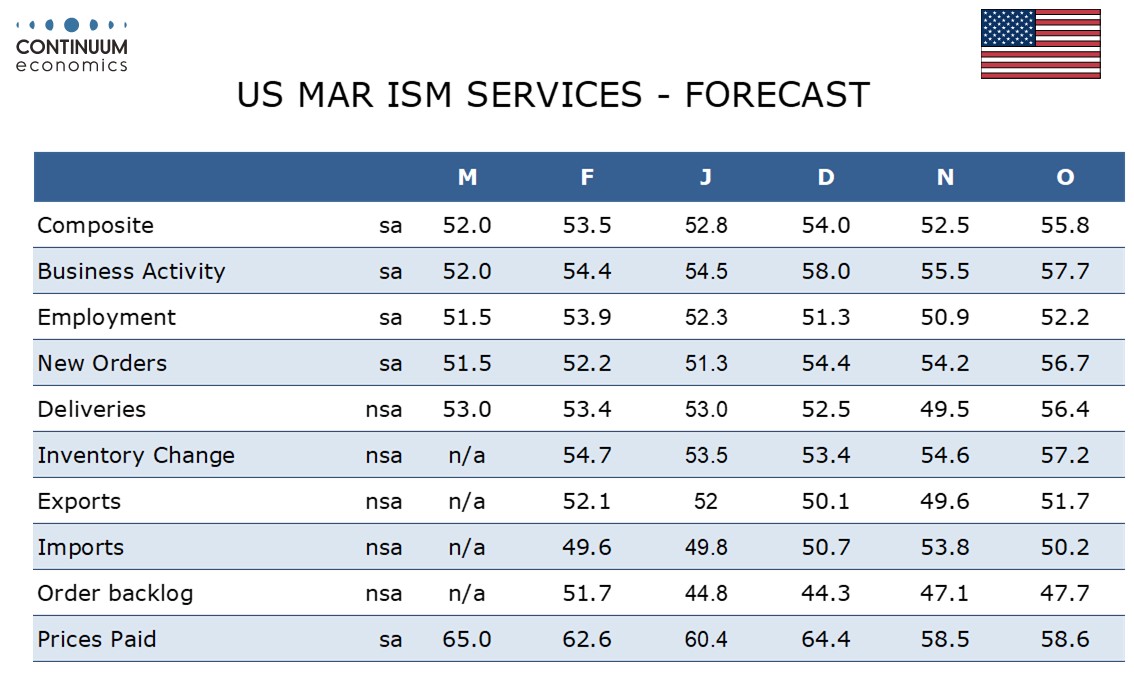

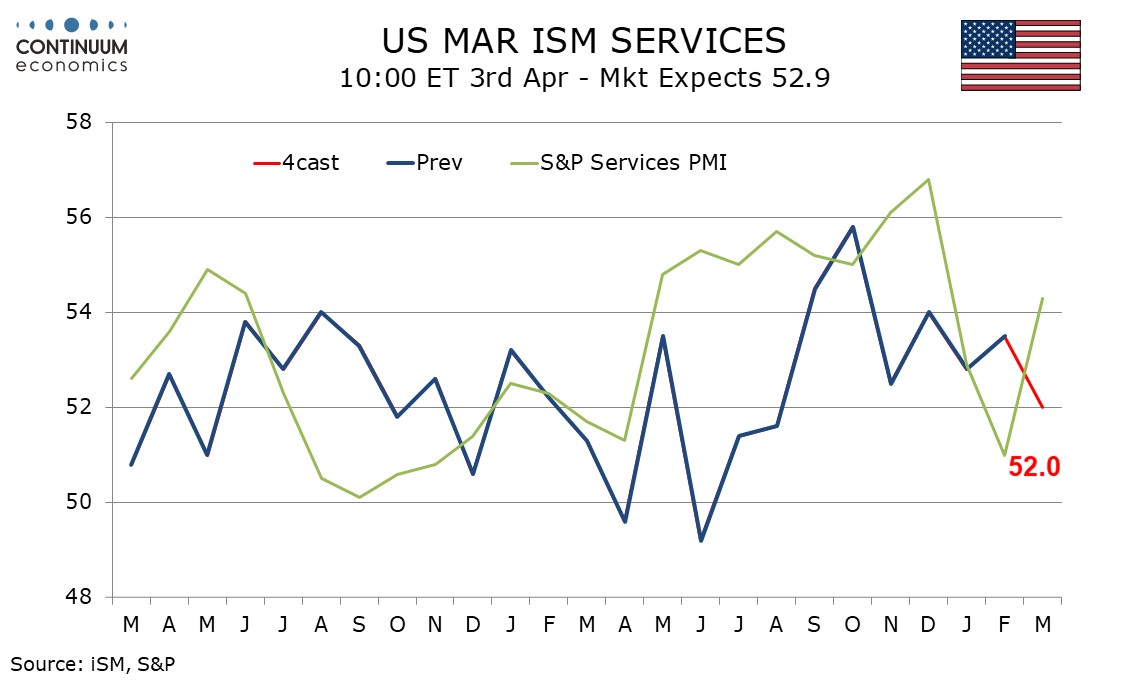

We expect March’s ISM services index to slip to a 7-month low of 52.0 from 53.5, contrasting a stronger S and P Services PMI.

The S and P Services PMI is not well correlated with the ISM’s. We suspect it was lifted in March by improved weather and slippage in mortgage rates, which ISM data may prove less sensitive to. Regional service sector surveys from the Empire State, Philly, Dallas and Richmond Feds were all weak in March.

We expect all four components of the ISM services composite to slip in March, while remaining above the neutral 50, these being business activity, new orders, employment and deliveries. Prices paid do not contribute to the composite. Here we expect a second straight increase, to 65.0 from 62.6, which would take the index to its highest level since January 2023.