BCB Minutes: Conservative Approach to the Inflation Battle

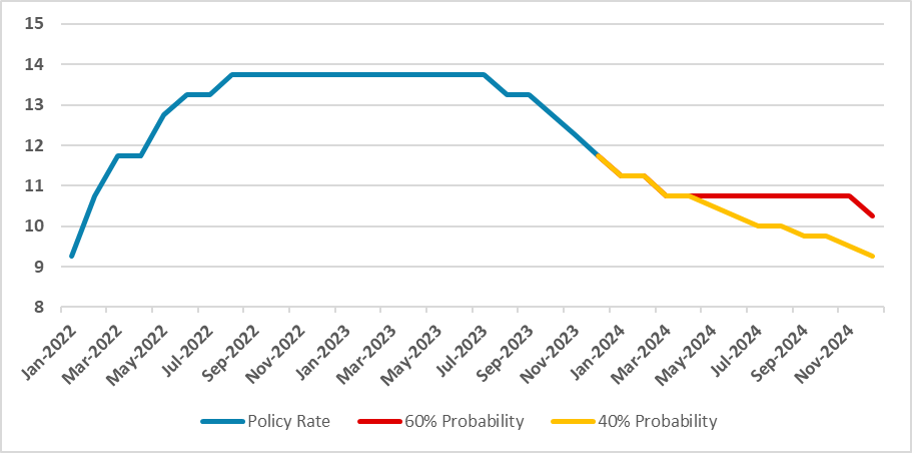

The Brazilian Central Bank lowered the policy rate by 50 basis points to 11.75% in line with market expectations. Despite larger-than-expected inflation decreases, the BCB remains cautious, emphasizing risks and dispelling rate cut acceleration rumours. The focus on domestic inflation is highlighted, with resilient family consumption and a robust Real performance. The existing outlook, marked by slower disinflation and global uncertainties, requires a composed approach. The BCB is expected to adhere to the current 50 bps cut strategy, with a 60% probability of a pause in May/June and a 40% probability of a slowdown to 25 bps.

Figure 1: Brazil Policy Rate (%)

Source: BCB and Continuum Economics

The Brazilian Central Bank has released the minutes of its recent meeting, during which it lowered the policy rate by 50 basis points to 11.75%, in line with market expectations. As customary for the BCB, the minutes took a conservative stance; despite larger-than-expected decreases in inflation, the BCB is cautious about counting its chickens before they hatch. The minutes emphasized the risks to the inflation outlook and dispelled rumours of an accelerated pace of rate cuts.

In terms of global markets, the BCB noted their volatility, influenced by the decline in long-term interest rates in the United States and early signs of core inflation decline. Notably, the robust performance of the Brazilian Real (BRL) suggests that much of the focus on inflation is domestic.

The latest GDP measure (here) aligns with the deceleration scenario anticipated by the BCB. However, family consumption continues to display resilience, possibly linked to increased disposable income from a buoyant labor market, social transfers, and decreasing inflation in certain consumer goods. The labor market analysis, despite recognizing its strength, indicated no signs of wage pressures and suggested marginal deceleration.

Fiscal considerations received marginal attention, emphasizing the importance of adhering to current fiscal targets. As new board members indicated by the Government comes in, criticism towards the fiscal strategy are diminishing, although a technical approach continues to be adopted by the BCB. Notably, the BCB underscored the potential impact of El Niño on food inflation, raising they forecast for this group in 2024.

The existing outlook, characterized by slower disinflation, unanchored expectations, and global uncertainties, necessitates a composed approach by the BCB. Furthermore, the adjustments are seen as reducing the degree of tightening rather than moving interest rates to a neutral level. We anticipate the BCB will likely adhere to the current strategy of 50 bps cuts unless the CPI approaches 3%. Two scenarios are foreseen: one with a 60% probability of a pause in May/June, resuming cuts in December, and the other, with a 40% probability, involving a slowdown in cuts to 25 bps.