GBP flows: GBP rallies on UK Budget, but due to forecasts more than measures

GBP gains helped by reduced risk premium as OBR forecasts better tax take due to higher wages and inflation, despite lower productivity growth. But GBP outlook still mildly negative longer term

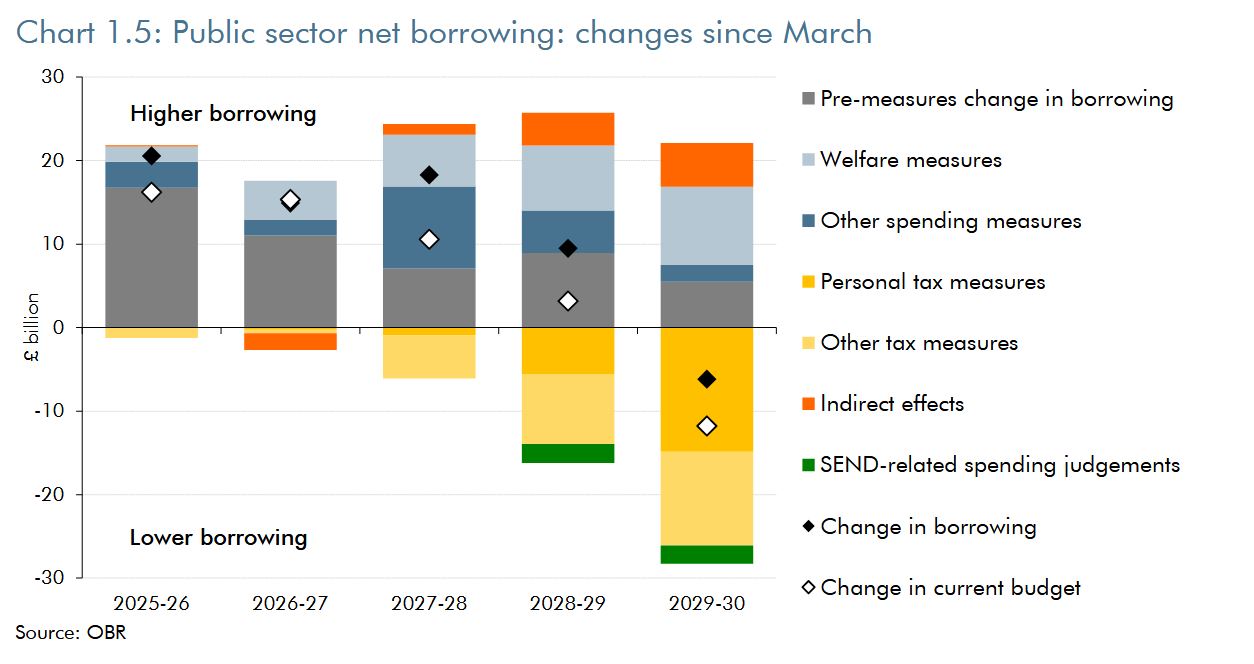

GBP has rallied after the Budget after an initial dip on the leaked release, despite yields dropping and a December rate cut from the BoE still being priced at around an 85% chance. The gains seemingly relate mostly to the more optimistic forecasts from the OBR which have reduced the supposed fiscal “hole” due to higher wage and inflation forecasts, despite lower productivity numbers. This in turn looks to have reduced the risk premium on gilts, in part because there is a lower requirement for gilt sales.

The measures themselves are less convincing. They temporarily raise aggregate demand and the OBR's central estimate of the real GDP level by 0.1 percentage point in 2026-27, with most of the fiscal tightening not coming in until 2028-9. Whether this is credible is highly doubtful, given a likely 2029 election and general uncertainties around the next couple of years. However, with a less tight fiscal picture for the next year there may be less immediate pressure on the BoE to ease. We would still expect GBP real rates to gradually converge towards EUR rates in the next couple of years, and while they are likely to remain above EUR levels, this would suggest EUR/GBP has potential to rise steadily towards 0.90, with today’s correction lower likely to be short-lived.