GBP flows: GBP weaker after soft CPI

Much weaker than expected CPI data increases scope for BoE easing, GBP to fall further

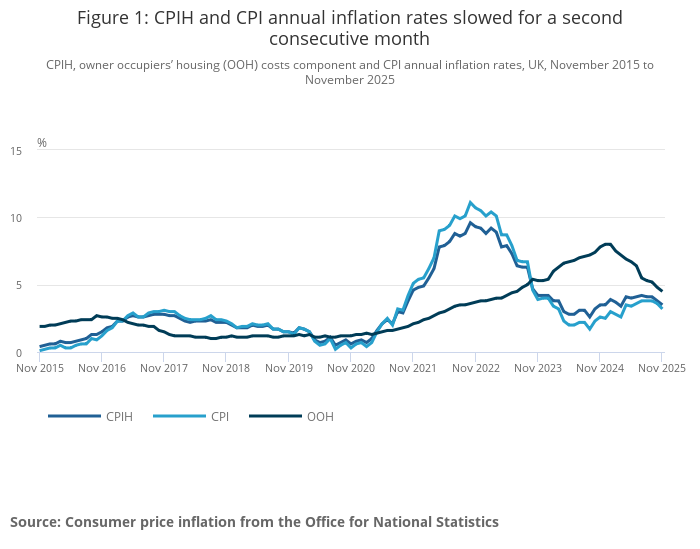

UK November CPI has come in significantly below expectations at 3.2% y/y for both the core and the headline. This should remove any doubt that the BoE will cut rates tomorrow - this was already 90% priced in, but there should now be no uncertainty. But combined with the weakness of private sector pay growth in the labour market data yesterday, the continued decline in employment and the declines in GDP in the last two months, this should increase the chances of more aggressive easing in the next year. With just 60bps of easing priced into the market, including the expected cut tomorrow, there is scope for further cuts to be priced in based on the weakness of the data. The stronger PMI data yesterday was seen as GBP positive, but we regard this data as having very little credibility given the lack of correlation with official data.

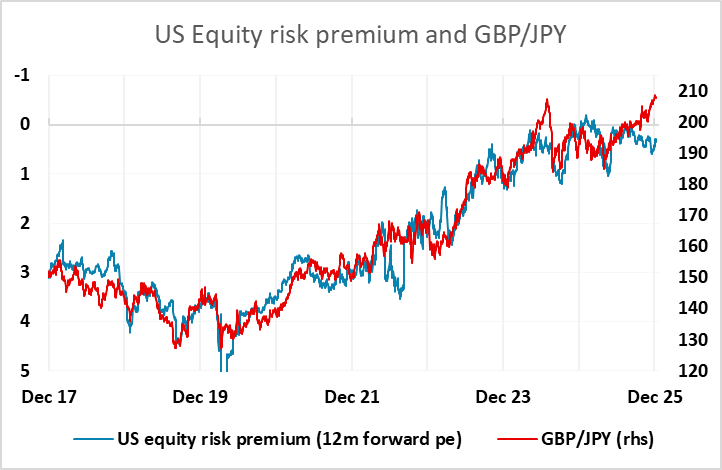

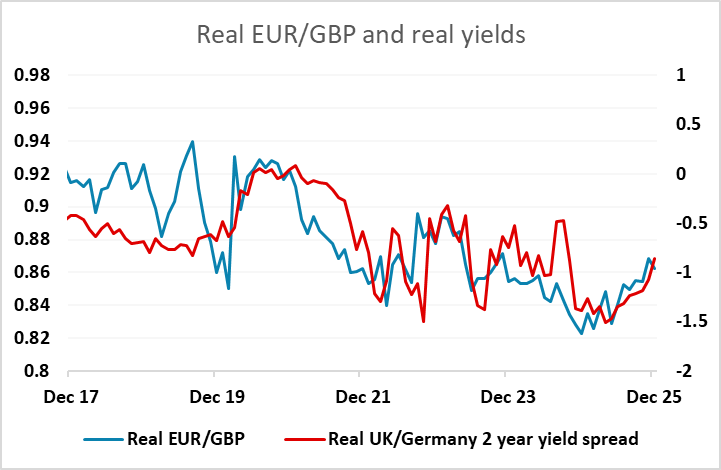

GBP has slipped a little lower in response to the CPI data, but the decline is quite modest and we see scope for a more substantial decline which may come after the BoE MPC meeting tomorrow which we would expect to deliver a dovish message along with a rate cut. We would still see scope for the 0.8865 high of the year in EUR/GBP to be tested before the end of the year, while GBP/JPY also looks dramatically overvalued and ought to have scope to drop well below 200.