GBP flows: GBP softer after BoE cuts rates

EUR/GBP rises as UK yields fall following the BoE decision to cut rates, with two votes for a 50bp cut providing a mild dovish signal

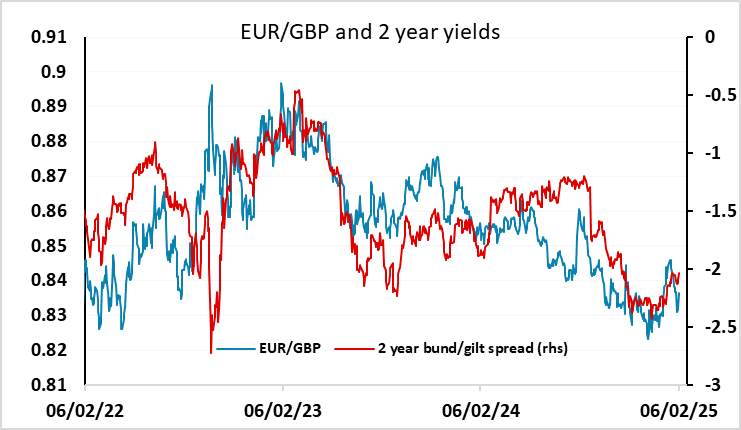

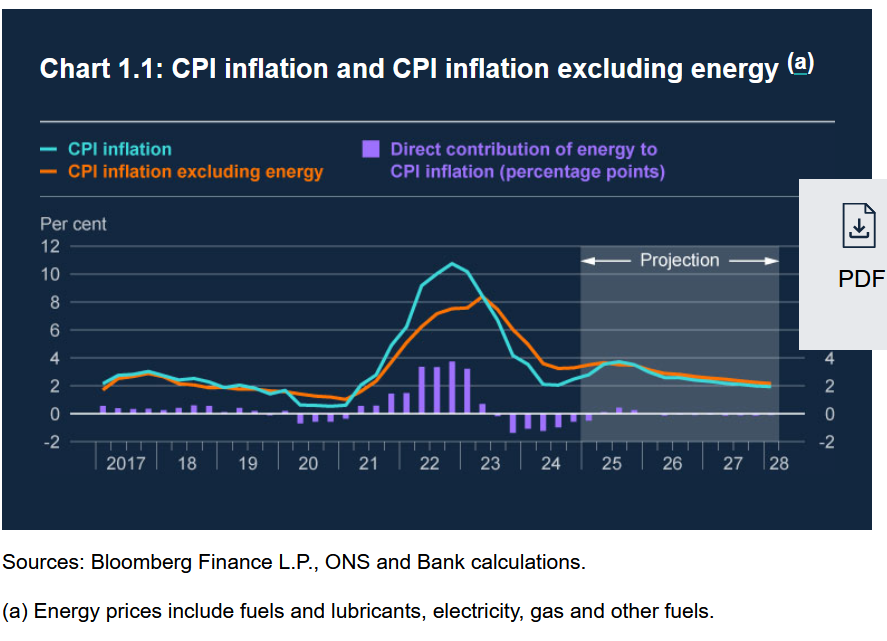

GBP has weakened after the BoE decision to cut rates 25bps. Although the BoE has slightly revised up inflation forecasts short term UK yields have edged lower on the announcement, perhaps because two MPC members voted for a 50bp rate cut, including Catherine Mann, who has typically been a hawk. EUR/GBP was also already trading at levels that looked a little low given current yield spreads, so the move up to 0.8375 looks justified, and there still looks to be scope to move back to 0.84 based on current yield spreads. Even so, the statement and MPR don’t suggest we should look for any more than three further rate cuts this year. This is almost now priced into the market, and there is still some concern about potential tariff action from the US against the EU that could limit the upside for EUR/GBP, with the UK being seen as less under threat.